Sensex Today Trades Higher; Bajaj Finance Up 3%

Asian markets traded higher on Monday, with Japanese markets hitting record highs after the country's ruling Liberal Democratic Party elected fiscal dove Sanae Takaichi as its new leader and become the next prime minister.

US stock market ended mixed on Friday, with the Dow Jones and S&P 500 registering record closing highs and the Nasdaq closing lower.

Here's a table showing how US stocks performed on Friday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 246.45 | 0.02 | 0.01% | 247.12 | 242.47 | 256.7 | 142.66 |

| Apple | 258.02 | 0.89 | 0.35% | 259.24 | 253.95 | 260.09 | 169.21 |

| Meta | 710.56 | -16.49 | -2.27% | 731 | 710.18 | 796.25 | 479.8 |

| Tesla | 429.83 | -6.17 | -1.42% | 446.77 | 416.58 | 488.54 | 212.11 |

| Netflix | 1153.32 | -9.21 | -0.79% | 1168 | 1143.22 | 1341.15 | 677.88 |

| Amazon | 219.51 | -2.9 | -1.30% | 224.2 | 219.34 | 242.52 | 161.43 |

| Microsoft | 517.35 | 1.61 | 0.31% | 520.49 | 515 | 555.45 | 344.79 |

| Dow Jones | 46758.28 | 238.56 | 0.51% | 47049.64 | 46566.87 | 47049.64 | 36611.78 |

| Nasdaq | 24785.52 | -107.24 | -0.43% | 24958.26 | 24713.58 | 24958.26 | 16542.2 |

Source: Equitymaster

At present, the BSE Sensex is trading 262 points higher, and the NSE Nifty is trading 74 points higher.

Bajaj Finance, TCS, and Kotak Mahindra are among the top gainers today.

Power Grid Corp, Tata Steel, and Adani Ports, on the other hand, are among the top losers today.

The BSE Midcap index is trading 0.1% higher, and the BSE Smallcap index is trading 0.1% higher.

Sectoral indices are trading mixed today, with stocks in the power sector and metal sector witnessing selling pressure. Meanwhile, stocks in the media sector and the banking sector witnessed buying.

The rupee is trading at Rs 88.6 against the US dollar.

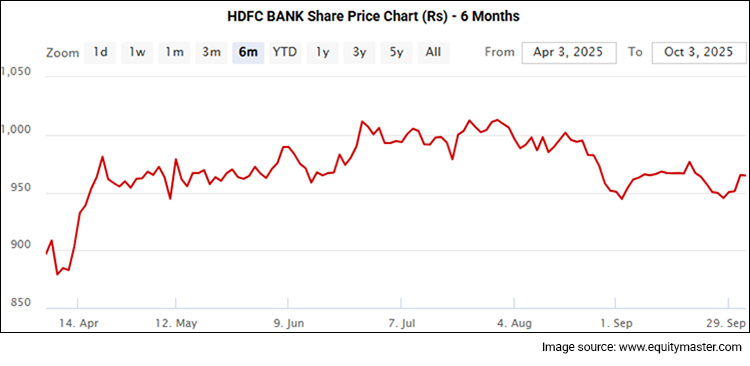

HDFC Reports Strong Growth in Q2 FY26

Shares of HDFC Bank came into focus after the company reported a 9% year-over-year (YoY) increase in its average advances under management to Rs 27,900 billion (bn) in the second quarter of the fiscal year 2025-2026 (Q2FY26).

It was Rs 25,600 bn during the same period of the previous fiscal year. In addition, the bank reported in a regulatory filing on Saturday that it increased 1.9% on a quarter-over-quarter (QoQ) basis from Rs 27,400 bn in the June FY26 quarter.

The average deposits of the largest private bank in the nation totalled about Rs 27,100 bn in the reviewed quarter, representing a 15.1% increase over the Rs 23,500 bn it recorded in the September quarter of FY25.

HDFC Bank's average deposits increased by 2% on a quarterly basis from Rs 26,600 bn in the first quarter of FY26.

Average CASA (Current Account and Savings Account) deposits at the bank increased 8.5% year over year to Rs 8,700 bn in Q2FY26 from Rs 8,100 bn in the September FY25 quarter.

During the reporting quarter, the bank's average time deposits increased 18.6% year over year to Rs 18,300 bn, compared to Rs 15,500 bn during the same period the previous year. From Rs 17,900 bn in the June FY26 quarter, it increased by 2% QoQ.

DMart Reports Strong Q2 Revenue Growth

The standalone business update for the quarter ending September 30, 2025 (Q2 FY26) was released by Avenue Supermarts Ltd., the company that runs the D-Mart retail chain stores.

DMart's Q2 standalone revenue from operations rose to Rs 162.19 bn in FY26, up from Rs 140.50 bn in FY25.

Vedanta Q2 Output Soars, Demerger Delayed

With the highest-ever second-quarter production of zinc and record quarterly and half-yearly production of aluminium, the natural resources miner reported a slight YoY increase.

According to the company filing, Vedanta also reported the highest quarterly and half-yearly alumina production it has ever had from its refinery in Lanjigarh.

In Q2FY26, Vedanta's average daily gross production of petrol and oil fell 15% to 89,300 barrels of oil equivalent per day. The quarter saw a 19% decline in iron ore production to 1.1 million tonnes, most likely due to increased rainfall or a weak demand for steel in construction.

The miner observed a steep decline in lead and silver production during the quarter, which dragged the metal basket, despite increased production in aluminium, alumina, zinc, and pig iron.

Vedanta's demerger deadline has been pushed to March 2026 due to pending approvals from the National Company Law Tribunal and government authorities. The demerger aims to split Vedanta's business into separate entities, allowing for greater autonomy and potential growth.

This move is expected to unlock shareholder value and enable each entity to focus on its core business.

More By This Author:

Sensex Today Ends 224 Points Higher; Nifty Above 24,850Sensex Today Trades Lower; M&M, Maruti Suzuki Top Losers

Sensex Today Rallies 715 Points; Nifty Above 24,800

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more