Overheated Housing Markets

The economies of Canada, Australia, New Zealand, Iceland, Norway, and Sweden, although geographically dispersed, share a few characteristics. They are all relatively small and open economies, they have their own currency and independent central bank (monetary policy), and they are export-oriented economies with some of them having significant exposure to commodities. But they also have in common a less desirable trait: overvalued housing markets.

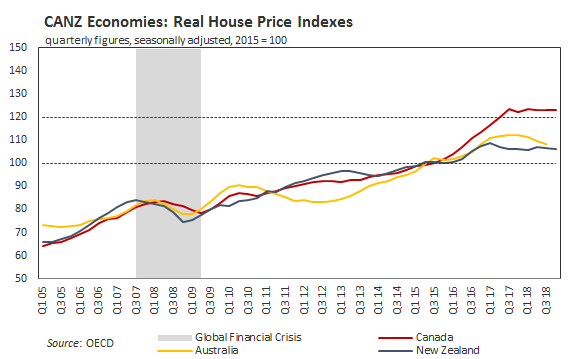

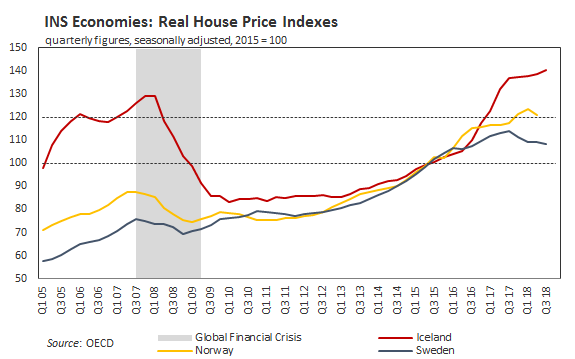

Below are charts that show OECD´s house price indices for these economies. The shaded area is the Global Financial Crisis period (Q3 07 to Q2 09). If one defines an index value of 120 (20%) or higher as overvaluation, compared to the index´s long-term trend, then the Canadian, Icelandic and Norwegian markets are overvalued. Latest data for Canada and New Zealand is Q4 of last year, Q3 for Australia, Sweden and Iceland, and Q2 for Norway.

(Click on image to enlarge)

(Click on image to enlarge)

In the wake of the GFC, the reliance on commodities and massive central bank interest rate cuts helped most of these economies to stave off a housing market correction. But falling commodity prices in 2014-16 triggered additional rate cuts and housing prices soared. So, their housing markets did not really reset. Instead, they went from being overvalued to be even more overvalued, with some of them currently being in a potential bubble state territory.

Iceland was a special case. An economic and financial collapse occurred in the country during the GFC. As can be seen in the chart, the drop in its house price index was much more severe than the decline in the other indices. Consequently, it took the index more time to bottom and start climbing. In Q2 2017, the index rose above its 2007 high level. Based on the latest figure, the Icelandic housing market is overvalued by 40%.

Disclosure: The analysis provided here is usually part of the analysis the author uses when he is designing and managing his investment portfolios.

Disclaimer: The analysis presented ...

more