High Yield: A Losing Proposition

High Yield: A Losing Proposition

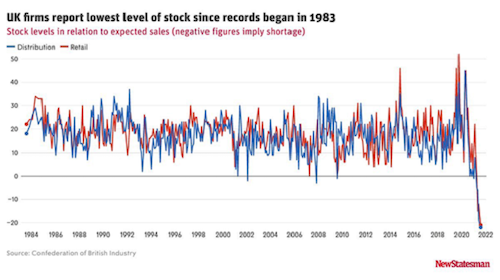

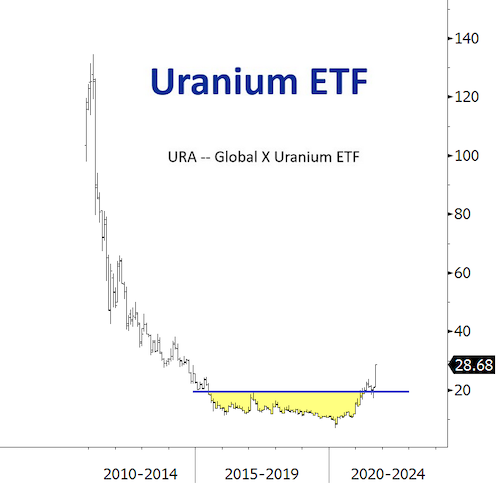

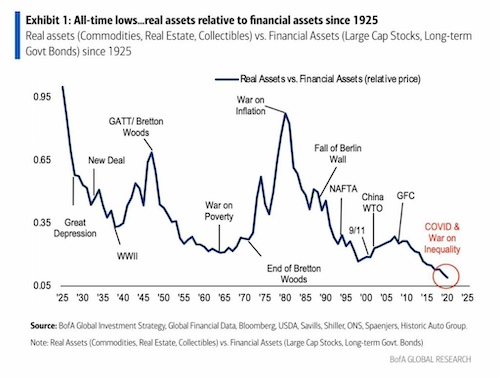

Take a look at this chart and then ask yourself what happens when folks wake to the reality that inflation is transitory in the same way as tofu is tasty?

Suddenly, that capital seeks inflation protection, that’s what.

No Love For Commodities

No Love For Commodities

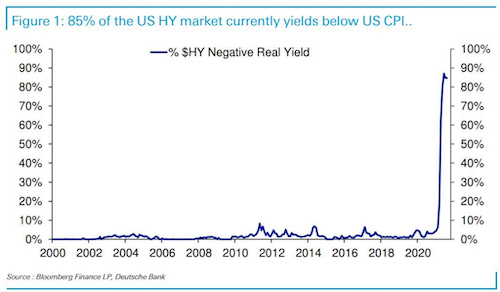

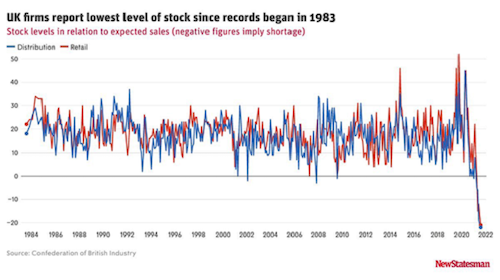

Now, where could that capital seek a safe haven? Hint…

For the majority of investors out there, commodities are still as hated as ever.

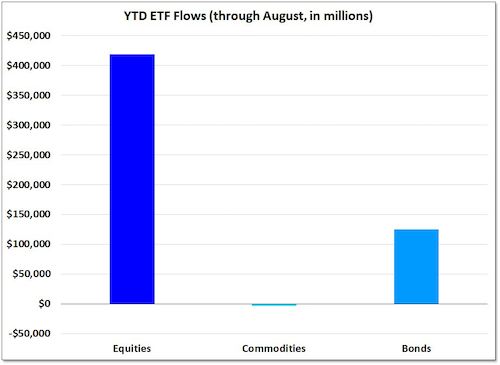

To get a better sense of just how out of whack the market really is, it pays to take a step back and truly put things into perspective.

The run we’ve seen so far is far from over. We remain convinced it’s just getting started. Or we’re wrong, and we’re in for some wonderful exponential age of never ending prosperity brought to us by insanely overvalued tech companies and bond markets.

So maybe that, but the probability of it would mean that we would break a cyclical pattern that has lasted with us for hundreds of years. To us, all this seems like a pretty obvious bet.

Uranium: Going Nuclear

Uranium: Going Nuclear

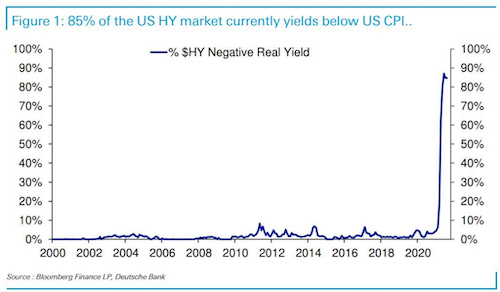

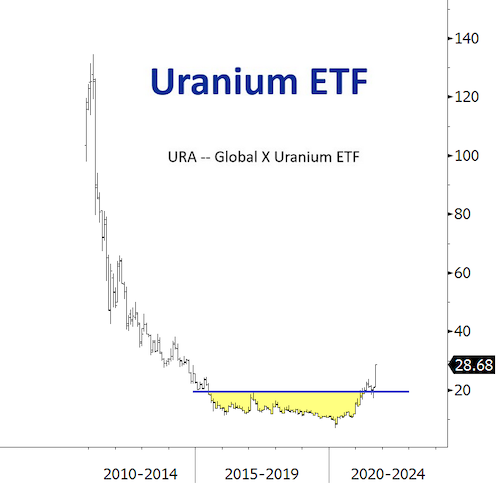

A lot has happened since we last discussed uranium in these missives a few weeks ago. The yellowcake has been on a tear — up 50% in the last month.

But just to give you some context of where we are in the cycle, here’s a long-term chart of the uranium ETF (URA) (hat tip to @NautilusCap for the chart). Side note: the ETF listing nicely coincided with the previous market top in uranium.

So hold on, folks. The best is yet to come.

Time To Go Shopping

Time To Go Shopping

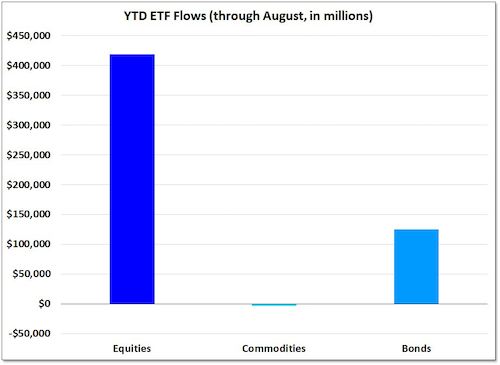

It’s becoming more and more clear we’re heading for some serious food shortages. Here’s Bloomberg on the topic:

Adjusted for inflation and annualized, costs are already higher now than for almost anytime in the past six decades, according FAO data. Indeed, it’s now harder to afford food than it was during the 2011 protests in the Middle East that led to the overthrow of leaders in Tunisia, Libya and Egypt, said Alastair Smith, senior teaching fellow in global sustainable development at Warwick University in the U.K.

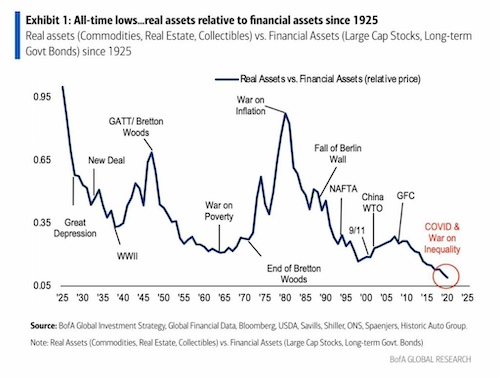

The below chart comes from Jared Dillian (@dailydirtnap). Over in the UK, food is flying off the shelves. It’s not much different in the US.

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even ...

more

Disclaimer: This is not intended to render investment advice. None of the principles of Capex Administrative Ltd or Chris MacIntosh are licensed as financial professionals, brokers, bankers or even candlestick makers in any jurisdiction, anywhere on this big ball of dirt.We do NOT know your individual situation, and you should always consult with your attorneys, accountants, financial planners, and those that are sanctioned to provide you with advice. DO YOUR OWN DUE DILIGENCE.

But seriously, all investments carry risk. Some of what I discuss arguably carries great risk. Investments which can lead to you losing 100% of your capital and maybe more if you are stupid and use margin.If you invest more than you can afford to lose, or borrow money from Joey down at the tavern, Master Card or Visa to make your investments, then you need to go and read a different website.

But really seriously…

Capex Administrative LTD – parent company of CapitalistExploits.at is not a a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes. Neither CapitalistExploits.at, Capex Administrative LTD purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers, subscribers, site users and anyone reading material published by the above mentioned entities should always conduct their own research and due diligence and obtain professional advice before making any investment decision. Capex Administrative LTD, it’s principles and employees cannot and will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our posts, newsletters, special reports, email correspondence, memberships or on this website. Like us, our readers are solely responsible for their own investment decisions.

The information contained herein does not constitute a representation by Capex Administrative LTD or CapitalistExploits.at or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters or on our website should be independently verified with the companies and individuals mentioned. The editor and publisher are not responsible for errors or omissions.

Capex Administrative LTD may receive compensation from time to time from the companies or individuals that may be mentioned in our newsletters, special reports or on our web site. If compensation is received we will indicate that compensation in the post or the content, or on this website within this “disclaimer.” You should assume a conflict of interest when compensation is received and proceed accordingly.

Any opinions expressed are subject to change without notice. Owners, employees and writers may hold positions in the securities that are discussed in our newsletters, reports or on our website.Owners, employees and writers reserve the right to buy and sell securities mentioned on this website without providing notice of such purchases and sales. You should assume that if a company is discussed on this website, in a special report or in a newsletter or alert, that the principals of Capex Administrative LTD have purchased shares, or will make an investment in the future in said company.

If you have a question as to what we own and when, we are happy to fully-disclose any and all interests to our readers.

less

How did you like this article? Let us know so we can better customize your reading experience.

High Yield: A Losing Proposition

High Yield: A Losing Proposition

No Love For Commodities

No Love For Commodities

Uranium: Going Nuclear

Uranium: Going Nuclear

Time To Go Shopping

Time To Go Shopping