Sensex Today Rallies 583 Points; Nifty Above 25,050

After opening the day higher, the benchmark indices continued their upward momentum, ended the session in green.

Indian equity market indices Senex and Nifty extended gains for the third consecutive session on Monday, with buying seen in information technology and banking stocks.

At the closing bell, the BSE Sensex closed higher by 583 points (up 0.7%).

Meanwhile, the NSE Nifty closed 183 points higher (up 0.7%).

TCS, Tech Mahindra, and Axis Bank are among the top gainers today.

Tata Steel, Adani Port, and Power Grid Corp, on the hand, were among the top losers today.

The GIFT Nifty was trading at 24,950, higher by 189 points at the time of writing.

The BSE MidCap index ended 0.7% higher, and the BSE SmallCap index ended 0.2% lower.

Sectoral indices are trading mixed today, with stocks in the metal sector and the power sector witnessing selling pressure. Meanwhile, stocks in the IT sector and the banking sector witnessed buying.

The rupee is trading at Rs 88.1 against the US$.

Gold prices for the latest contract on MCX are trading 1.4% higher at Rs 119,838 per 10 grams.

Meanwhile, silver prices were trading 1.2% higher at Rs 147,512 per 1 kg.

Bank of Baroda Shares Surge on Q2 Update

In the news from the banking sector, shares of Bank of Baroda surged 3% after posting provisional business figures for the September quarter of the current financial year (Q2FY26).

The public-sector lender's regulatory filing states that as of 30 September 2025, its worldwide operations had grown by 10.47% year-over-year (YoY) Rs 27,800 billion (bn).

The bank's global deposits increased by 9.28% YoY to Rs 15,000 bn, while its global advances increased by 11.90% YoY to Rs 12,800 bn.

While domestic advances increased 11.4% YoY to Rs 10,470 bn, domestic deposits saw a respectable YoY increase of 9.66 percent to Rs 12,720 bn.

Bank of Baroda's domestic retail advances, excluding pool purchases, increased 17.5% year over year to Rs 2,700 bn.

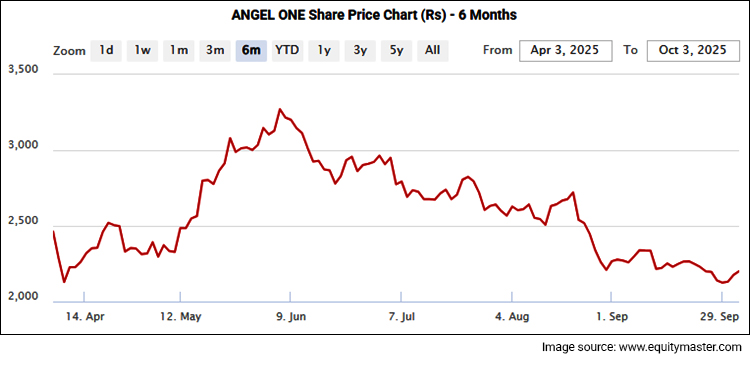

Angel One Q2 Update Boosts Shares

Moving on to the news from financial services sector, shares of Angle One surged 3% after the company released its September quarter update.

In September 2025, the company registered 34.08 million clients, up 24% from 27.49 million (m) the previous year.

However, compared to 489.18 m a year ago, its number of orders decreased 26.3% year over year (Y-o-Y) to 360.43 m. Orders increased by 5% sequentially.

The average daily orders (ADO) were 5.63 m, down from 7.64 m in the previous year. The ADO grew by 0.1% on a quarter-over-quarter (Q-o-Q) basis.

Based on notional turnover, Angel One's average daily turnover (ADTO) was Rs 450.8 bn, while it was Rs 453.9 bn year over year.

In addition, its revenue for the quarter decreased by 19% to Rs 11.4 bn from Rs 14.1 bn in the same period last year. On the other hand, revenue increased by 8% on a sequential basis.

By almost tripling the minimum trading lot size and restricting weekly options contracts to one per exchange, the market regulator increased the entry barrier for trading derivatives last October, making it more expensive to trade the asset class.

For brokers who rely heavily on the turnover of derivatives, the action, which was intended to reduce speculative retail trading, raised concerns about potential short-term pressure on volumes and revenue.

IndusInd Bank's Q2 Advances and Deposits Decline

Moving on to the news from banking sector, shares of IndusInd Bank came into focus after the company released its September quarter update.

IndusInd Bank Ltd. revealed a contraction in its business performance for the second quarter, with advances and deposits falling both sequentially and year over year.

At Rs 3,270 bn the bank's net advances represented a 2% quarterly decline and an 8% annual decline. At Rs 3,890 bn, net deposits also decreased 2% from quarter to quarter and 5% from year to year.

Indicating a move away from low-cost deposits, the lender's Current Account and Savings Account (CASA) ratio also weakened during the quarter, falling to 30.80% from 31.50% the previous quarter and 35.90% a year earlier.

More By This Author:

Sensex Today Trades Higher; Bajaj Finance Up 3%

Sensex Today Ends 224 Points Higher; Nifty Above 24,850

Sensex Today Trades Lower; M&M, Maruti Suzuki Top Losers

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more