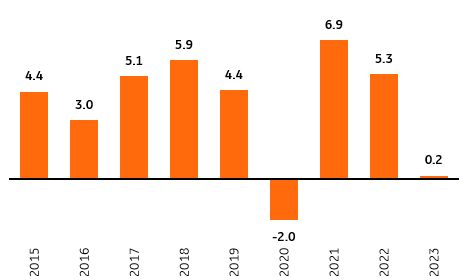

Slow Turnaround In Polish Economy In 2023

According to the flash estimate, Poland's economy grew by 0.2% in 2023, following a GDP expansion of 5.3% in 2022. The recovery started in mid-2023 but then lost steam in the fourth quarter due to weaker consumption and sluggish production and exports.

Developments in 2023

In 2023, GDP grew by 0.2%, following an expansion of 5.3% in 2022. Domestic demand contracted by 4.1% last year, with household consumption falling by 1.0% and investment rising by a hefty 8.0%.

The change in inventories last year had a large negative impact on GDP. In contrast, support for the economy was provided by an improvement in the foreign trade balance, with this mainly due to a deep decline in imports amid falling exports.

The data suggests that GDP grew by only 1% year-on-year in 4Q23 vs 0.5% YoY in 3Q23. The recovery started in mid-2023 but then lost steam in the fourth quarter due to weaker consumption and sluggish production and exports. We estimate that household consumption was stagnant (around 0.1% YoY), after an initial recovery beginning in 3Q23. On the other hand, fixed investments continued on a solid growth path (around 7.6% YoY).

For the next consecutive quarter, the CSO reports a profoundly negative contribution to GDP from the change in inventories and a significant positive impact from the foreign trade balance. This suggests that we may see significant revisions to the GDP structure in the coming quarters compared to the initial estimate.

Sluggish growth in Poland in 2023

Real GDP in %

GUS

Outlook for 2024

The data released today indicates that the recovery remained sluggish in 4Q23 (GDP growth of about 1% YoY, after 0.5% YoY in 3Q23). In particular, the anticipated rebound in consumption has so far been disappointing (about 0.1% YoY in 4Q23, after 0.8% YoY in 3Q23), despite a marked improvement in real household disposable income, supported by double-digit wage growth and rapid disinflation. This suggests that the marginal propensity to save is elevated and consumers are hesitant to spend.

We continue to expect that real income growth, coupled with the marked improvement in consumer sentiment that we have seen for more than a year, will translate into increased consumer outlays. Against the backdrop of weak external demand, we count on domestic consumption to be the main driver of economic growth in 2024. Investment continues to maintain a solid pace.

We forecast Poland's GDP growth in 2024 at 3%, but in the context of a weak external environment (soft economic conditions in Germany) and the slow rebound in consumption so far, the risks to our forecast are broadly balanced.

More By This Author:

FX Daily: US Data Does The Talking

Japan’s December Activity Data Suggests Mild 4Q GDP Rebound

French Inflation Eases More Than Expected

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more