Soft Commodities Speculators Raising Bullish Bets In Most Cases

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday, April 19th and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

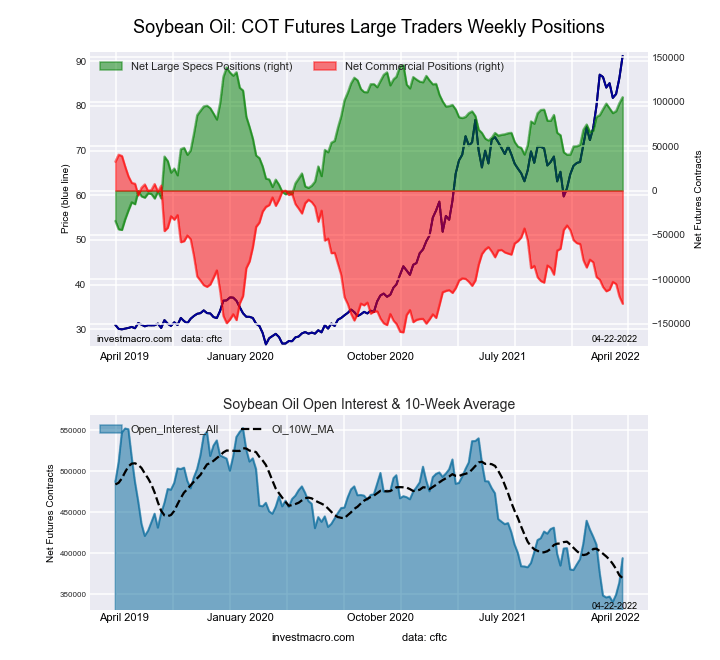

Highlighting the COT soft commodities data is the recent rises in Soybean Oil futures bets. The speculative net position in the Soybean Oil futures has gained for three straight weeks and has increased in eight out of the past ten weeks. Soybean Oil speculator positions have added a total of +39,176 contracts over the past ten weeks as well. This ascent in bullish bets has brought the current overall position to over +100,000 net contracts and to the highest level of the past fifty-six weeks, dating back to March 23rd of 2021.

Soybean Oil prices raced to a record high level at over $80 per pound this week and surpassed the previous price peaks of 2008 and 2021. The Soybean Oil prices have had a strong fundamental component driving it higher. The war in Ukraine has created a major disruption in Sunflower Oils (Ukraine and Russia are major suppliers) that has pushed the prices in alternative oils and other soft commodities sharply higher. Reuters news service also cited an Indonesia ban on exports of Palm Oil as having caused an even greater demand for alternative vegetable oils. The dreary outlook for vegetable oil production could mean we see even higher Soybean Oil prices.

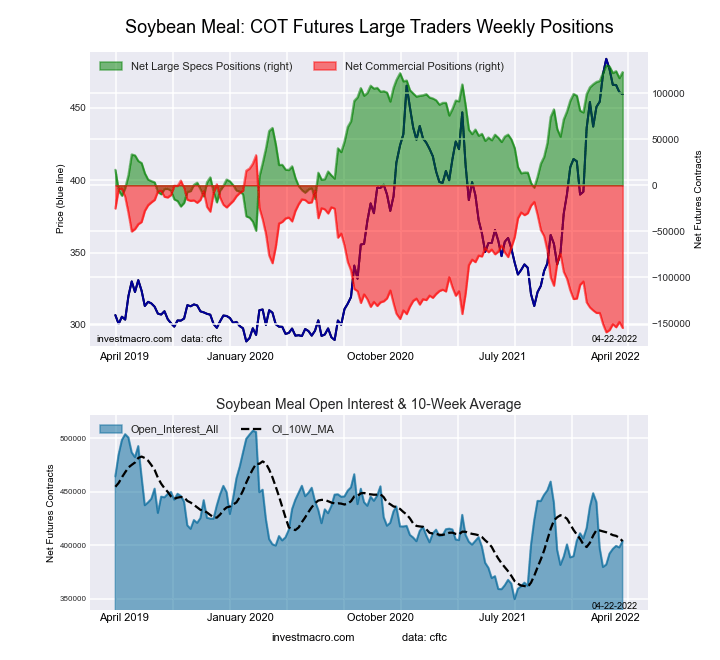

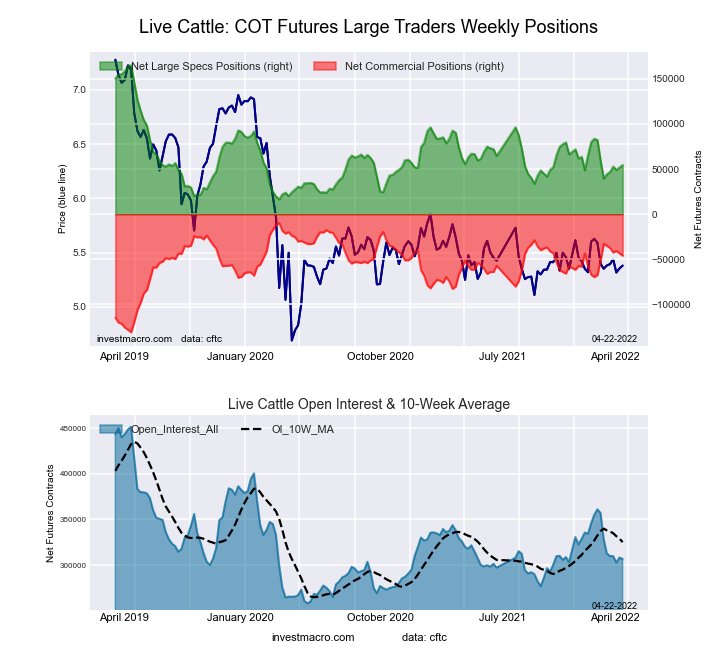

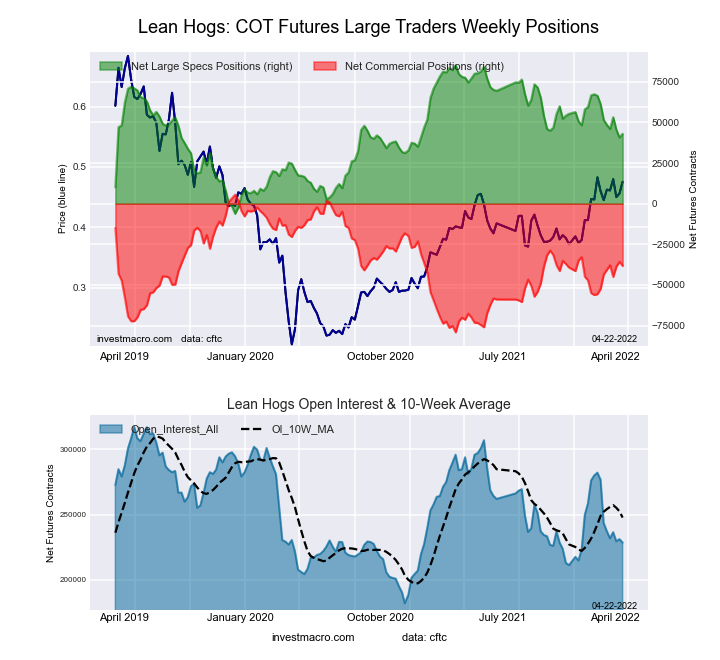

Overall, the soft commodities that saw higher bets this week were Corn (5,031 contracts), Soybeans (1,803 contracts), Soybean Oil (6,887 contracts), Soybean Meal (6,498 contracts), Live Cattle (2,683 contracts), Lean Hogs (2,231 contracts) and Cotton (1,900 contracts).

The soft commodities that saw lower bets this week were Sugar (-349 contracts), Coffee (-6,126 contracts), Cocoa (-2,802 contracts) and Wheat (-641 contracts).

Data Snapshot of Commodity Market Traders | Columns Legend

| WTI Crude | 1,740,300 | 0 | 307,697 | 1 | -351,252 | 100 | 43,555 | 76 |

| Corn | 1,625,198 | 42 | 500,612 | 94 | -456,269 | 7 | -44,343 | 18 |

| Natural Gas | 1,144,047 | 14 | -130,006 | 40 | 82,113 | 57 | 47,893 | 100 |

| Sugar | 909,622 | 21 | 239,515 | 86 | -295,470 | 12 | 55,955 | 77 |

| Soybeans | 762,855 | 36 | 200,098 | 80 | -174,873 | 25 | -25,225 | 28 |

| Gold | 575,202 | 40 | 239,757 | 60 | -275,525 | 37 | 35,768 | 66 |

| Heating Oil | 349,618 | 31 | 6,455 | 52 | -32,434 | 37 | 25,979 | 88 |

| Wheat | 337,038 | 1 | 23,245 | 67 | -20,425 | 21 | -2,820 | 98 |

| Coffee | 209,410 | 0 | 41,803 | 79 | -45,447 | 24 | 3,644 | 15 |

| Copper | 203,896 | 29 | 18,840 | 56 | -28,307 | 40 | 9,467 | 80 |

| Brent | 191,883 | 33 | -40,102 | 44 | 37,663 | 56 | 2,439 | 42 |

| Silver | 170,577 | 35 | 46,429 | 69 | -63,288 | 37 | 16,859 | 41 |

| Platinum | 61,603 | 24 | 7,537 | 13 | -13,812 | 89 | 6,275 | 50 |

| Palladium | 6,435 | 0 | -2,182 | 9 | 1,560 | 85 | 622 | 80 |

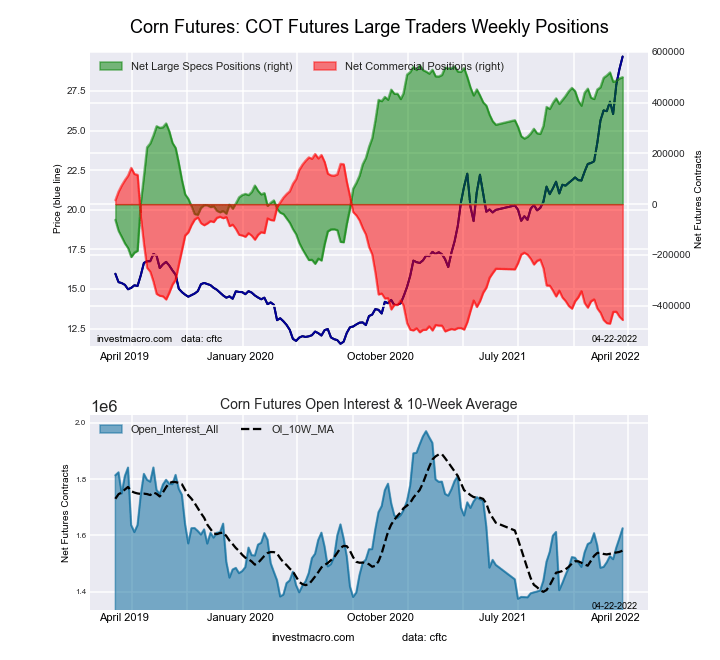

CORN Futures:

The CORN large speculator standing this week equaled a net position of 500,612 contracts in the data reported through Tuesday. This was a weekly lift of 5,031 contracts from the previous week which had a total of 495,581 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 94.0 percent. The commercials are Bearish-Extreme with a score of 6.9 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 17.5 percent.

| CORN Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 36.1 | 45.0 | 9.4 |

| – Percent of Open Interest Shorts: | 5.3 | 73.1 | 12.1 |

| – Net Position: | 500,612 | -456,269 | -44,343 |

| – Gross Longs: | 586,638 | 731,004 | 152,407 |

| – Gross Shorts: | 86,026 | 1,187,273 | 196,750 |

| – Long to Short Ratio: | 6.8 to 1 | 0.6 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 94.0 | 6.9 | 17.5 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.3 | 0.1 | -1.7 |

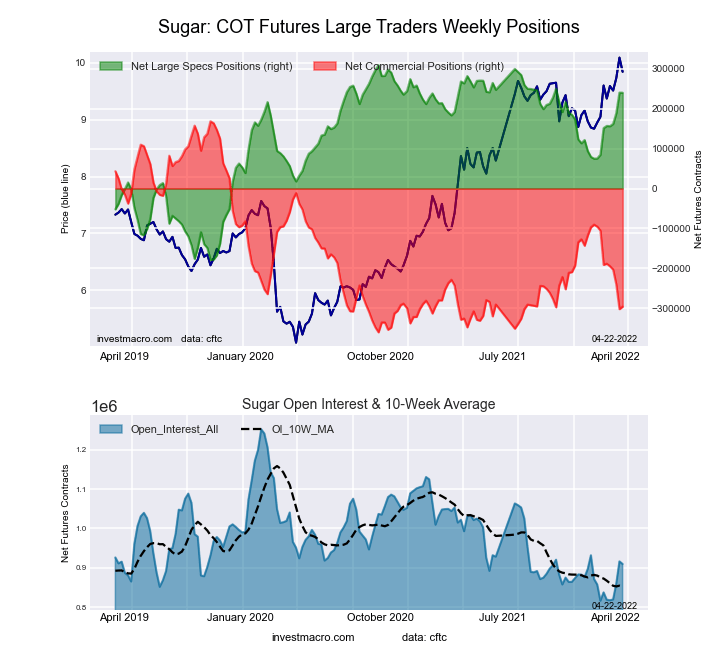

SUGAR Futures:

The SUGAR large speculator standing this week equaled a net position of 239,515 contracts in the data reported through Tuesday. This was a weekly decrease of -349 contracts from the previous week which had a total of 239,864 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 85.8 percent. The commercials are Bearish-Extreme with a score of 12.1 percent and the small traders (not shown in chart) are Bullish with a score of 77.0 percent.

| SUGAR Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.6 | 44.2 | 11.6 |

| – Percent of Open Interest Shorts: | 6.3 | 76.7 | 5.5 |

| – Net Position: | 239,515 | -295,470 | 55,955 |

| – Gross Longs: | 296,437 | 402,400 | 105,565 |

| – Gross Shorts: | 56,922 | 697,870 | 49,610 |

| – Long to Short Ratio: | 5.2 to 1 | 0.6 to 1 | 2.1 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 85.8 | 12.1 | 77.0 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 18.2 | -19.8 | 20.0 |

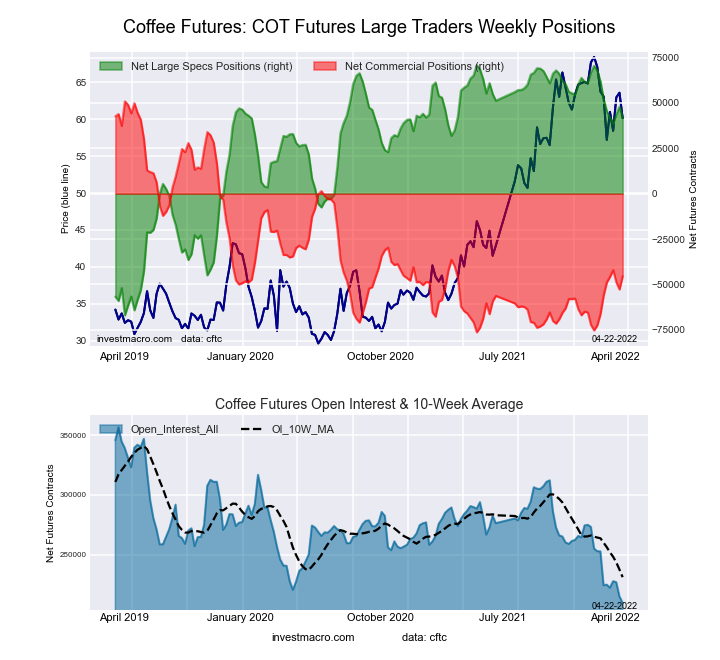

COFFEE Futures:

The COFFEE large speculator standing this week equaled a net position of 41,803 contracts in the data reported through Tuesday. This was a weekly fall of -6,126 contracts from the previous week which had a total of 47,929 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 78.5 percent. The commercials are Bearish with a score of 24.5 percent and the small traders (not shown in chart) are Bearish-Extreme with a score of 15.4 percent.

| COFFEE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 25.5 | 53.8 | 4.7 |

| – Percent of Open Interest Shorts: | 5.5 | 75.5 | 2.9 |

| – Net Position: | 41,803 | -45,447 | 3,644 |

| – Gross Longs: | 53,423 | 112,616 | 9,760 |

| – Gross Shorts: | 11,620 | 158,063 | 6,116 |

| – Long to Short Ratio: | 4.6 to 1 | 0.7 to 1 | 1.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 78.5 | 24.5 | 15.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -7.6 | 8.4 | -2.5 |

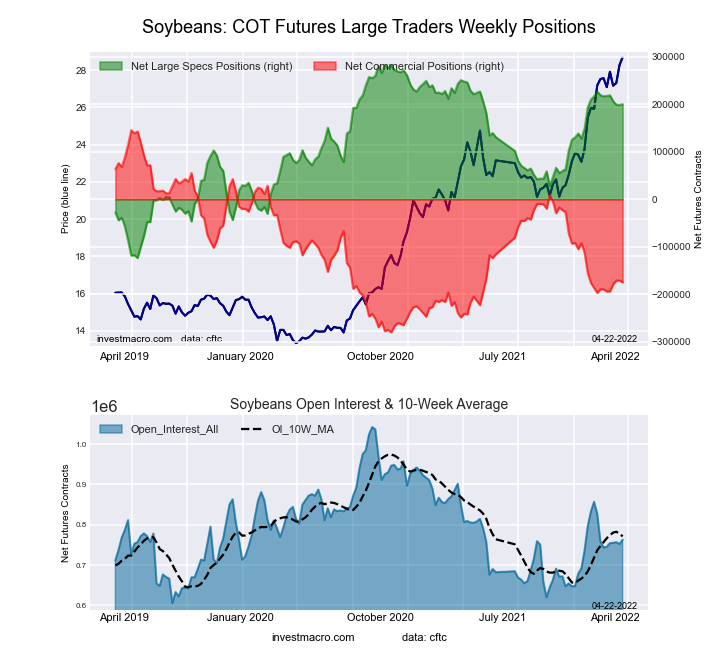

SOYBEANS Futures:

The SOYBEANS large speculator standing this week equaled a net position of 200,098 contracts in the data reported through Tuesday. This was a weekly boost of 1,803 contracts from the previous week which had a total of 198,295 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 79.8 percent. The commercials are Bearish with a score of 24.7 percent and the small traders (not shown in chart) are Bearish with a score of 28.4 percent.

| SOYBEANS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 32.8 | 46.0 | 7.2 |

| – Percent of Open Interest Shorts: | 6.6 | 69.0 | 10.5 |

| – Net Position: | 200,098 | -174,873 | -25,225 |

| – Gross Longs: | 250,566 | 351,286 | 55,231 |

| – Gross Shorts: | 50,468 | 526,159 | 80,456 |

| – Long to Short Ratio: | 5.0 to 1 | 0.7 to 1 | 0.7 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 79.8 | 24.7 | 28.4 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -4.1 | 3.4 | 3.6 |

SOYBEAN OIL Futures:

The SOYBEAN OIL large speculator standing this week equaled a net position of 105,211 contracts in the data reported through Tuesday. This was a weekly lift of 6,887 contracts from the previous week which had a total of 98,324 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 80.6 percent. The commercials are Bearish-Extreme with a score of 16.1 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 96.2 percent.

| SOYBEAN OIL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.5 | 44.2 | 10.5 |

| – Percent of Open Interest Shorts: | 4.8 | 76.5 | 4.9 |

| – Net Position: | 105,211 | -127,399 | 22,188 |

| – Gross Longs: | 124,302 | 174,162 | 41,383 |

| – Gross Shorts: | 19,091 | 301,561 | 19,195 |

| – Long to Short Ratio: | 6.5 to 1 | 0.6 to 1 | 2.2 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 80.6 | 16.1 | 96.2 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 7.3 | -9.5 | 20.0 |

SOYBEAN MEAL Futures:

The SOYBEAN MEAL large speculator standing this week equaled a net position of 122,756 contracts in the data reported through Tuesday. This was a weekly boost of 6,498 contracts from the previous week which had a total of 116,258 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 95.8 percent. The commercials are Bearish-Extreme with a score of 2.4 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 99.0 percent.

| SOYBEAN MEAL Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 33.5 | 42.4 | 13.1 |

| – Percent of Open Interest Shorts: | 3.1 | 80.7 | 5.2 |

| – Net Position: | 122,756 | -154,801 | 32,045 |

| – Gross Longs: | 135,397 | 171,107 | 52,874 |

| – Gross Shorts: | 12,641 | 325,908 | 20,829 |

| – Long to Short Ratio: | 10.7 to 1 | 0.5 to 1 | 2.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 95.8 | 2.4 | 99.0 |

| – Strength Index Reading (3 Year Range): | Bullish-Extreme | Bearish-Extreme | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 0.6 | -2.2 | 13.0 |

LIVE CATTLE Futures:

The LIVE CATTLE large speculator standing this week equaled a net position of 54,525 contracts in the data reported through Tuesday. This was a weekly lift of 2,683 contracts from the previous week which had a total of 51,842 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 29.5 percent. The commercials are Bullish with a score of 67.0 percent and the small traders (not shown in chart) are Bullish with a score of 56.0 percent.

| LIVE CATTLE Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 37.6 | 39.8 | 10.1 |

| – Percent of Open Interest Shorts: | 19.8 | 54.8 | 12.9 |

| – Net Position: | 54,525 | -45,886 | -8,639 |

| – Gross Longs: | 115,285 | 122,065 | 30,955 |

| – Gross Shorts: | 60,760 | 167,951 | 39,594 |

| – Long to Short Ratio: | 1.9 to 1 | 0.7 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 29.5 | 67.0 | 56.0 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 11.6 | -12.0 | -5.7 |

LEAN HOGS Futures:

The LEAN HOGS large speculator standing this week equaled a net position of 43,002 contracts in the data reported through Tuesday. This was a weekly increase of 2,231 contracts from the previous week which had a total of 40,771 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 53.6 percent. The commercials are Bearish with a score of 48.2 percent and the small traders (not shown in chart) are Bullish with a score of 69.8 percent.

| LEAN HOGS Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 36.4 | 34.4 | 10.7 |

| – Percent of Open Interest Shorts: | 17.6 | 51.1 | 12.7 |

| – Net Position: | 43,002 | -38,275 | -4,727 |

| – Gross Longs: | 83,133 | 78,601 | 24,424 |

| – Gross Shorts: | 40,131 | 116,876 | 29,151 |

| – Long to Short Ratio: | 2.1 to 1 | 0.7 to 1 | 0.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 53.6 | 48.2 | 69.8 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -9.3 | 6.1 | 16.7 |

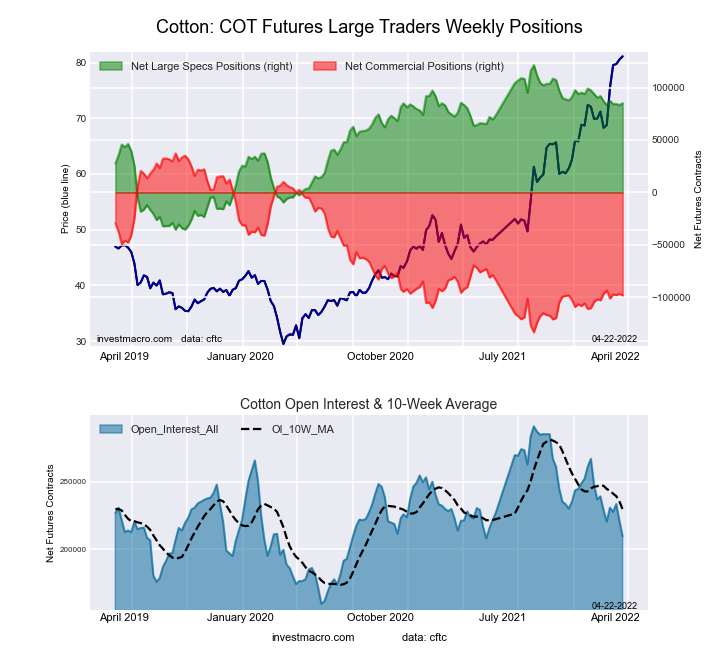

COTTON Futures:

The COTTON large speculator standing this week equaled a net position of 85,120 contracts in the data reported through Tuesday. This was a weekly gain of 1,900 contracts from the previous week which had a total of 83,220 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 76.9 percent. The commercials are Bearish with a score of 20.6 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 94.6 percent.

| COTTON Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 46.6 | 35.0 | 9.4 |

| – Percent of Open Interest Shorts: | 6.0 | 81.8 | 3.1 |

| – Net Position: | 85,120 | -98,107 | 12,987 |

| – Gross Longs: | 97,613 | 73,296 | 19,582 |

| – Gross Shorts: | 12,493 | 171,403 | 6,595 |

| – Long to Short Ratio: | 7.8 to 1 | 0.4 to 1 | 3.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 76.9 | 20.6 | 94.6 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | -1.1 | -1.0 | 20.9 |

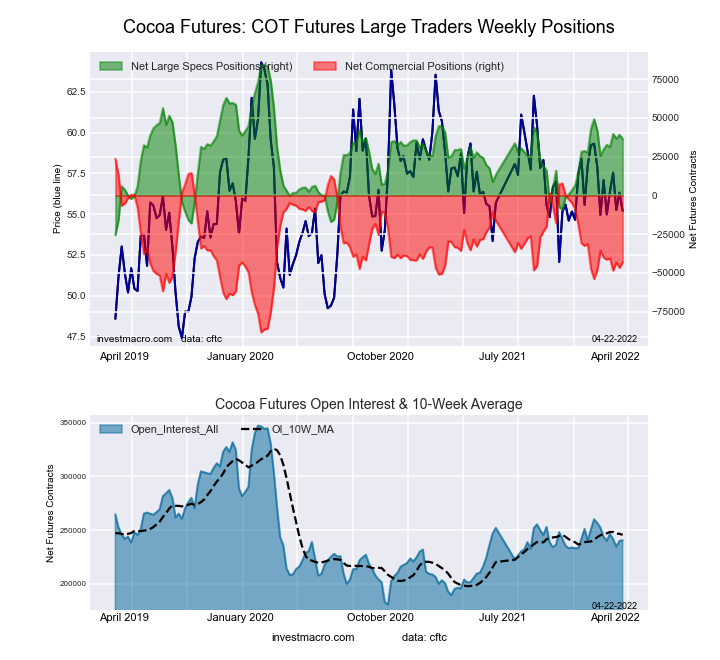

COCOA Futures:

The COCOA large speculator standing this week equaled a net position of 36,357 contracts in the data reported through Tuesday. This was a weekly reduction of -2,802 contracts from the previous week which had a total of 39,159 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 53.3 percent. The commercials are Bearish with a score of 44.0 percent and the small traders (not shown in chart) are Bullish with a score of 65.1 percent.

| COCOA Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 31.5 | 45.6 | 6.3 |

| – Percent of Open Interest Shorts: | 16.4 | 63.5 | 3.5 |

| – Net Position: | 36,357 | -43,099 | 6,742 |

| – Gross Longs: | 75,822 | 109,538 | 15,230 |

| – Gross Shorts: | 39,465 | 152,637 | 8,488 |

| – Long to Short Ratio: | 1.9 to 1 | 0.7 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 53.3 | 44.0 | 65.1 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 6.5 | -2.9 | -34.9 |

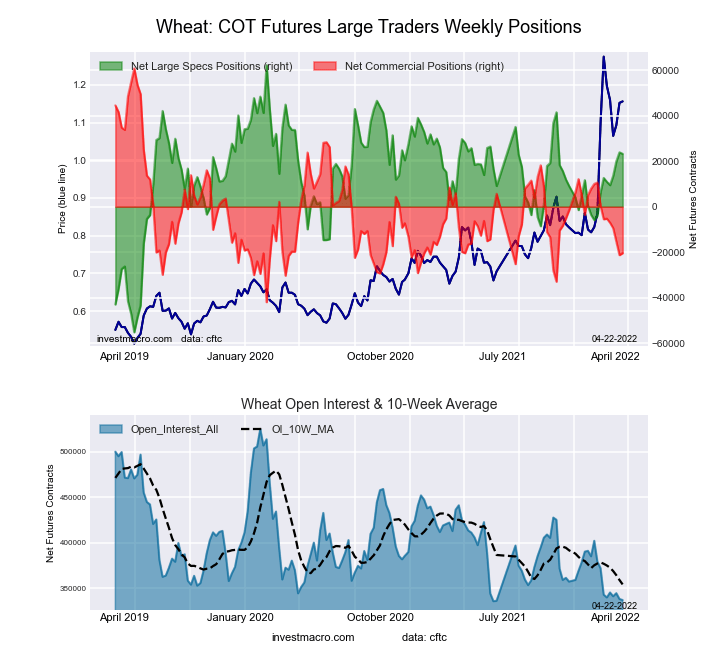

WHEAT Futures:

The WHEAT large speculator standing this week equaled a net position of 23,245 contracts in the data reported through Tuesday. This was a weekly fall of -641 contracts from the previous week which had a total of 23,886 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 66.8 percent. The commercials are Bearish with a score of 21.0 percent and the small traders (not shown in chart) are Bullish-Extreme with a score of 98.1 percent.

| WHEAT Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| – Percent of Open Interest Longs: | 36.0 | 37.6 | 9.5 |

| – Percent of Open Interest Shorts: | 29.1 | 43.7 | 10.4 |

| – Net Position: | 23,245 | -20,425 | -2,820 |

| – Gross Longs: | 121,339 | 126,766 | 32,116 |

| – Gross Shorts: | 98,094 | 147,191 | 34,936 |

| – Long to Short Ratio: | 1.2 to 1 | 0.9 to 1 | 0.9 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 66.8 | 21.0 | 98.1 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.0 | -14.5 | 22.9 |

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting).See CFTC criteria here.

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more