Nikkei 225 Just 2% Of New Record High

The JP225 index is now trading back above the 38,000 mark, reaching a 34-year high.

This stock index, which tracks the benchmark Nikkei 225, is racing towards its existing record high of 38,947.44 from back in December 1989.

And that's despite the negative surprise today that Japan’s economy had unexpectedly fallen into a technical recession amid weakening domestic demand.

NOTE: A technical recession is when the economy shrinks (posts negative grow) for two consecutive quarters.

Why is JP225 soaring?

Generally, stocks prefer a low interest rate environment.

The latest lower-than-expected GDP reading (-0.1% vs 0.3% forecast) may prevent the Bank of Japan (BoJ) from lifting the interest rates out of sub-zero territory.

Recall that Japan is the only country in the world that still has negative interest rates, now stuck at minus 0.1%.

The economic contraction, which delays a BoJ rate hike, could cause the Japanese Yen to depreciate further.

On the other hand, that weaker Yen could pave the way for export-oriented Japanese companies to gain more earnings, potentially contributing to new stock market gains.

Dovish monetary policy may be maintained for longer than originally expected due to Japan’s reliance on exports as domestic demand weakens.

On the technical side …

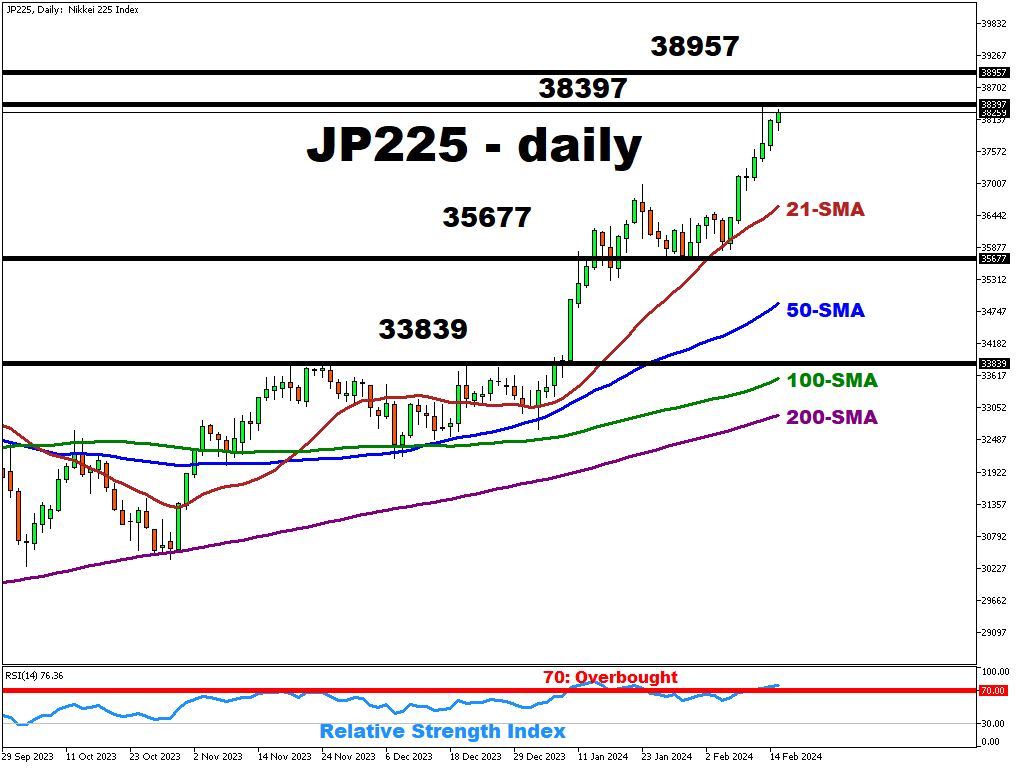

- The Nikkei 225 is trading above all major simple moving averages (21, 50, 100 & 200-period SMAs), highlighting strong bullish momentum

- On the downside, the 21-period SMA (~36604.1) and 35677 could provide strong support if the bears take the initiative

- Other potential support levels are at 34900.1 (50-period SMA) and 33839

- To the upside, 38957 is the clear target, while the Feb 13th high (38397) may act as immediate resistance

- However, the Relative Strength Index is in oversold territory (>70 - overbought, <30 - underbought), indicating the potential for a technical pullback

More By This Author:

GBPUSD Tumbles Amid The Lower UK Inflation Reading

Bitcoin Surges Above $50000

Gold Stays Close To 50-Day SMA Ahead Of CPI Signals

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more