Russian Current Account May Keep The Music Playing For The Ruble

Strong current account – thanks to a rebound in exports and restrained foreign travel – and benign global context may allow the ruble to reach mid-year on an upbeat note after all. At the same time, 3Q21 may still be volatile. Potential obstacles to the ruble include a fast recovery in imports, the dividend season, and continuous capital outflow.

Ruble has been supported by strong current account

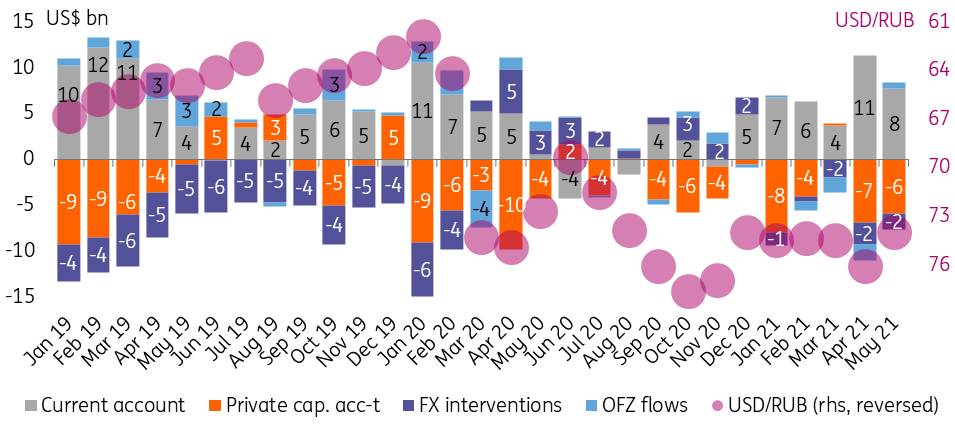

Bank of Russia's preliminary estimates of 5M21 balance of payments suggests that following a US$11.3bn surplus in April, the current account surplus shrank only very modestly to US$7.7bn (Figure 1). We take it as a strong result, given our recent concerns with fast growth in merchandise imports, which according to preliminary customs data accelerated to 40-50% year-on-year in April-May (vs. a 12% YoY drop in 1Q21). It appears, that the current account was supported by strong oil&gas and other exports as well as by the lack of mass outward tourism.

For June, it is evident that the favorable commodity market conditions combined with extended travel restrictions to the most popular tourist destinations (such as Turkey) should also be supportive. As a result, our expectations of a more even quarterly distribution of the current account throughout this year have been reinforced. It would be safe to assume that following the US$17bn surplus in 1Q21, one can expect a 2Q21 surplus in the US$15-20bn range. The June current account will still be negatively affected by the accrual of the annual corporate dividends in favor of non-residents that are paid out throughout the summer (more on this below).

Figure 1: Current account remained highly positive in May despite a 30% YoY growth in imports

(Click on image to enlarge)

Source: Bank of Russia, Refinitiv, ING

Other balance of payment items supportive, but private capital outflow remains an issue

Portfolio flows to the local state bond market (OFZ) was also suportive in May, showing a small US$0.7bn inflow, according to our estimates, following a US$1.7bn outflow in April. The return of the inflows was assured by the stabilization of the global bond market mood and a small decline in US-Russia tensions. The upcoming Putin-Biden summit, scheduled for 16 June, should be the checkpoint in this story.

Also, to remind, May's balance of payments benefited from a temporary decline in FX purchases to US$1.7bn, which was followed by a reversal to US$3.0bn in June. The government and the CBR have yet to confirm a reduction in the annual FX purchases thanks to expected local investments out of the sovereign fund by US$4-5bn.

At the same time, our key concern regarding the Russian balance of payments has been partially confirmed, with net private capital outflow staying elevated (relative to the monthly current account performance) at US$5.9bn (Figure 1), higher than the monthly average year-to-date. A somewhat redeeming feature is that according to the brief CBR commentary, this reflects not just accumulation of foreign assets, but also some decline in foreign liabilities, which is positive from a macro stability perspective. That said, we continue to see private capital flows as a key watch factor for the ruble in the medium term.

Dividend season this year: not overly taxing but still worth keeping in mind

The relatively benign current account for 5M21 combined with the global USD weakness, strong commodities, calm foreign policy newsflow, and hawkish stance by the Bank of Russia (the latter is likely to make at least a 50bp hike this Friday) have created more favorable conditions for the ruble, than we thought initially, at least for the next couple of weeks.

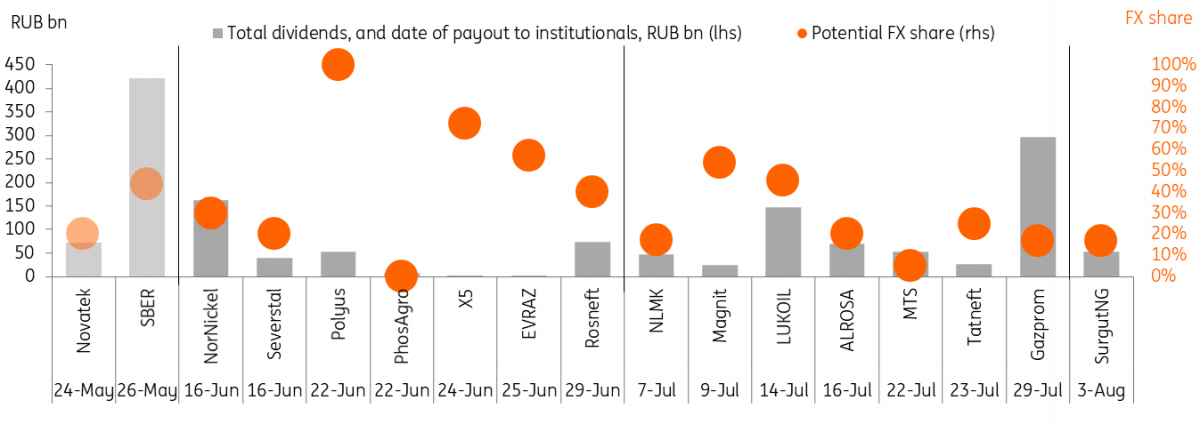

Nevertheless, for the rest of the summer and 3Q21, we remain cautious, in no small part due to the corporate dividend season, which this year for the largest payers is taking place from mid-May till early August. The normal practice is higher demand for RUB ahead of the payout, followed by increased demand for FX related to conversion in favor of non-resident shareholders. Most of the payments are made in favor of strategic and institutional investors.

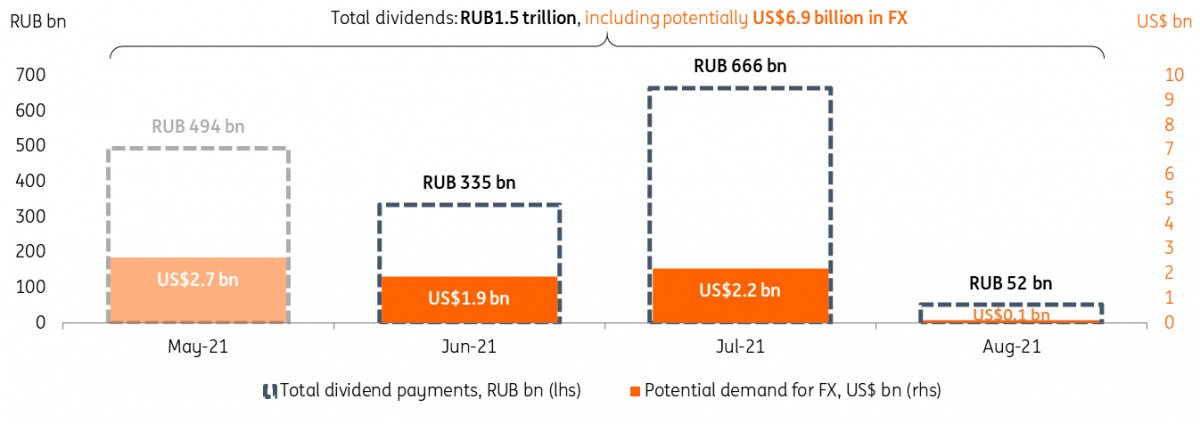

According to the payment schedule (Figure 2), after the first round of dividend payments in May, the Russian market has still two months of payments to go. According to our estimates, this year's dividend period will result in the largest corporates paying RUB1.5tr in May-August, with around US$7bn of this sum attributable to non-residents (Figure 3). This volume is more modest than in the previous year (in 2019, for example, the numbers were, respectively RUB2.0tn and US$9bn, respectively) and is due to the decline in overall corporate profits in 2020 as a result of the Covid-related downturn. At the same time, the payments should still be noticeable in the slow summer trading, and we expect dividend-related seasonality to manifest itself this year too.

Figure 2: Dividend payout season has just started in Russia

(Click on image to enlarge)

Source: Refinitiv, company data, media, ING

Figure 3: We expect remaining dividend-related demand for FX to reach US$4.2bn, most of the large payments to be made in June and July

(Click on image to enlarge)

Source: Refinitiv, company data, media, ING

Improving short-term view on ruble, medium-term expectations unchanged

The strength of the Russian current account in May removes some of our recent concerns, allowing to expect USDRUB stabilization close to the middle of the 70-75 range in June. Nevertheless, the risks of volatility going forward still remain for the rest of the summer given the dividend season, persistent uncertainties regarding foreign policy, acceleration of imports, and continued private capital outflow.

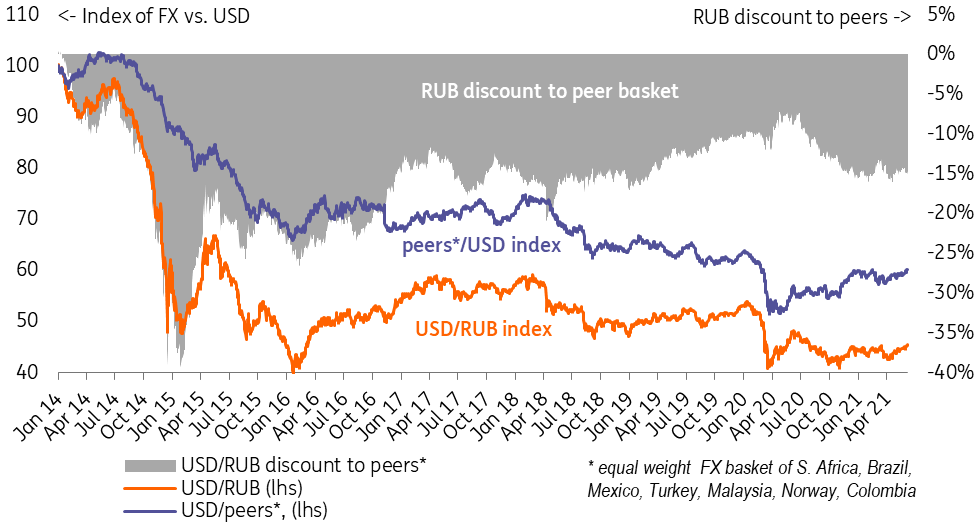

In addition, we would also note, that the recent ruble appreciation took place mostly on the back of a benign global environment (Figure 4), while Russia-specific conditions were largely neutral. While being positive in the short term, this highlights the ruble's vulnerability to negative global surprises, which are so far outside the base case.

Figure 4: Ruble appreciation so far was in line with peers, country-specific factors have played little role

(Click on image to enlarge)

Source: Refinitiv, ING

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more