Sensex Today Ends 323 Points Higher; Nifty Above 24,950

After opening the day higher, the benchmark indices continued their upward momentum, ended the session in green.

Indian equity market indices Senex and Nifty settled on a positive note on Wednesday, buoyed by a rally in IT and public sector bank stocks.

At the closing bell, the BSE Sensex closed higher by 323 points (up 0.4%).

Meanwhile, the NSE Nifty closed 104 points higher (up 0.4%).

Bharat Elec, HCL Tech, and TCS are among the top gainers today.

M&M, Maruti Suzuki, and Tata Motors, on the other hand, were among the top losers today.

The GIFT Nifty was trading at 25,073, higher by 110 points at the time of writing.

The BSE MidCap index ended 0.8% higher, and the BSE SmallCap index ended 0.7% higher.

Sectoral indices are trading mixed today, with stocks in the media sector and the realty sector witnessing buying. Meanwhile, stocks in the telecommunications sector and the auto sector witnessed selling pressure.

The rupee is trading at Rs 88.1 against the US$.

Gold prices for the latest contract on MCX are trading 0.3% higher at Rs 109,342 per 10 grams.

Meanwhile, silver prices were trading 0.7% higher at Rs 125,436 per 1 kg.

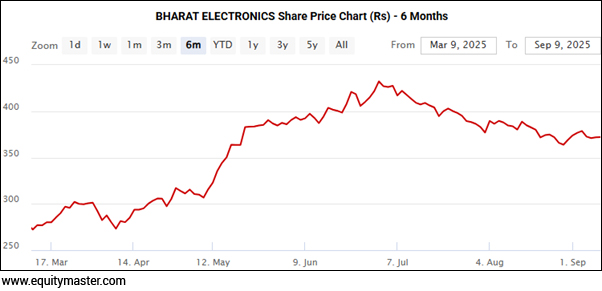

Bharat Electronics Shares Surge on Dividend News

In the news from defence sector, shares of Bharat Electronics Ltd (BEL) rose 3.4% after the company announced that it will pay the dividend of Rs 0.90 per share on 23 September 2025.

BEL will pay a final dividend as declared at the 71st Annual General Meeting.

BEL has secured new orders worth Rs 6.4 billion (bn) since July 30, 2025. These orders include defence and technology projects such as data centres, ship fire control systems, tank navigation systems, communication equipment, electronic voting machines, and more.

Bharat Electronics Limited, founded in 1954, is a prominent public sector undertaking under India's Ministry of Defence. It specializes in defence electronics, providing advanced technologies to the Indian Army, Navy, and Air Force.

Mamata Machinery Shares Surge on Orders

Moving on to the news from engineering sector, shares of Mamata Machinery rallied over 17% after the company announced two order wins for its 9-layer blown film plants valued at Rs 0.9 bn each.

The company revealed several order wins for its cutting-edge 9-layer blown film plants under the Co-Extrusion product segment in an exchange filing.

An international client recently placed the company's second export order, worth approximately Rs 0.9 billion, for the construction of a high-barrier film plant that is expected to be put into service by March 2026.

Additionally, Mamata has obtained a significant order worth approximately Rs 0.9 billion from a client located in the United Arab Emirates. This enhances its worldwide presence and represents its third order in this segment in a row.

According to the company's statement, the UAE plant will be delivered during the fourth quarter of the fiscal year that ends in March 2026.

Mamata Machinery has secured new orders, following recent wins in India and Latin America, expanding its global presence for advanced co-extrusion solutions.

Thermax Shares Surge on Investment Deal

Moving on to the news from engineering sector, shares of Thermax jumped 5% after the company invested Rs 1.2 bn in First Energy Private Limited (FEPL), a wholly owned subsidiary, for further investment in First Energy 10 Private Limited (FE10), a wholly owned subsidiary of FEPL.

Operating in the renewable energy sector, FEPL offers commercial and industrial client's sustainable solutions such as solar, wind, wind-solar hybrids, and storage batteries.

Thermax purchased 11.5 crore equity shares in FEPL for Rs 10 each as part of the deal, and they also purchased an equivalent number of shares in FE10.

Samvardhana Motherson Shares Surge on Acquisition

Moving on to the news from auto sector, shares of Samvardhan Motherson International came in focus after the company announced it had completed the acquisition of the remaining 25% 1stake in its two Turkish subsidiaries, SMR Plast Met Molds and Tools and SMR Plast Met Automotive Tec.

The transaction, first disclosed on 19 June 2025, was finalised on 9 September 2025, after receiving necessary approvals.

The purchase of the remaining 25% of SMR Plast Met Moulds and Tools and SMR Plast Met Automotive Tec was authorised by Samvardhana Motherson International's Board of Directors on 19 June 2025.

Since Samvardhana Motherson purchased a 75% stake in the company in 2021, both entities are anticipated to become 100% indirectly owned subsidiaries of the company after the transaction is completed.

Samvardhana Motherson recently announced its 5-year growth plan, aiming for $108 billion in revenue and a 40% return on capital employed (RoCE) by FY30.

Samvardhana Motherson plans to expand its business by partnering with more American, Chinese, Japanese, and Korean car manufacturers, offering its existing products and developing new ones.

More By This Author:

Nifty Above 24,900; Welspun Living Up 8%

Sensex Today Ends 314 Points Higher; Nifty Above 24,850

Nifty Above 24,800; Sensex Today Trades Higher

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more