Russia Economic Sit-Rep: Recession In The Coming Year?

Image source: Pixabay

Gorodnichenko, in YahooFinance:

Moscow’s economy is extremely dependent on petrodollars, or dollars obtained through the oil and gas trade, Gorodnichenko said. Yet, with Russia’s energy flows upended by sanctions, it’s unclear if sales to friendly nations will be enough to prop up the Kremlin’s hefty war budget — or if Russia will have enough access to dollars to readily import all the goods and resources its economy needs to function, he said.

That could put Russia’s economy on the fast track to a recession in the next 12 months, Gorodnichenko predicted.

“If they have to finance the war and they don’t have this resource, it’s not clear where they will raise this money,” he added. “I predict they’re going to face a very serious recession.”

BOFIT notes that sanctions have been tightened on oil exports, while new EU sanctions on natural gas have been implemented.

The IMF’s July WEO update (released today, but based on exchange rates April 22-May 20) indicates that, while there’s been no downward revision in 2024 y/y growth, 2025 has been marked down by 0.3 ppts, to 1.5% y/y (The World Bank’s June forecast is 1.4%) This despite upward marking in oil prices. If on the other hand, oil prices fall, then one could expect conditionally, slower growth.

BOFIT’s latest assessment of economic challenges was July 5th.

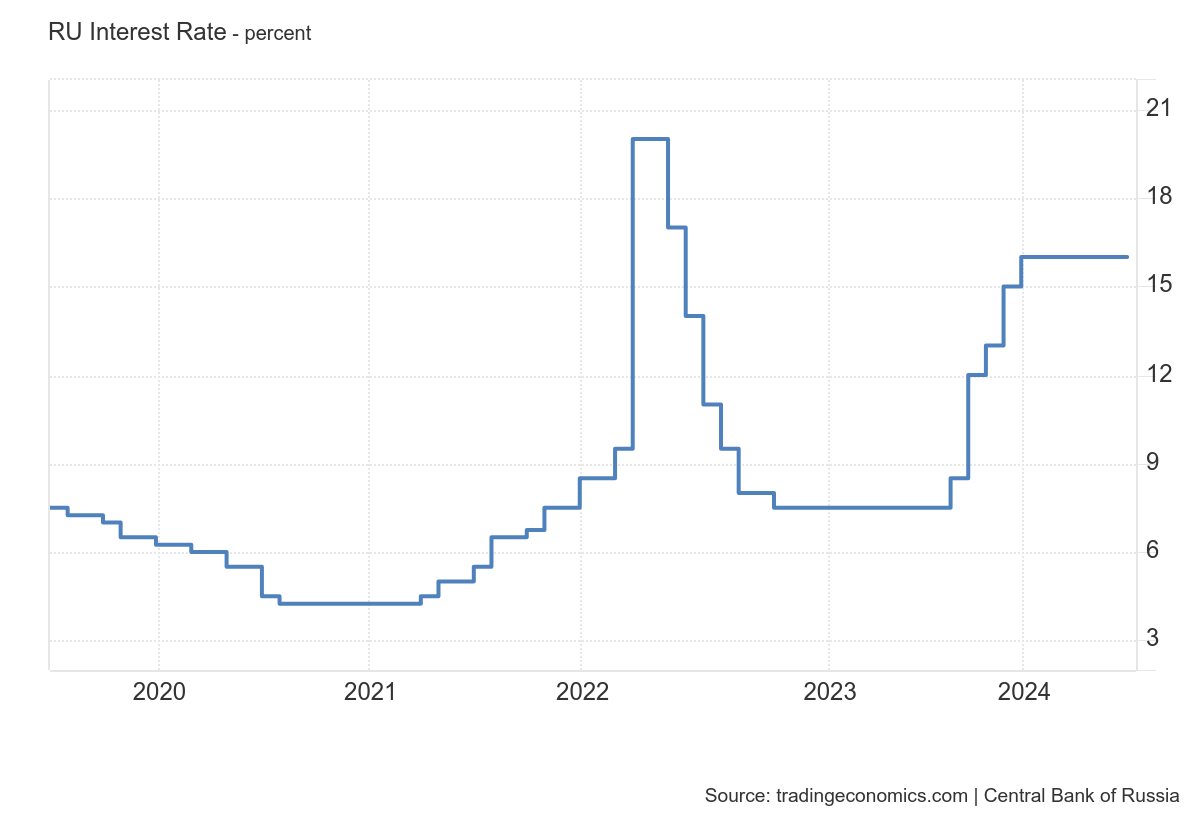

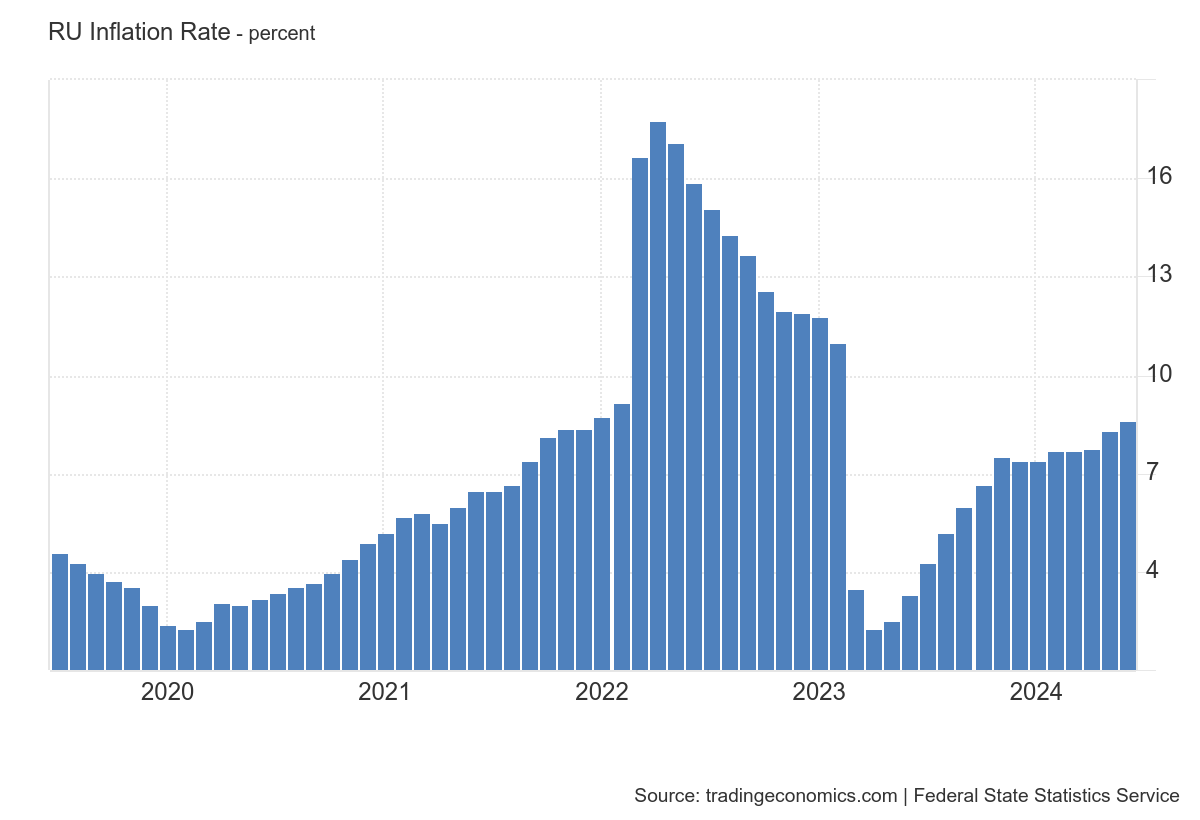

Here’s some pictures of the latest monetary conditions. Note the policy rate remains high, at 16%.

We don’t know what the ex ante real policy rate is in the absence of a good estimate of expected inflation. Assuming adaptive expectations (lagged y/y inflation is a proxy for current expected inflation), the real policy rate is positive.

With June y/y inflation at 8.6%, then the real policy rate is 7.4%. A high real rate stabilizes the currency, and tends to stifle inflation, but at the cost of depressing economic activity in interest sensitive sectors.

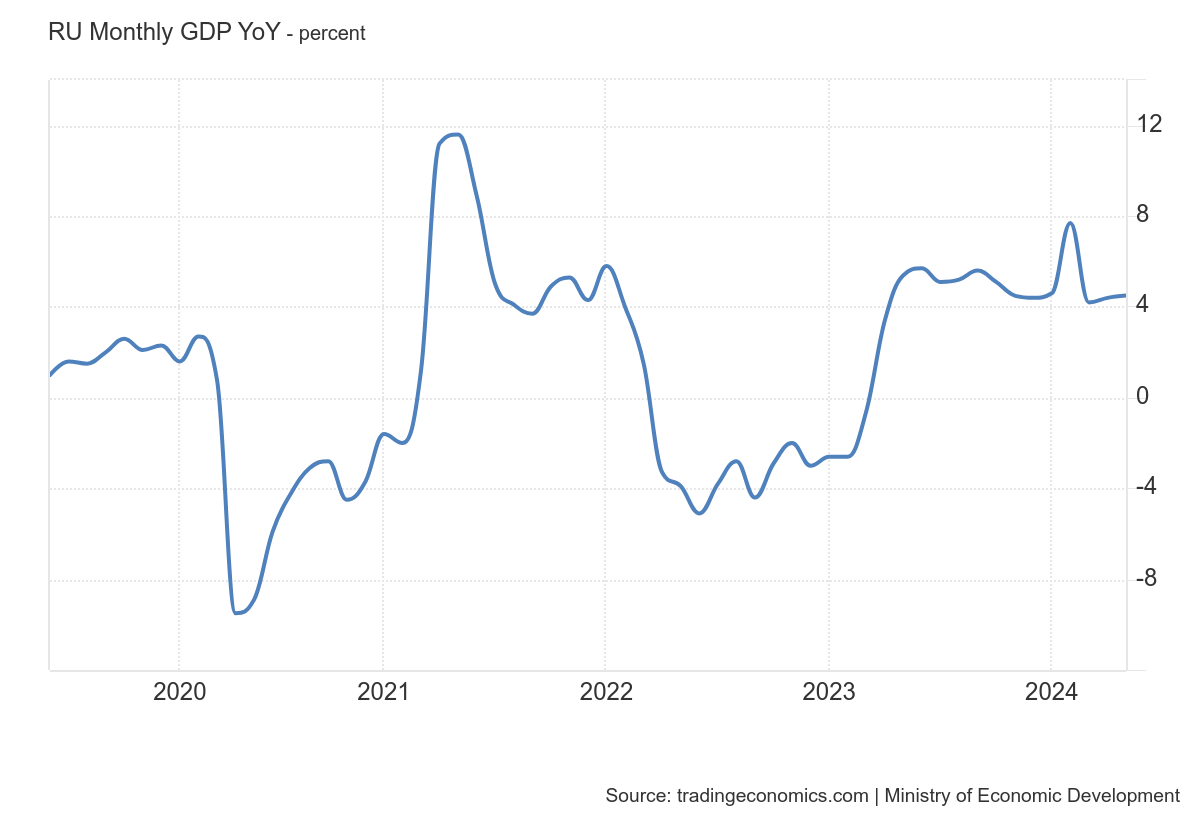

While reported GDP growth (y/y, through May) is positive at around 4%, if one took out defense and security spending, growth would probably be substantially lower. I haven’t done this calculation for 2023 or 2024, but here‘s the calculation based off of 2023 estimates and forecasts.

More By This Author:

The Market Based SOFR PathFood Inflation Stable, Down In The Midwest

China Economic Sentiment