Nifty Below 25,100; Sensex Today Ends 119 Points Lower

After opening the day marginally higher, the Indian benchmark turned negative as the session progressed and ended the day lower.

Following a volatile session, the benchmark equity indices settled in red after paring the initial gains on Wednesday amid a cautious market sentiment and mixed global cues.

At the closing bell, the BSE Sensex closed lower by 153 points (down 0.2%).

Meanwhile, the NSE Nifty closed 62 points lower (down 0.3%).

Tita, Infosys, and TCS are among the top gainers today.

Tata Motors, Trent, and ONGC, on the other hand, were among the top losers today.

The GIFT Nifty was trading at 25,107, down by 117 points at the time of writing.

The BSE MidCap index ended 0.7% lower, and the BSE SmallCap index ended 0.4% higher.

Sectoral indices were trading mixed, with stocks in the IT sector and the consumer durables sector witnessing buying. Meanwhile, the stocks in the auto sector and capital goods sector are witnessing selling pressure.

The rupee is trading at 88.8 against the US$.

Gold prices for the latest contract on MCX are trading 0.2% lower at Rs 122,999 per 10 grams.

Meanwhile, silver prices were trading 2.2% at Rs 148,950 per 1 kg.

Why Godrej Consumer Shares are Falling

In the news, shares of Godrej Consumer Products fell nearly 3% on October 8, hitting a six-month low of Rs 1,120 each, following the company's Q2 FY26 business update.

In an exchange filing released after market hours on October 7, Godrej Consumer Products explained that recent GST reforms could have a short-term impact on profitability. The company noted that the latest GST rate cuts led to certain "short-term adjustments" across trade channels, as distributors and retailers focused on clearing existing inventories. This delayed new orders and temporarily slowed consumer purchases, affecting both growth and profitability.

The firm expects mid-single-digit consolidated revenue growth, but the GST transition is likely to weigh on profitability in the short term, resulting in lower EBITDA for Q2 FY26.

Bank Nifty Snaps 6 Day Gains

Moving on to news from the banking sector, the Nifty Bank index declined on October 8, ending a six-session gaining streak as investors appeared to book profits at elevated levels. Analysts have highlighted key support and resistance levels to watch for the index.

Among individual stocks, Canara Bank led the losses, falling over 2.4% to Rs 124.97. Punjab National Bank (PNB) followed with a drop of around 2%, while IndusInd Bank fell more than 1%.

Other major banks including Axis Bank, Bank of Baroda, AU Small Finance Bank, SBI, and HDFC Bank declined nearly 1% each. ICICI Bank and Kotak Mahindra Bank were also trading in the red with marginal losses.

Tata Capital IPO Fully Subscribed

Moving on, Tata Capital's Rs 155 bn IPO was fully subscribed on Day 3, driven by strong demand from qualified institutional buyers (QIBs).

On October 8, the IPO had received bids for 334.8 m shares against 333.4 m shares on offer, according to consolidated NSE and BSE data.

Investor interest remained robust on the final day of bidding for the Tata group's flagship financial services arm. This marks the largest IPO of 2025 so far and the biggest since Hyundai Motor India's listing last year.

The QIB segment was subscribed 1.19 times, led by mutual funds and foreign investors, while the non-institutional investor (NII) portion saw 1.11 times subscription. The retail segment was subscribed 0.84 times, and the employee quota attracted strong participation at 2.33 times.

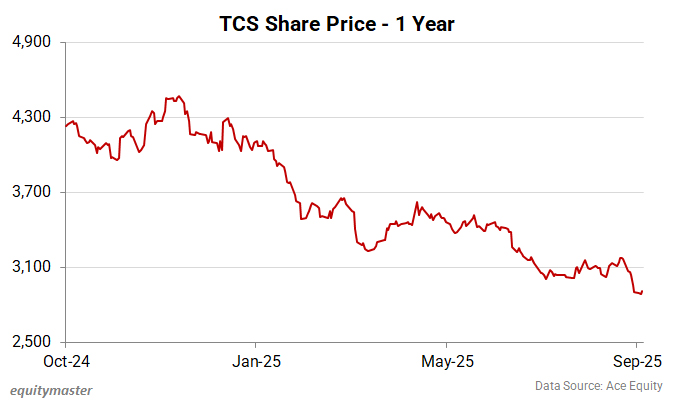

TCS Q2 Results

Moving on to news from the IT sector, Tata Consultancy Services (TCS), India's largest IT services exporter, will kick off the Q2 earnings season for July-September on October 9, with the board also reviewing a second interim dividend for FY26.

The results come at a time when the IT industry faces multiple challenges, including layoffs, a sharp rise in H-1B visa costs, and a proposed 25% outsourcing tax under the Trump administration.

US President Donald Trump recently signed a proclamation increasing the fee for new H-1B visas to $100,000, a steep jump from the current range of US$2,000-5,000 depending on employer size and other factors.

TCS has previously stated that it has reduced its dependency on US H-1B visas to below 50% for its North American operations, while still maintaining a significant share of approvals among top-tier Indian IT companies.

More By This Author:

Nifty Above 25,100; Titan Up 3%

Sensex Today Ends 136 Points Higher; Nifty Above 25,100

Sensex Today Trades Higher; Nifty Above 25,150

Disclosure: Equitymaster Agora Research Private Limited (Research Analyst) bearing Registration No. INH000000537 (hereinafter referred as 'Equitymaster') is an independent equity ...

more