Sensex Today Gains 158 Points On Budget Day

After opening the day on a firm note, Indian share markets reversed gains and turned quite volatile post-Budget 2023 announcements.

Benchmark indices fell after the budget speech, to end on a mixed note with Sensex closing in green, while Nifty ended in the red.

The fall was led by insurance companies after the Union budget proposed to limit tax exemptions for insurance proceeds.

Meanwhile, Adani Group shares tumbled and once again witnessed a steep selloff, which dampened sentiment.

At the closing bell, the BSE Sensex stood higher by 158 points (up 0.3%).

Meanwhile, the NSE Nifty closed lower by 46 points (down 0.3%).

ITC, Tata Steel, and ICICI Bank were among the top gainers today.

Adani Enterprises, Adani Ports, and Ambuja Cement on the other hand were among the top losers today.

The SGX Nifty was trading at 17,700, down by 52 points, at the time of writing.

Broader markets settled on a negative note. The BSE Midcap ended 0.9% lower while the BSE SmallCap index fell 1.1%.

Sectoral indices ended on a mixed note with stocks in the FMCG sector, and the IT sector witnessing buying.

While stocks in the power sector, oil & gas sector, and power sector witnessed selling.

Shares of Polycab India, and M&M hit their 52-week highs today.

Asian share markets ended the day on a positive note. The Hang Seng rose 1.1%, while the Shanghai Composite index ended 0.9% higher. The Nikkei edged 0.1% higher.

US stock futures are trading on a negative note. Dow futures are trading lower and Nasdaq futures are trading down by 0.4%.

The rupee is trading at 81.91 against the US$.

Gold prices for the latest contract on MCX are trading higher by 1.1% at Rs 57,796 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading up by 1.4% at Rs 69,800 per kg.

Speaking of stock markets, markets have remained under pressure after the American short-seller Hindenburg Research issued a report on Adani group stocks.

The top Adani group stocks have taken a hit. However, this is not new ...the same thing happened before with Vakrangee.

In January 2018, Co-head of Research at Equitymaster Tanushree Banerjee observed how the market capitalization of Vakrangee crossed pharma behemoth Lupin's market cap. This is a perfect case of an exciting business gaining dominance over a boring one!

Mind you, Vakrangee was already a 1,000-bagger then!

It was not difficult to see why investors were scampering to get a share of the pie. Nothing about Vakrangee seemed to surprise the streets.

What happened next? Watch the below video to know more...

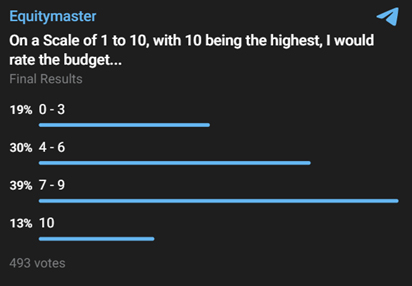

Also, to understand what our readers are thinking about the Union budget announced today, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 400 participants, the majority of investors rated this year's budget between 7-9.

Why Adani Group stocks crashed today

Adani group stocks continued their route today. Most Adani group shares extended their sharp falls on Wednesday as a detailed rebuttal of a US short-sellers criticisms by the Indian conglomerate failed to pacify investors.

The shares of Adani's flagship entity, Adani Enterprises, crashed 30% amid a report that Credit Suisse has stopped accepting bonds of Adani companies as collateral for margin loans.

While Adani Ports slumped 15%, Adani Total Gas and Adani Green Energy lost 10%.

Credit Suisse has assigned a zero lending value for notes sold by Adani Ports and Adani Green Energy.

Adani stocks have been in a freefall ever since American short-seller Hindenburg Enterprises brought out a report against the ports-to-power conglomerate owned by billionaire Gautam Adani.

You can check out Equitymaster's Indian Stock Screener to view the fundamentals of companies within a business group.

It also includes the Adani Group. These screens would help you get a better grip on fundamentals, business group-wise.

Maruti Suzuki January 2023 sales rise 12%

Moving on to news from the auto sector, shares of Maruti Suzuki were in focus today.

The country's largest carmaker Maruti Suzuki India on Wednesday reported a 12% increase in total sales at 1,72,535 units in January. The company had sold a total of 1,54,379 units in the year-ago period.

Total domestic passenger vehicle sales rose 14.2% from January 2022.

Its total exports last month stood at 17,393 units compared to 17,937 units in the same month last year.

The depleted inventory resulted in slightly muted retails, taking up the network stack to 1.84 lakh units. On the demand side, the inquiries and bookings have been steady despite price hikes done by several OEMs.

The constraint of production continues due to the semiconductor supply situation, which resulted in some losses in wholesale as well as retail.

Apart from this, on Monday, Maruti Suzuki hit a cumulative sales of 25 m units.

Apart from this, driving the EV revolution, it is developing hybrid electric vehicles (HEV) with Toyota.

Note that the electric vehicle (EV) megatrend is a once-in-a-century revolution happening right in front of us.

The revolution has taken the auto sector by storm. All segments of the sector are ripe for disruption, and India's top EV stocks are set to benefit from this shift.

It remains to be seen how the above developments pan out.

Why ITC share price is falling

Moving on to news from the FMCG sector, the share price of ITC plunged 6% intraday.

This fall was after Finance Minister Nirmala Sitharaman hiked calamity duty on cigarettes and tobacco products by 16%.

The hike in the duty would increase the prices of cigarettes, reducing consumption.

The cigarette segment contributes more than 40% to the total business for ITC, and the rest of the revenue comes from FMCG, paper, and hotel businesses.

However, the market largely feared either a hike in excise duty or NCCD duty on cigarettes and tobacco products, as the last tax hike was announced three years ago.

Shares of ITC rebounded sharply from the day's low and traded with 2% gains at the close of the session.

ITC is one of the best dividend-paying stocks. We did an editorial back in January 2022 listing the best dividend stocks you can count on.

More By This Author:

Sensex Today Rallies 500 Points Ahead Of Union Budget; Adani Group Stocks Extend FallSensex Today Rebounds 400 Points From Day's Low

Sensex Today Falls 350 Points; Adani Group Stocks Trade Mixed

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more