Sensex Today Rallies 715 Points; Nifty Above 24,800

After opening the day higher, the benchmark indices continued their upward momentum and ended the session in green.

Indian equity market indices, Sensex and Nifty, snapped the eight-day losing streak after the Reserve Bank of India (RBI) monetary policy committee (MPC) kept the repo rate unchanged at 5.5 per cent and maintained its stance at Neutral.

At the closing bell, the BSE Sensex closed higher by 715 points (up 0.9%).

Meanwhile, the NSE Nifty closed 225 points higher (up 0.9%).

Tata Motors, Kotak Mahindra, and Trent are among the top gainers today.

Bajaj Finance, SBI, and Tata Steel, on the other hand, were among the top losers today.

The GIFT Nifty was trading at 24,95,0 higher by 189 points at the time of writing.

The BSE MidCap index ended 0.9% higher, and the BSE SmallCap index ended 1.1% higher.

Sectoral indices are trading mixed today, with stocks in the realty sector and media sector witnessing selling pressure. Meanwhile, stocks in the metal sector and the financial services sector witnessed buying.

The rupee is trading at Rs 88.1 against the US$.

Gold prices for the latest contract on MCX are trading 0.5% higher at Rs 116, 434 per 10 grams.

Meanwhile, silver prices were trading 1.3% higher at Rs 144,090 per 1 kg.

Here are three reasons why Indian share markets are rising:

#1 RBI MPC Announcements

The Reserve Bank of India kept the repo rate unchanged at 5.5% and maintained a neutral stance, citing benign inflation and resilient growth prospects.

RBI Governor Sanjay Malhotra announced that GDP growth is projected at 6.8% for FY26, while inflation is expected to be 2.6%. The central bank's decision reflects a wait-and-watch approach amid global trade uncertainties and tariff-related headwinds.

#2 Auto Stock Boost

Tata Motors gained 3.35% after its demerger took effect on October 1, splitting into two separate entities for commercial and passenger vehicles. This move aims to unlock value and improve strategic focus for each division. Nifty Auto rose 0.59% intra trade, with other auto stocks also rallying.

#3 BROADER SECTORAL RALLY SUPPORTS MARKET

Several other sectors joined the uptrend. Among the Nifty indices, Media led with a gain of 2.53%, followed by Private Bank at 1.81%, Financial Services at 1.25%, Healthcare at 1.08%, and Pharma at 1.04%.

Energy and IT stocks also posted modest gains, with Nifty Oil & Gas up 0.43% and Nifty IT rising 0.42%. Realty, FMCG, and consumer durables indices traded higher as well.

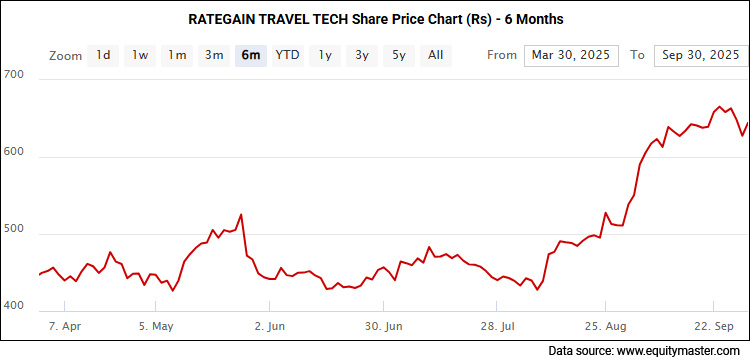

RateGain Shares Surge on Strategic Acquisition

In the news from IT sector, shares of RateGain jumped 8% after the company through its subsidiary, RateGain Technologies Limited, UK, entered into a definitive agreement to acquire Sojern Inc.

The company also stated in a separate filing that it will discuss raising money through the issuance of equity shares at its meeting on 4 October 2025.

The acquisition supports RateGain's AI-first approach and furthers its goal of creating a single platform that helps hotels attract visitors, interact with and keep them while they are there, and then increase wallet share.

By adding Sojern, RateGain will be able to better serve its large hospitality clients as well as the rapidly expanding SMB hotel market, giving hotels of all sizes access to cutting-edge AI-powered solutions. Consumers can expect increased productivity and new opportunities to enhance the visitor experience.

Sojern's expertise in Martech, adopted by properties, destinations, attractions, and corporates, will complement RateGain's distribution, analytics, and revenue optimization solutions. This combination will provide hospitality players with a broader set of tools to compete effectively in the travel industry.

RITES Shares Jump on Etihad Partnership

Moving on to the news from engineering sector, shares of RITES surges 3% after the Reserve Bank of India (RBI) on Wednesday announced its plan to reduce the cost of infrastructure financing by NBFCs.

It proposed to reduce the risk weights applicable to lending by NBFCs to operational, high-quality infrastructure projects.

Additionally, the engineering and consulting firm for transport infrastructure announced that it has inked a business partnership agreement with Etihad Rail, a company based in the United Arab Emirates, through its subsidiary, National Infrastructure Construction Company (NICC).

According to the statement, the partnership intends to shape infrastructure projects in the area by fusing the NICC's execution skills with RITES' fifty years of experience in engineering solutions, transport infrastructure, and consulting.

More By This Author:

Sensex Today Trades Marginally Higher; Nifty Above 24,600

Sensex Today Ends 97 Points Lower; Nifty Below 24,650

Sensex Today Trades Marginally Higher; Nifty Above 24,650

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more