Sensex Today Ends Volatile Session Higher

After opening the day on a negative note, Indian share markets witnessed volatile trading activity throughout the session and managed to bounce back during closing hours.

Benchmark indices ended on a mixed note with Sensex closing in green due to upbeat global sentiment and tracking positive sentiment following budget 2023.

Meanwhile, the Nifty 50 index ended in the red as Adani Group shares tumbled once again. Nifty index has several Adani stocks, so it ended on a negative note.

At the closing bell, the BSE Sensex stood higher by 224 points (up 0.4%).

Meanwhile, the NSE Nifty closed lower by 6 points.

ITC, Britannia, and HUL were among the top gainers today.

Adani Enterprises, Adani Ports, and UPL on the other hand were among the top losers today.

The SGX Nifty was trading at 17,639, down by 61 points, at the time of writing.

Broader markets settled on a positive note. The BSE Midcap ended 0.2% higher while the BSE SmallCap index rose 0.4%.

Sectoral indices ended on a mixed note with stocks in the FMCG sector, and the IT sector witnessing buying.

While stocks in the power sector, oil & gas sector, and energy sector witnessed selling.

Shares of Britannia, Blue Star, and ITC hit their 52-week highs today.

Asian share markets ended the day on a positive note. The Hang Seng rose 0.5%, while the Shanghai Composite index ended flat. The Nikkei edged 0.2% higher.

US stock futures are trading on a mixed note. Dow futures are trading down by 0.1% and Nasdaq futures are trading up by 1.3%.

The rupee is trading at 82.23 against the US$.

Gold prices for the latest contract on MCX are trading higher by 1.5% at Rs 58,783 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading up by 2.7% at Rs 71,780 per kg.

Speaking of stock markets, markets have remained under pressure after the American short-seller Hindenburg Research issued a report on Adani group stocks.

The top Adani group stocks have taken a hit. However, this is not new ...the same thing happened before with Vakrangee.

Adani group stocks hit lower circuit

After global bankers Citigroup and Credit Suisse stopped accepting securities of Adani companies as collateral for margin loans, most Adani group shares were today locked in their respective lower circuit limits.

Adding to that, the surprise move to withdraw the Rs 200 bn FPO weighed on Adani Enterprises as it slipped 25% to hit a new low of Rs 1,815.05 today.

Apart from this, shares of Adani Transmission and Adani Green Energy hit their 10% lower circuit limit. While shares of Adani Ports considered the group's cash cow, lost 14% today to hit a fresh 52-week low.

Adani Power and Adani Wilmar were locked in at a 5% lower circuit.

Amid the bloodbath, Adani stocks have fallen up to 62% from their all-time high levels.

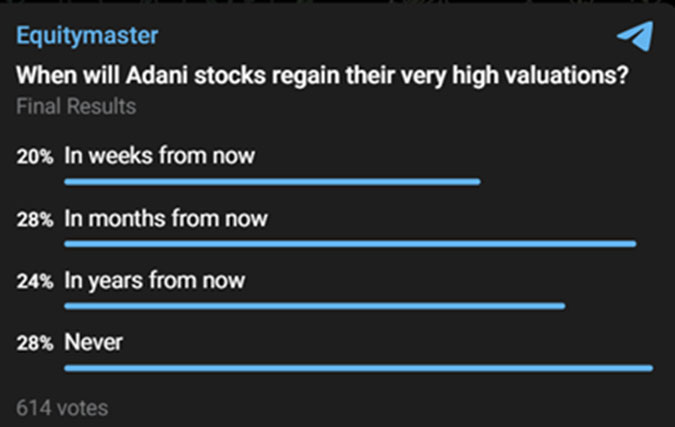

To understand what our readers are thinking about the wild movement in Adani group stocks, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

Some think that the stocks would regain their valuations in a month.

While some think the Adani stocks will never gain their high valuation. This can be due to investors' doubts about the group following the Hindenburg report.

HDFC Q3 results

Moving on to news from the finance sector, shares of HDFC were in focus today.

Private mortgage lender HDFC (Housing Development Finance Corporation), on Thursday, reported a standalone net profit of Rs 36.9 bn for the December 2022 quarter. This was 13.2% higher than Rs 32.6 bn profit reported in the year-ago period.

For the first nine months of FY23, HDFC's profit before tax stood at Rs 146. bn compared to Rs 126.2 bn in the corresponding period of the previous year.

The lender's net interest income rose by 14% to Rs 48.7 bn for the December 2022 quarter from Rs 42.8 bn a year back.

Its loan book grew by 13% YoY on an asset under management (AUM) basis.

HDFC's assets under management (AUM) at the end of the December 2022 quarter stood at Rs 7 tn against Rs 6.1 tn in the previous year. Of this, individual loans comprised 82 percent of the AUM.

Asset quality improved during the said quarter with the gross non-performing loans (GNPLs) falling to Rs 88.8 bn, down 2.3% YoY.

The gross individual NPLs stood at 0.86% against 1.4% last year, while the gross non-performing non-individual loans stood at 3.9%.

HDFC is a pioneer of housing finance in India, and has always stood by its core value of integrity, trust, transparency, and professional service.

Why ITC share price is rising

Moving on to news from the FMCG sector, the share price of ITC rose 6% today.

Shares of cigarette-to-hotels major ITC hit a 52-week high of Rs 384.4 on Thursday after the hike in duty on cigarettes in the Union Budget speech had a limited impact on the company.

The government has hiked the National Calamity Contingent Duty (NCCD) on cigarettes by 16%. NCCD accounts for about 10% of overall taxes on cigarettes.

But this would increase the prices of ITC's cigarettes only by 2-3%, which can be easily passed on to the investors, increasing the margin.

For ITC, cigarettes constitute more than 80% of the company's net profit and about 45% of its topline.

ITC is one of the best dividend-paying stocks. We did an editorial back in January 2022 listing the best dividend stocks you can count on.

More By This Author:

Sensex Today Trades Flat; Adani Stocks Selloff Deepens

Sensex Today Gains 158 Points on Budget Day

Sensex Today Rallies 500 Points Ahead Of Union Budget; Adani Group Stocks Extend Fall

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more