Russian GDP In Question

Official statistics suggest the country is below recent business cycle peak.

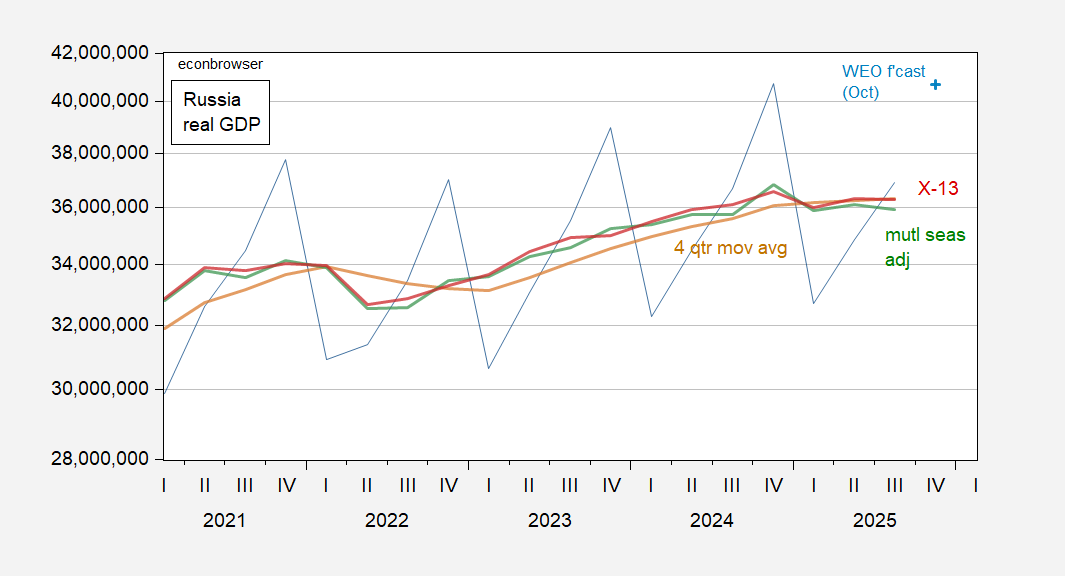

Figure 1: Russian real GDP, n.s.a. (blue), seasonally adjusted by author using X-13 in logs (red), using multiplicative seasonals (green), and 4 quarter moving average (tan). Source: IMF, IFS, and author’s calculations.

I’m using a loose definition, based on GDP. Since the Russian Federation does not publish a seasonally adjusted quarterly series for real GDP, I have seasonally adjusted using Census X-13 (with log transform, X-11 ARIMA) and multiplicative seasonal adjustment, applied to aggregate GDP. I also plot the 4 quarter trailing moving average. Note that while output is below recent peak, it has not declined two consecutive quarters, a typical rule of thumb measure.

In terms of forecasts, it is true that Russian output did not fall as much in 2022 in many Western forecasts. For instance, the March 2022 Bloomberg consensus was for a 9% decline q4/q4 in 2022, while the actual (as reported) was only about 2%.

Of course, one has to believe in the deflators used in order to believe in the real GDP statistics. As noted previously, the official Russian CPI seems to have been running cooler than a private sector series, ROMIR — until that series ceased publication (i.e., was induced to cease publication). Here’s the official CPI and GDP deflator series. Vlasiuk et al. (2025) plot official series, and their estimate of inflation.

Source: Vlasiuk et al. (2025).

A higher price level for a given nominal GDP implies a smaller real GDP. Vlasiuk et al.‘s estimate is that Russian GDP has been decreasing y/y in 2023 and 2024.

Source: Vlasiuk et al. (2025).

Simple addition suggests that Russian GDP is about 1.5 percentage points below 2021 levels, rather than 7.3 percentage points above.

There’s a lot of uncertainty about the correct values for GDP deflator inflation. However, we can be pretty sure that actual GDP growth is less than that reported.

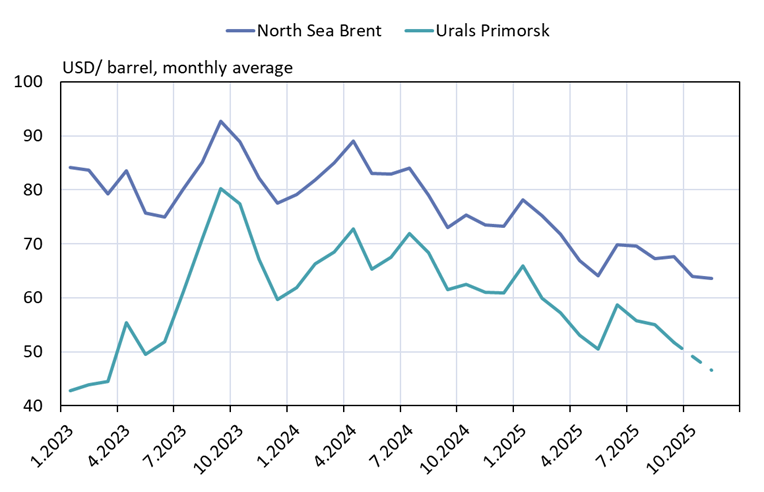

If this is true, the strain on the Russian economy servicing the war effort must surely be onerous, so much so that it’s unclear how much longer the offensive can be maintained, particularly with oil revenues decreased.

Source: BOFIT, Dec 5, 2025.

More By This Author:

Six Estimates Of Nonfarm Payroll EmploymentThe PRC’s Intimidation Campaign

Corporate Profit Peaks and Business Cycle Peaks