Share Prices Of Two Icelandic Banks Improving

Image Source: Pexels

The Price-to-Tangible Book Value ratio (P/TBV) is a common measure used to value bank stocks. Using TBV in the denominator rather than Book Value (BV) is considered a more conservative metric, as it uses only the hard or real assets of banks. The P/TBV ratio will always be at least as high as the P/BV ratio.

Both ratios can be utilized to determine if the current stock price is over- or undervalued relative to TBV or BV. A lower ratio can be interpreted as if the market price of the shares of the underlying company is potentially trading at a discount to its TBV or BV (the share price is relatively cheap). Book Value is another word for Equity (Assets minus Liabilities).

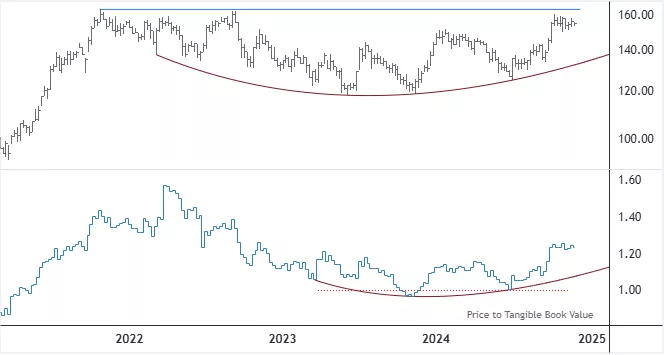

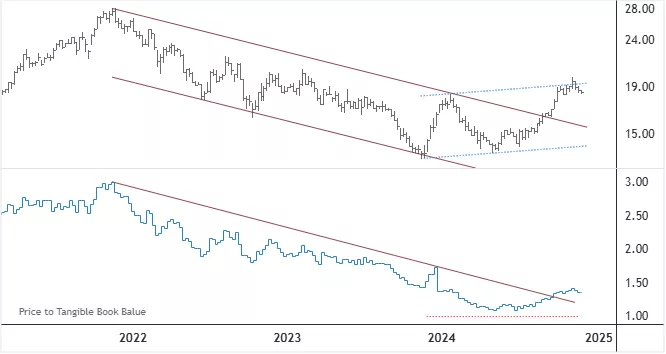

The two weekly charts below show the dividends-adjusted share prices of two banks listed on the Icelandic stock market: Arion banki and Kvika banki. In the lower windows, the P/TBV ratios utilizing market price and TBV on a per share basis are shown.

Share Price of Arion banki – Weekly Chart

The price (after adjusting for dividends) is close to its 3+ year high and potentially setting up for a breakout to the upside. Compared to its TBV, the ratio has turned up after staying below 1 for about seven weeks in late 2023. Currently, the shares are trading at a 1.23 multiple.

Share Price of Kvika banki – Weekly Chart

The price has, seemingly, reversed its long-term trend from down to up. Preferably it needs to stay above 16 ISK/share for the uptrend thesis to remain in place. In comparison to TBV, the ratio has been steadily rising since mid-year 2024 with the stock price currently trading at 1.35 times its TBV.

More By This Author:

Return Of OMXIPI On A Cyclical Upturn

OMXIPI Expected To Drop

Increased US Recession Risk

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his articles ...

more