Now Lending Money Is A Privilege

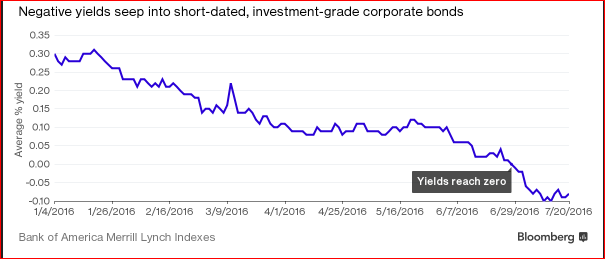

History was made last week when Henkel, the German maker of household detergents and Sanofi, the French drug maker became first non-financial public companies to sell euro-dominated bonds at negative yields. The two combined to raise 1.5 billion Euros at a rate of minus 0.05 percent . Negative yields are commonplace in the EU sovereign debt markets. Now that investment grade debt has entered this segment of the credit markets, the once unthinkable is a feature of the corporate bond world. As Figure 1 shows the move from positive to negative yields in corporates was relatively swift and uninterrupted this year.

Figure 1 Negative Yields in Investment Grade Bonds

According to estimates by BAML, investors are holding about 465 billion Euros ($512 billion) of investment-grade company bonds with yields below zero or 24 percent of the total investment grade market. This represents an eleven-fold increase on the start of the year. The highest-rated euro-denominated senior and secured debt of non-bank companies maturing in one to three years yields an average of minus 0.08 percent, the BAML data shows. This development is not totally confined to the European market. The CIBC, one of the top five Canadian banks, recently raised $1.8 billion covered bonds with a negative yield in the Euro bond market. No doubt the CIBC’s success will likely encourage other financial institutions in North America to tap this market. This does not appear to be just a passing fad.

It is noteworthy that, initially, financial companies were able to take advantage of this market ( Figure 2).

Figure 2

|

Selected Negative Yielding Capital Structures, |

|||

|

Corporation |

Investment Rating |

Country of Risk |

|

|

BMW Finance |

A |

Germany |

|

|

Daimler Fin |

A- |

Germany |

|

|

GE Capital Eur. |

AA_ |

US |

|

|

Shell Int`l Fin |

AA- |

Netherlands |

|

|

BNP Paribas SA |

A+ |

France |

|

|

Siemens Fin.NV |

A+ |

Germany |

|

|

Source: Goldman Sachs |

|||

It is very likely that more investors will have the same "privilege" of buying zero or sub-zero coupon bonds from a range of industrial enterprises. The motivating factor behind the growth in negative bonds is the ECB’s policy of charging commercial banks a rate of minus 0.4 percent to keep cash on deposit overnight. This has resulted in much of the European sovereign bond markets trading at negative rates well into the mid-range of the yield curve. The ECB is turning cash into an undesirable asset class in Europe. Holding cash is too expensive, at least more expensive than holding negative yielding bonds. Investors may lose 0.05 percent holding corporate debt but that is preferable to losing 0.4 percent depositing the cash in a commercial bank.

Some of the borrowing is re-financing existing debt at a much lower rate. Corporations are extending duration out to 10 years; previously loan terms were in the 3-5 year range. It is hard for corporate treasurers to resist the temptation for either adding very cheap debt to the balance sheet or for lowering the cost the existing debt.

As for investors, they’re effectively paying for the opportunity to hold negatively yield debt. Strange as it may seem, that’s still better than buying into the safest government bonds, where yields are even lower. Where can an investor go in such a difficult climate?

Finally, there remains the most important issue to consider: how do the corporate treasurers use this new- found source of cheap money? As yet there is no definitive trend in place, as treasurers debate whether to use the funds: to re-finance existing, higher priced debt; to undertake new capital investment; to acquire competitors; or, to just offer shareholders higher dividends or higher stock prices through share buybacks. The last option is the least desirable from a macroeconomic viewpoint. Let’s hope the treasurers look to options for the re-financing and/or capital investment, at least the money will serve a productive purpose.

This bond buying is an unintended consequence of reverse interest on reserves.