Is The Banking Crisis Really Over?

The banking crisis, which is mainly affecting U.S. regional banks, has deepened this week.

The KRE index measuring the performance of regional banks is falling again. While it had stopped its fall following the announcement of the Fed's support measures, the index has not managed to rebound since mid-March:

(Click on image to enlarge)

After the fall of First Republik, other institutions saw their share price drop dramatically in the space of one session: PacWest, Western Alliance, Keycorp, Zions Bank, Metropolitan, Homestreet, Comerica...

Pacwest's share price was divided by 10 in one year:

(Click on image to enlarge)

On Wednesday, the share price collapsed by another 50% in the post-session...

U.S. banks are breaking through lows relative to the indices. The BKX/SPX report, which measures the performance of banks relative to the rest of the market, is breaking down:

(Click on image to enlarge)

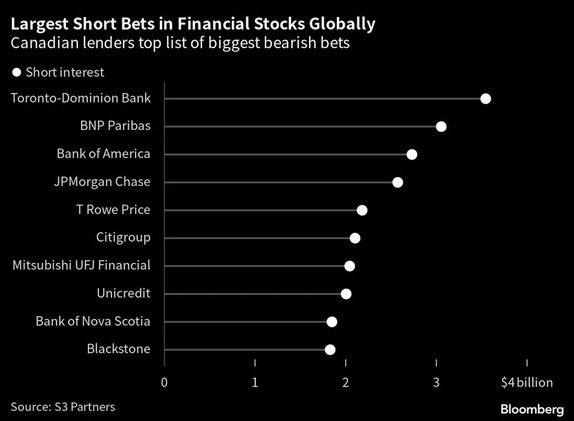

This downward movement logically attracts many bearish speculators on all banks:

The Daily Telegraph is adding fuel to the fire by claiming that half of the banks are now insolvent and that a credit crunch is developing.

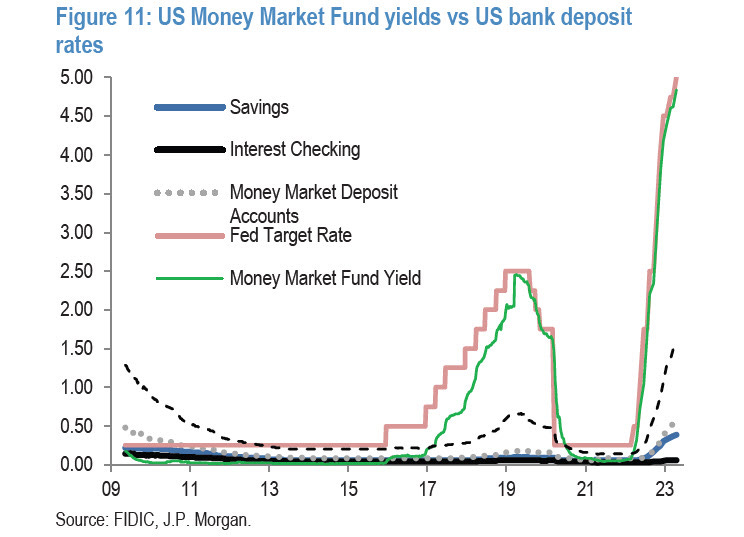

The origin of this insolvency is very simple to explain. It can be summed up in a single chart:

Because of the sharp rise in interest rates, money market funds are currently earning much more than checking and savings accounts. This encourages American bank customers to empty their accounts and put their money in money market funds, which are not only safer but also pay more.

The fractional system of the regional banks is mechanically challenged, forcing these banks to sell assets to compensate for the flight of depositors.

This movement, however, benefits the big banks.

While its boss, Jamie Dimon, is rather optimistic that the crisis will be resolved soon, JP Morgan acquired the vast majority of the assets of First Republic Bank, under emergency conditions that allowed it to carry out an excellent operation: without these particular conditions, the operation would probably not have been as interesting for the largest bank in the United States.

The halt in rate hikes hinted by the Fed on Wednesday suggests that the value of the distressed banks' bond portfolios will rise. And if we focus solely on this asset value, we might even share Mr. Dimon's optimism and realize how perfect the timing of the First Republic Bank takeover was.

The optimists imagine that the failures of regional institutions will lead to consolidation in the banking sector, without having a major impact on the US economy. The results of large banks such as HSBC confirm that the crisis remains contained at the regional bank level.

For other observers, the failure of regional banks is not a minor event. The amount of deposits involved in these failures now exceeds that seen during the 2008 crisis.

PacWest Bank has seen its market capitalization drop from $10 billion to less than $400 million... Those few million support $28.5 billion in deposits and $44.3 billion in assets. PacWest may be a regional bank, but it is not insignificant.

The impact of the regional bank crisis will be far greater than anticipated. The number of loans to small and medium-sized businesses has already collapsed, marking the first step in the credit crunch that is about to hit Main Street hard.

The US credit crunch has probably begun. The debacles of SVB and Signature Bank have made commercial banks cautious, as evidenced by the loan availability component of the NFIB small business survey falling sharply. This means businesses are having a tougher time getting a loan. pic.twitter.com/g1vVuIQp2q

— Gavekal (@Gavekal) April 17, 2023

We can logically expect an avalanche of bankruptcies among these local players in the American economy.

Beyond the risk to small businesses, it is the commercial real estate time bomb that is of most concern.

One and a half trillion in commercial debt is up for renegotiation over the next two years, with rates 4 to 5 % higher than previously determined. Commercial real estate vacancy rates are now at 20%.

The impact of this bombshell on the accounts of the regional banks has yet to be truly measured. Even a consolidation of the US banking sector will not magically make this refinancing problem disappear.

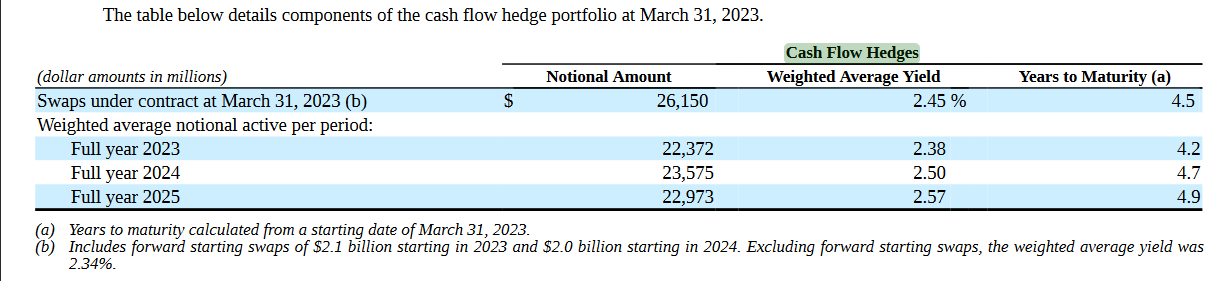

More seriously, the banking risks now concern the amount of hedging of interest rate products, the famous "interest rate swaps".

For example, if we look at Comerica's accounts, we can see that a bankruptcy of the bank would suddenly leave large holes in the accounts of several large financial institutions because the insurance covering them against a rise in rates would suddenly no longer be honored.

(Click on image to enlarge)

To date, the Fed has spent $400 billion to save the banking sector and avoid bank runs. Jerome Powell just announced a pause in rate hikes, but that doesn't mean that the Fed will pivot: high rates will continue to weigh on regional banks and on a real estate sector already heavily impacted by their sudden increase. US economic activity figures should soon reflect the onset of the credit crunch.

Regional bank failures will certainly have a greater impact than the Fed and the big banks are suggesting.

The gold price is benefiting from this tense environment. The prospect of an end to rate hikes has blown through the $2,000 resistance level. But it is mostly the contagion from the banking crisis that is fueling the continued rise in precious metals...

(Click on image to enlarge)

More By This Author:

Silver/Euro Nearing A Weekly Breakout, Monthly Already ConfirmedIs The United States At Risk Of Default?

After Inflation, The Great Depression?

Disclosure: GoldBroker.com, all rights reserved.