Sensex Today Rallies 1,310 Points; Nifty Above 22,800

After opening higher, Indian benchmark indices rallied as the session progressed, ending the day strongly.

Indian benchmark equity indices BSE Sensex and Nifty50 ended higher on Friday following the pause in US tariffs for most nations, except China.

At the closing bell, the BSE Sensex stood higher by 1,310 points (up 1.8%).

Meanwhile, the NSE Nifty closed higher by 429 points (up 1.9%).

Hindalco, Coal India, and Tata Steel are among the top gainers today.

Asian Paints, TCS, and Apollo Hospital, on the other hand, were among the top losers today.

The GIFT Nifty was trading at 22,913, up by 426 points at the time of writing.

The BSE MidCap index ended 1.8% higher, and the BSE SmallCap index ended 2.% higher.

Sectoral indices ended on a positive note in the metal sector, power sector, and energy sector, witnessing most buying speer.

The rupee is trading at 86.1 against the US$.

Gold prices for the latest contract on MCX are trading 1.6% higher at Rs 93,526 per 10 grams.

Meanwhile, silver prices were trading 1.3% higher at Rs 92,788 per 1 kg.

Here are the four key factors driving the market's momentum.

#1 Trump's Tariff Pause

This rally is mainly driven by Trump's tariffs pause for 90 days, excluding China. However, the important part in this tariffs' pa use is an exemption for the Indian export to the US, which has fueled buying on Dalal Street during the early morning session on Friday.

#2 Tariff on China

While India has been given a 90-day waiver from the reciprocal tariffs, the US has upped its ante against China and has imposed a 145-per cent tariff on the country. The 145-per cent tariff on China includes reciprocal tariffs of 125% and 20% tariffs for China's alleged supply of fentanyl in the US.

In retaliation, China has been taking various steps to punish supply of US products in its country.

#3 India Eyes Negotiations

Amid Trump's pause on tariffs, reports suggest India is negotiating hard to crack a deal with the United States. According to US Secretary of the Treasury, Scott Bessent, trade negotiations are taking place with "China's neighbours" like Japan, South Korea, and India.

Further, another report suggested on Thursday that India has proposed to the US to lower tariffs on automobiles. In return, it has asked the US to provide concessions on agricultural products.

#4 The Rupee & Oil Factor

India's domestic currency opened higher on Friday, rising 45 paise to 86.24 against the US dollar. The rise in Indian Rupee was aided by a sharp decline in the dollar index and oil prices, amid rising US-China trade tensions. During the intraday trade, Rupee hit a high of 85.955 per US dollar.

A stronger rupee makes investments by foreign investors lucrative in rupee-denominated securities, likely supporting FII inflows.

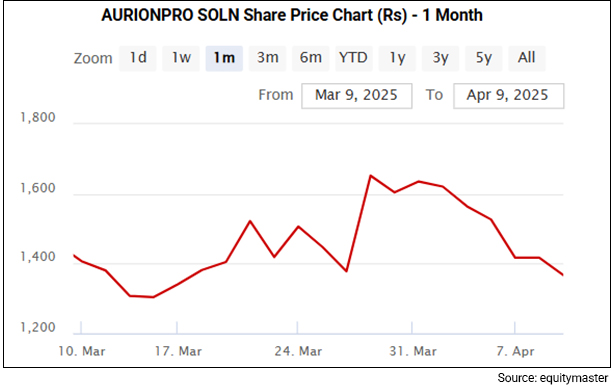

Aurionpro Solutions Shares Jump 15%

In news from the IT sector, shares of Aurionpro Solutions jumped over 15% to Rs 1,578 per share on 11 April, following the company's announcement of acquiring Hyderabad-based Fintra Software in a move aimed at strengthening its next-generation trade finance solutions for global banks.

The company stated that it has entered into an agreement to acquire 100% stake in Fintra Software Private. This acquisition includes all intellectual property rights and associated resources and is intended to boost Aurionpro's capabilities in the Transaction Banking space.

The integration of Fintra's solutions is expected to deliver a comprehensive, front-to-back platform for cash and trade management, further enhancing Aurionpro's product offerings and presence in the transaction banking market.

Aurionpro Solutions is a technology company that specialises in software platforms for Wholesale Banking, with a focus on Trade Finance, Supply Chain Finance, Escrow, and Factoring solutions.

Why EMS Stocks are Rising?

Moving on to news from the EMS sector, shares of major Electronics Manufacturing Services (EMS) firms such as Dixon Technologies, Kaynes Technology and Amber Enterprises rose by up to 8% in Friday's trading session amid the intensifying US-China trade war.

The shares of the EMS companies jumped on hopes of higher orders and margins as investors feel a prolonged dispute between the world's two biggest economies - US and China is likely to benefit the Indian manufacturers and exports linked to electronics manufacturing.

China raised additional tariffs on US goods to 125% from 84%, effective 12 April 2025.

This came after US President Donald Trump raised tariffs against China to 145% on Thursday, even after announcing a 90-day pause on the reciprocal tariffs on most other countries.

Dixon Technologies (India) was the top gainer in the Nifty Consumer Durables index, rising 7.7%.

PG Electroplast shares followed closely to rise 8.4% to a high of Rs 923 per share.

The United States has hit a pause button on additional tariffs of up to 26% on India for a period of 90 days, until 9 July.

More By This Author:

Sensex Today Rallies 1,110 Points; Nifty Above 22,700

Sensex Today Ends 379 Points Lower; Nifty Below 22,400

Sensex Today Trades Lower; Nifty Below 22,400; Infosys Drops 3%

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more