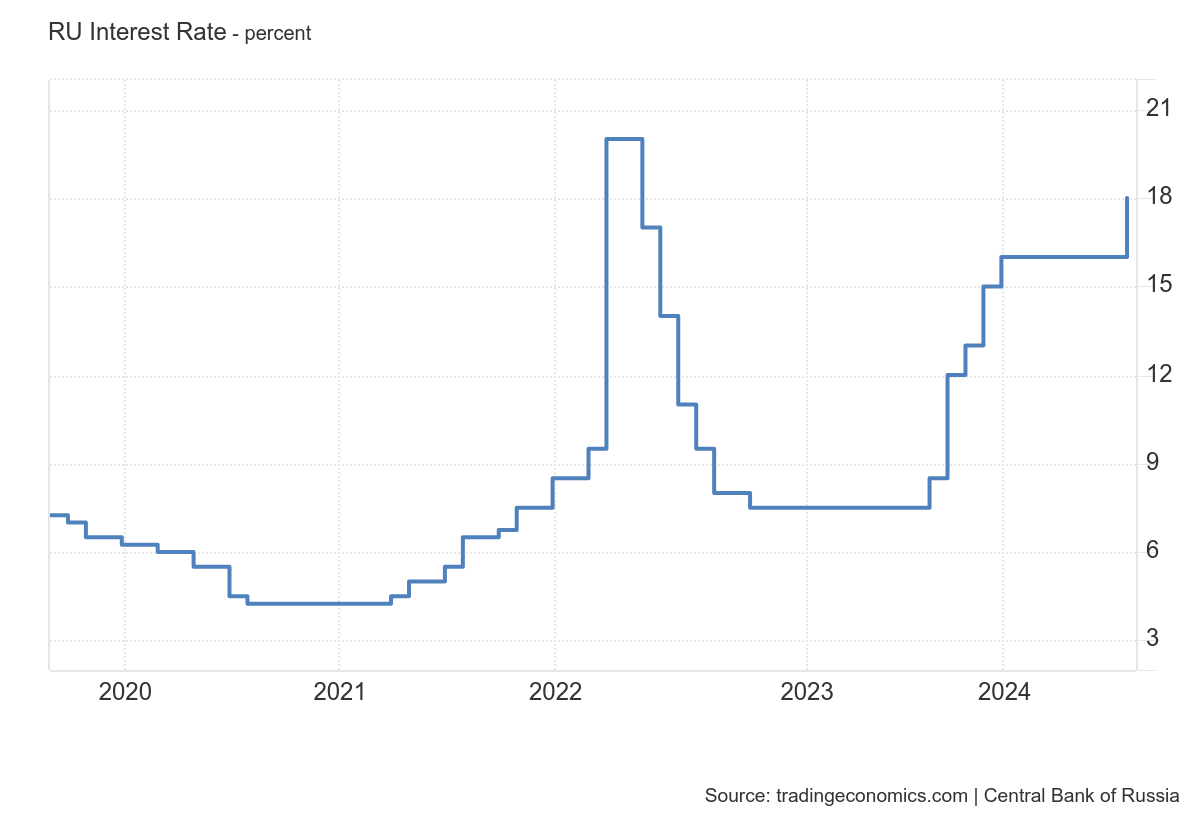

Russia: Policy Rate Raised To 18%

As of today:

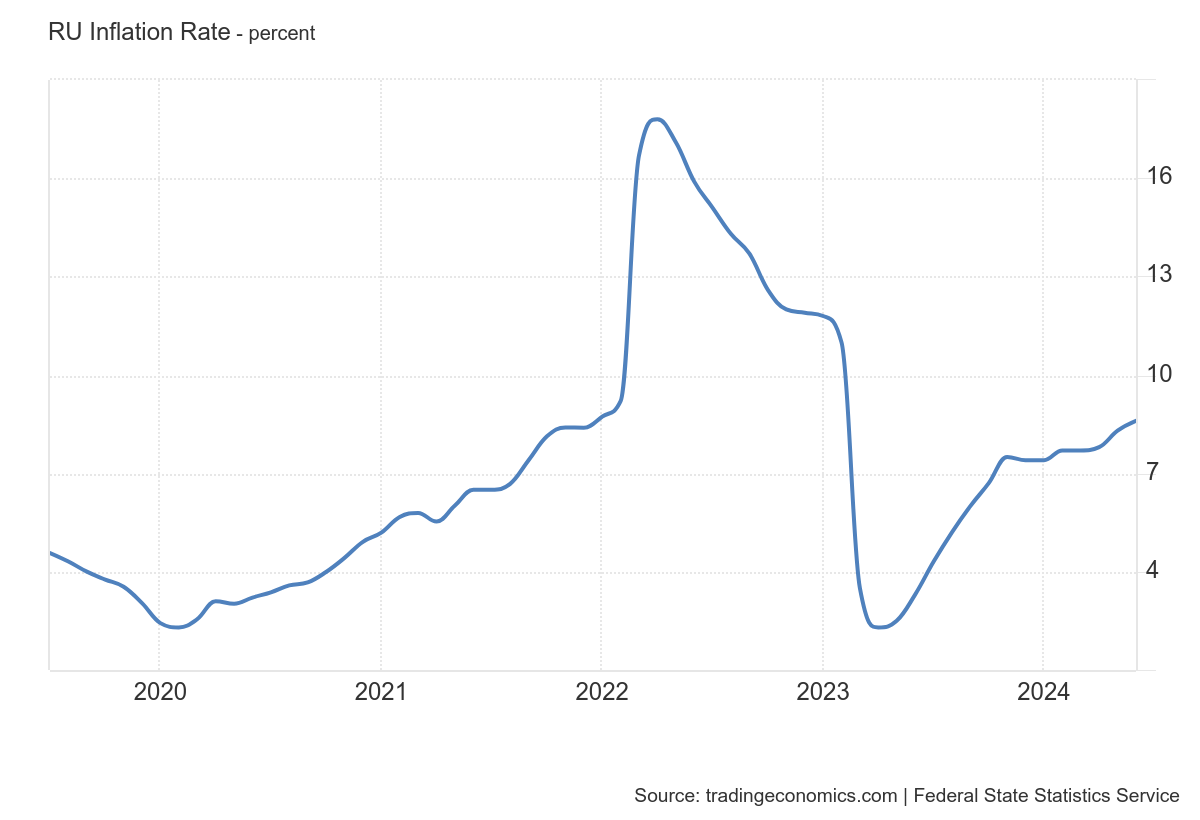

For comparison, here is the y/y (official) inflation rate (through June).

With the policy rate at 18%, and y/y inflation at 8.6% (through June), we have in essence a contractionary monetary policy. The ex-post real rate was 7.4% in June. Assuming adaptive expectations, the ex ante real rate for August onward is about 9.4%…(Central Bank of Russia projects 9% inflation in July).

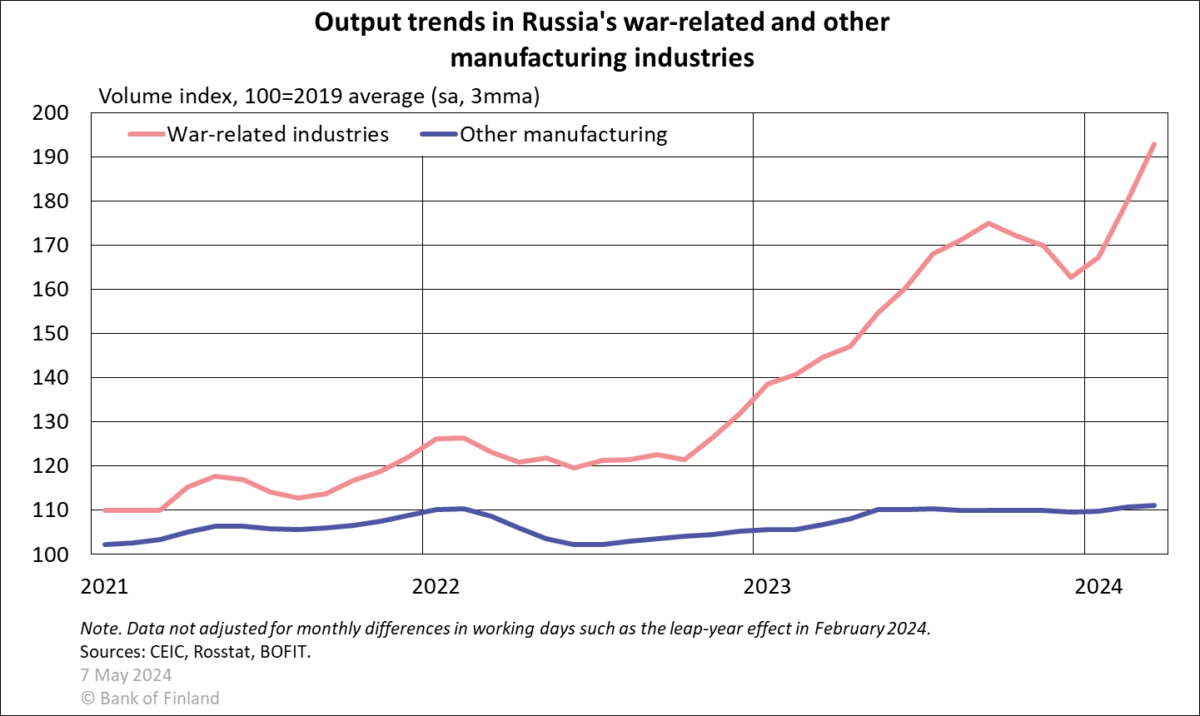

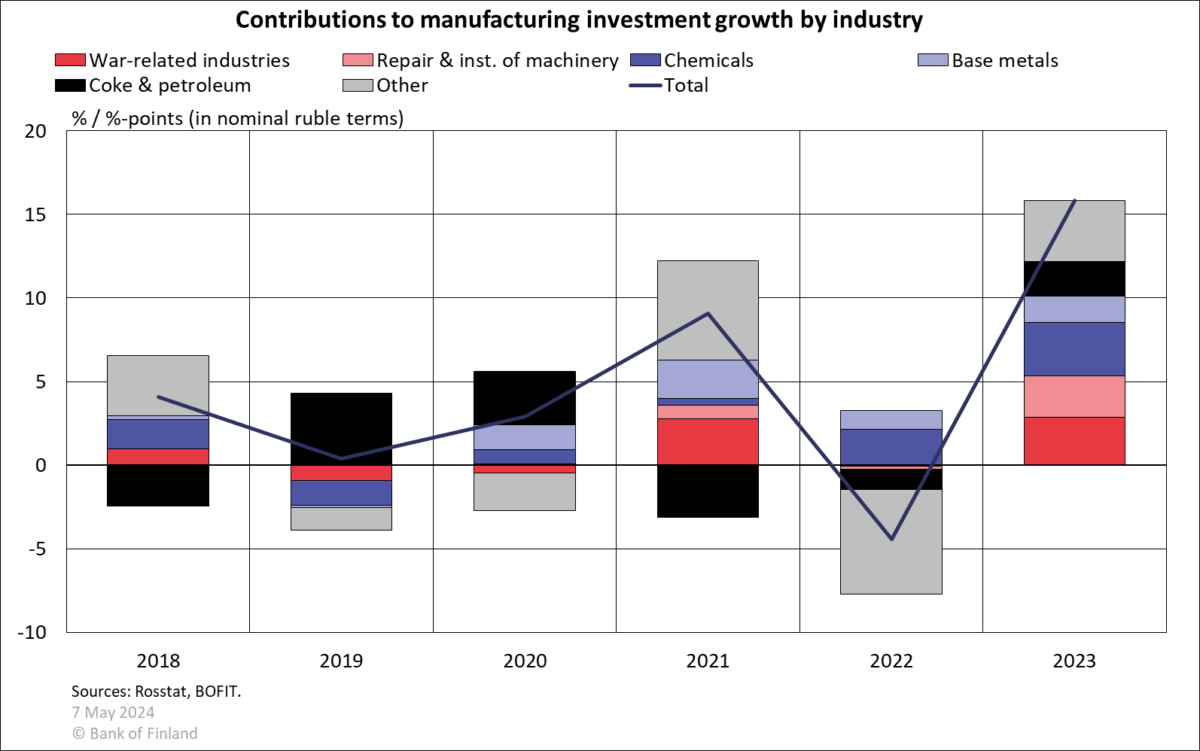

The combination of extremely expansionary fiscal policy (with heavy emphasis on war industries) plus supply shocks (sanctions on critical inputs, emigration, conscription) requires tight monetary policy in order to keep inflation under control.

For more on the extent to which Russia is running a war economy now, see BOFIT’s Heli Simola “Military dominance increases imbalances in the Russian economy” (May 2024). Two graphs:

(Click on image to enlarge)

See also my estimates of the growth of the non-military economy, here.

It will be interesting to me to see how long the economy can withstand 9% or so real rates without experiencing a recession (or without the government sacking the Central Bank governor).

More By This Author:

Business Cycle Indicators At End Of July2024Q2 GDP Advance Release: Too Good To Be True?

Still Strong After All These Years