Sensex Today Tanks 705 Points; Nifty Below 24,550

After opening the day lower, the benchmark indices continued their downward momentum, ended the session in the red.

Indian equity market indices Senex and Nifty settled lower as investors digested the impact of 50 per cent tariffs on US exports that took effect on Wednesday. The new tariffs that took effect a day earlier are among the highest in Asia as tensions between New Delhi and Washington ramped up. The additional tariffs were imposed for India's continued purchase of Russian crude oil.

At the closing bell, the BSE Sensex closed lower by 705 points (down 0.9%).

Meanwhile, the NSE Nifty closed 211 points lower (down 0.9%).

Titan Company, Maruti Suzuki, and Axis Bank are among the top gainers today.

Sun Pharma, Tata Steel, and Trent, on the other hand, were among the top losers today.

The GIFT Nifty was trading at 24,626, lower by 71 points at the time of writing.

The BSE MidCap index ended 1.1% lower, and the BSE SmallCap index ended 0.9% lower.

Sectoral indices are trading negatively today, with stocks in the telecommunication sector and the service sector witnessing selling pressure.

The rupee is trading at Rs 87.6 against the US$.

Gold prices for the latest contract on MCX are trading 0.0% lower at Rs 101,539 per 10 grams.

Meanwhile, silver prices were trading 0.4% higher at Rs 116,659 per 1 kg.

Here are four reasons why Indian share markets are falling:

#1 The Trump tariff impact

The US imposed a 50% tariff on Indian goods from August 27, citing India's alleged oil imports from Russia. This move has hit market sentiment, but both countries are expected to work towards finding common ground. US Treasury Secretary Scott Bessent expressed confidence that India and the US will come together to resolve the issue.

#2 Elevated valuation

The Indian market is struggling with high valuations and slow earnings growth, causing foreign investors to sell stocks. However, domestic institutional investors (DIIs) are aggressively buying, providing strong support to the market.

#3 FII continue selling Indian stocks

Foreign institutional investors (FIIs) have sold ?34,733 crore worth of Indian stocks in August and ?47,667 crore in July, amid tariff uncertainties and a shift in market sentiment. Indian stocks are now the least favoured among emerging market investors. Investors have been moving their funds from India to other markets like Taiwan, Hong Kong/China, and South Korea.

#4 Weak global cues

Trump's tariffs on India could delay the country's expected earnings revival in the second half of the year. The trade war's global implications may also slow down India's economy, as a global economic downturn could impact Indian markets.

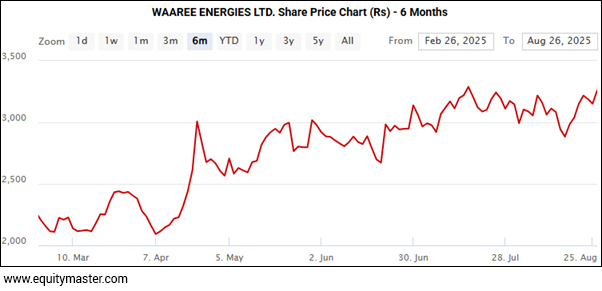

Why Waaree Energies Share Price Is Rising

In the news from electronic equipment sector, shares of Waaree Energies jumped 4% after its US arm Waaree Solar Americas bagged a 425-megawatt (MW) supply order for advanced solar modules.

The company has revealed that a well-known American developer and owner-operator of utility-scale solar and energy storage projects across the US had placed an order for solar modules from its wholly owned subsidiary.

In a regulatory filing, Waaree Energies stated that the solar module order, which is expected to be delivered during the 2026-2027 fiscal year (FY27), demonstrates a strategic shift in how the US market is embracing Indian manufacturing strength to accelerate its decarbonisation goals and enhances the company's expanding presence in North America.

The President of Waaree Solar Americas said the order symbolizes India's growing strength in clean energy manufacturing. Waaree is proud to support the US's renewable energy goals, serving as a reliable partner between continents and boosting confidence in the global transition to clean energy.

Dr Agarwal's Shares Drop on Merger Plan

Moving on to the news from healthcare sector, shares of Dr. Agarwal's Eye Hospital Ltd.'s fell as much as 18% after the company revealed that its board of directors had approved a plan to merge (by absorption) with its listed parent, Dr. Agarwal's Healthcare Ltd.

The merger plan needs regulatory and shareholder approval. If approved, AHCL will issue new shares to AEHL shareholders based on a set exchange ratio.

The merger is a key strategic move that will boost the combined businesses' potential and create long-term value for stakeholders by simplifying the group structure.

The CEO of Dr. Agarwal's Health Care Limited said they've worked hard towards the merger and are committed to completing it soon. The swap ratio is fair and in the best interest of all stakeholders, setting a strong base for future growth.

More By This Author:

Sensex Today Tanks 600 Point; Nifty Below 24,550

Sensex Today Ends 304 Points Higher; Nifty Above 24,600

Nifty Above 24,550; Sensex Today Trades Higher

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more