Precious Metals: In The End, Physical Supply Will Prevail

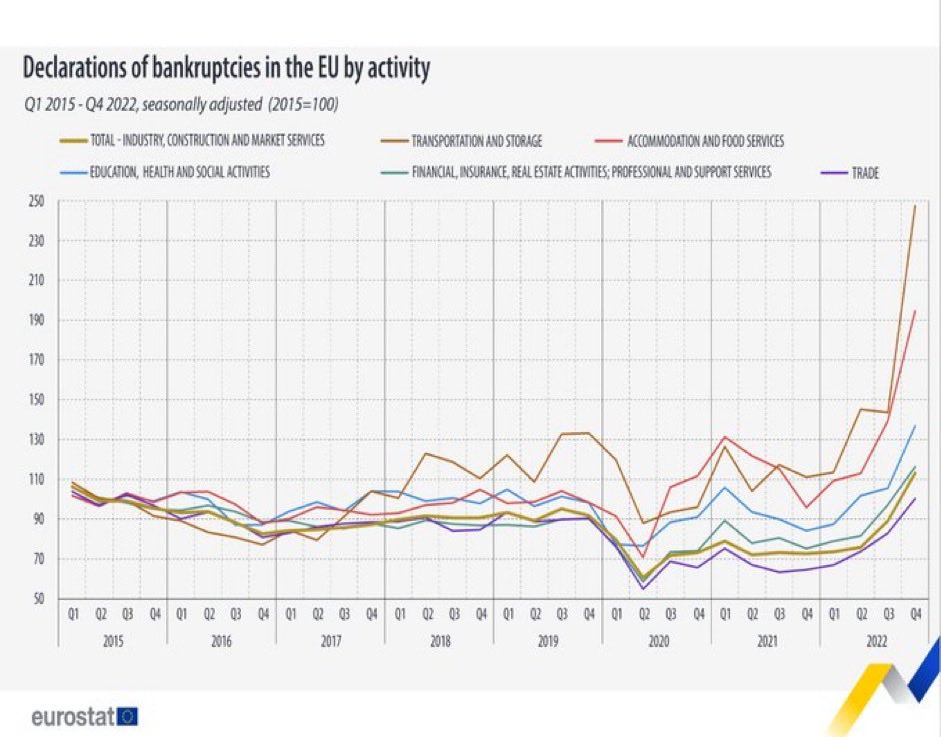

The economic slowdown is confirmed in Europe.

German industrial output is in contraction compared to last month:

The number of bankrupt companies has increased dramatically in recent months.

Inflation fueled by rising labor and energy costs, rising interest rates, and the deglobalization of the economy are the main reasons for this increase in bankruptcies :

China is in a different economic cycle. The country, which emerged later from the constraints of the Covid crisis, is enjoying a vigorous economic recovery. Retail sales soared by +20% last month. May 1st saw a record number of rail passengers: 19.7 million Chinese traveled by train that day!

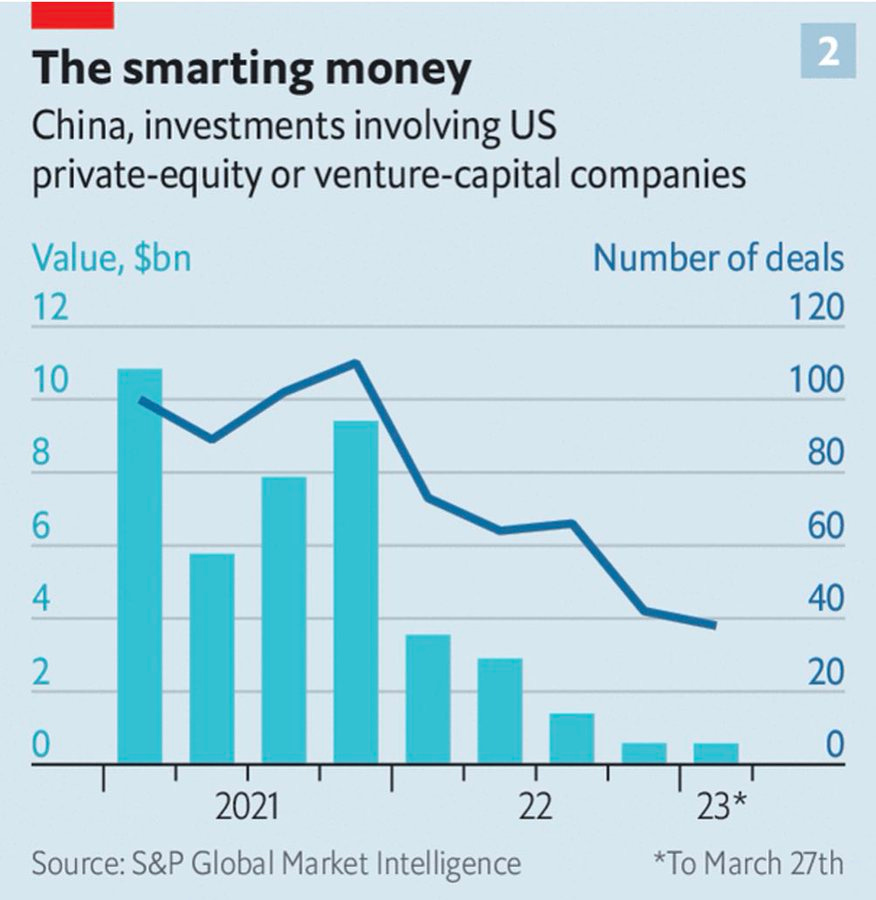

Unlike previous economic cycles, the current recovery is not resulting in a significant increase in investment by U.S. companies in the country.

More specifically, in the area of Private Equity, U.S. investment has declined significantly since the Covid-19 crisis and has yet to show signs of a positive recovery:

The activity of these specialized PE funds is declining around the world, with a particularly sharp drop in China.

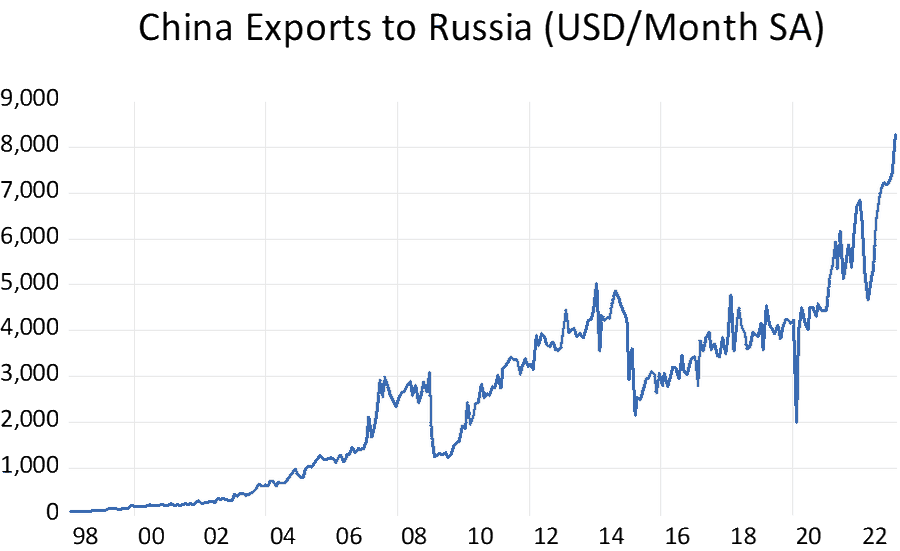

While U.S. investment in China is shrinking, Chinese exports are regaining momentum with a notable +8.5% increase in April, exceeding expectations.

Notably, exports to Russia are up sharply:

Trade between China and the other BRICS countries is increasing. A significant change has occurred in the last twenty years:

In 2002, the economic activity of the G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, the United States) accounted for 42% of global GDP, while the share of the BRICS (Brazil, Russia, India, China, South Africa) was 19%.

Twenty years later, the figures are not at all the same: the BRICS' share of world GDP has risen to 31.5% and exceeds that of the G7 countries, which now represents only 30.7%.

The BRICS are now on a roll and are considering the entry of nineteen additional countries into their world-leading club. Among the applications for membership, there are many Arab countries. The use of the dollar as a currency within the group is increasingly being questioned. Saudi Arabia's possible entry into the club would be a blow to the petrodollar system established since 1970.

The gold purchases made by the central banks are preparing the ground for the emergence of this new bloc. The divorce from the G7 system is being prepared. Confidence in the dominant position of the dollar is being shaken, and more and more countries are considering breaking with the system that has prevailed until now. However, the break is not sudden, as these countries still need the support of their former key partners. As in a couple that breaks up, they do not immediately announce that they have found a more interesting boyfriend or girlfriend, but rather they bring up relationship problems in order to negotiate an optimal and economically advantageous divorce with their future ex-spouse. In the medium term, trade between China and its trading partners outside the G7 could take place in a totally different context. The de-dollarization of reserves paves the way for a de-dollarization of trade.

This de-dollarization involves a more important role for gold. It is becoming increasingly clear that gold will play a crucial role in this new trading system. China is encouraging its population to consider gold as a savings option.

According to analyst Bai Xiaojun, several major Chinese banks, such as China Construction Bank, Postal Saving Bank of China, and Bank of Communication, have introduced a service to convert renminbi (RMB) accounts into gold accounts. This service offers customers the possibility to buy gold using their RMB accounts and deposit it into a metal account.

Just in: Many Chinese banks have launched RMB account conversion gold account business. It can purchase gold from a RMB account and deposit it into a gold account. Unlike purchasing gold in a store, bank account gold is recorded in two ways: current and fixed. (1) pic.twitter.com/hdZaA3Q1Rd

— Bai Xiaojun (@oriental_ghost) May 8, 2023

This ease of access to metal accounts is likely to increase demand for physical gold from individuals.

The continued high price of gold is mainly due to demand for physical gold from two groups: Asian individuals and BRICS central banks. In contrast, demand in the West remains relatively weak. Fund exposure and allocation to GLD (the gold-backed exchange-traded fund) is minimal, in no way confirming a particular appetite for gold among Western investors.

At a recent mining conference I attended, I could verify a certain distrust of the gold sector. There was much less interest in gold than in metals related to the energy transition. As a whole, investors in Western countries seem to be completely missing out on gold's current rise. Gold's rise over the past six months is taking place in a climate of total denial, as evidenced by the lack of interest in mining companies not accompanying this rise in precious metals. The disconnect between mining and gold prices is a clear sign of investor disinterest in the precious metals sector.

In this context, it makes sense to see Western speculators taking bearish positions at these high levels in gold. Since this rise is not based on fundamental movements and lacks momentum, it tends to attract bearish speculators who do not perceive the physical demand taking place, since it is manifesting itself at another level.

These speculative paper investments, disconnected from physical demand and placed blindly, also concern other metals.

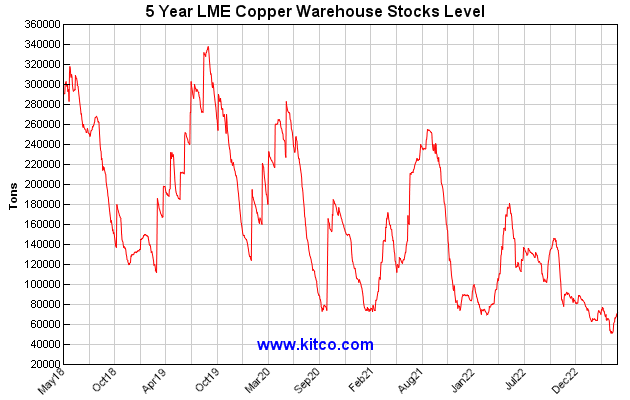

In prevision of a downturn and recession, many funds have taken downward positions in copper, causing it to fall below its 200-day moving average for the first time since the beginning of the year:

(Click on image to enlarge)

These funds are now hoping that copper's chart pattern, which began with its summer rally, will turn into a bearish flag once the currently tested consolidation channel is broken.

This investment is made without taking into account the stocks available on the LME (London Metal Exchange), which are currently at their lowest level in five years and still show no signs of significant seasonal replenishment:

The Chinese recovery, lower mine production in 2022 and lower 2023 forecasts are likely to put further pressure on copper stocks. But again, this data is difficult to understand for investors who traditionally use copper as an indicator of economic activity in Europe and the United States. When this activity is expected to decline, Dr. Copper is shorted, a strategy that has worked quite well over the past 30 years.

However, given the historic decline in copper stocks, these bearish speculators who rely on a not-so-objectionable macroeconomic bet may soon be faced with the challenge of securing the metal's supply. This is ultimately what matters most: no matter how many derivative contracts are opened, they are all ultimately linked to a finite quantity of physical metal. When this physical stock disappears, despite an increasing quantity of derivative contracts on the metal, it is the one who holds the physical metal who dictates the rules. In this context, promises on paper contracts are only binding on those who still trust their counterparties.

The realization of the disconnection between the paper market and physical supply is likely to come very late: it is only when copper reserves are almost exhausted that the importance of physical versus paper will be truly measured. This sudden realization, which will also occur in silver, could lead to extreme volatility in metal prices.

More By This Author:

Why Are Many Central Banks Accumulating So Much Gold?

Dow/Gold Ratio Testing A Bear Flag

Is The Banking Crisis Really Over?

Disclosure: GoldBroker.com, all rights reserved.