Negative Interest Rates Next Up - Will Pump Markets But Eventually Destroy The Global Financial System

Once again, in the September Federal Reserve (FED) policy meeting, the FED did not raise the fed fund rate, leaving it at 0% to 0.25%.

The stock market has had a huge run since the lows of 2009. At their recent all-time highs this year, gains of nearly 200% since 2009 were reached, yet the real economy has barely seen anything better than flat growth during this time. Simply stated, this is not a real bull market, but a distorted inflated market based on monetary policy that has been too easy, and for far too long.

So why doesn't the FED begin the normalization process and begin to raise the fund rate? Because if they do, it will cause an instant forced deleverage and instant insolvencies globally. Additionally, many institutions have had a false sense of security from buying and selling derivatives and "derivative insurance."

Derivatives are the one thing that has still not seen any regulation, and these were the primary reason the market crashed in 2008. Warren Buffet rightly calls the derivative market "weapons of mass financial destruction."

However, Warren specifically was referring to derivatives tied excessive leverage (risk taking) risk parity - derivative insurance.

What is, and are these specific and dangerous derivatives you might ask? Derivatives are financial contracts that are assigned a perceived value backed by underlying assets which are used as 'collateral' if you may -- what is commonly referred to as "creative financial engineering."

Now, if the FED were to raise the fund rate, the FED would want better collateral to ensure the short term loan can be paid back at the higher rate. By raising the rates now, the collateral requirements for short term overnight parking at the FED would rise considerably. The current collateral is basically monetized derivative junk debt.

Because the collateral currently is basically garbage junk that has been swapped back and forth for years now in the banking repo market. Institutions/banks could instantly lose access to park this money short term, of which has mainly been used to lever up the stock market by lending/leverage between 'banks' at the FED discount rate, which is currently around 0.75% -- a rate hike also hikes the discount rate, and underlying bonds that institutions rely on to borrow against lose value quickly as yields rise.

High frequency trading firms would instantly lose a lot of liquidity. If you remove massive amounts of liquidity from equity markets too quickly, you get a fast, sudden, and severe market sell off. When we saw the fast downturn in August, this was in part from a liquidity drop shock, also caused in part by China dumping US treasuries (that's another discussion).

More and more, we are also seeing a continuing decline in stock market futures liquidity.

As an example, companies like Valeant (NYSE:VRX) would be under severe pressure to service their ballooned debt, and could quickly go "belly up," due to their massive amount of levered acquisitions that used high yield grade junk bond induced debt verses real assets.

The above is the real reason for the fed not raising the Fed fund rate. It's not as simple as saying, " it's only a 0.25% hike, what can be so bad about that?" The stock market is disconnected from the real economy, rising to record levels primarily from quick and easy monetary policies and easily gained leverage. This is basically the same problem we saw in 2008, but on a much more massive scale as it's just not one market (housing), but the entire global equity market. The current financial condition out there is much more fragile than most realize, even by the most educated of men and women who are taught on a theoretical basis of how economies used to work, not as they currently work.

Let's take a look at the current derivative exposure that major banks and institutions have:

*sourced from Zerohedge.com

JPMorgan Chase

Total Assets: $2,476,986,000,000 (about 2.5 trillion dollars)

Total Exposure To Derivatives: $67,951,190,000,000 (more than 67 trillion dollars)

Citibank

Total Assets: $1,894,736,000,000 (almost 1.9 trillion dollars)

Total Exposure To Derivatives: $59,944,502,000,000 (nearly 60 trillion dollars)

Goldman Sachs

Total Assets: $915,705,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $54,564,516,000,000 (more than 54 trillion dollars)

Bank Of America

Total Assets: $2,152,533,000,000 (a bit more than 2.1 trillion dollars)

Total Exposure To Derivatives: $54,457,605,000,000 (more than 54 trillion dollars)

Morgan Stanley

Total Assets: $831,381,000,000 (less than a trillion dollars)

Total Exposure To Derivatives: $44,946,153,000,000 (more than 44 trillion dollars)

These are just 4 'banks' who have both bought and sold a ton of derivatives and derivative insurance. Where do you think electronically traded funds (ETF'S) get their liquidity from? I would like to hear from someone who can explain to me how these banks can come close to paying off the derivative bets which they have been selling like hotcakes in the event of more financial stress?

No legislation or regulations cover these derivatives, therefore capital requirements of these banks being met is completely moot if they can't pay off bets if they come due = insolvency.

Again, this is the real reason the FED won't raise rates and will likely sit idle during the next market sell off and main street economic recession in order to bring in their negative fed fund interest rates - the ultimate drug high!

One only has to reference this article to see the cavalier attitude towards buying and selling Credit Default Swaps (CDS), the same type of bets that mainly caused the crash of 2008. It's truly junk because it's not backed by assets that can cover the bets. Think of a company who sells 10,000% above the actual authorized shares allotted, or Bernie Madoff's scam he got busted for, or a gambler who keeps racking up markers he/she cannot ever pay off to understand it.

Velocity of Debt has grossly outrun main street velocity of growth

According to the last revised GDP data, the U.S. economy grew 3.7% in Q2, 2015. However, this growth is mostly debt growth which is counted towards GDP. In the "old days" before the overly easy monetary policies, debt spending was a crucial part of economic growth. Commonly, when debt spending dramatically increased, economic growth followed at the same pace. This was an equal weighted velocity and healthy.

Based on the current debt spending, public and private, U.S. GDP should well be over 5.5% in my estimation, but it's nowhere close. Mainly, the jobs being 'created' are of the low paying variety. We need to see wage growth velocity, but we aren't. In fact, we are seeing wage growth stale at best. The Job market participation rate is near 62%, which are 40 year lows. One would think with all the money printed, and leverage on that printed money, that we would be 'booming.'

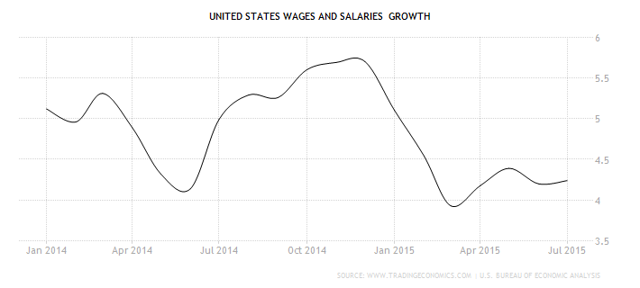

(click to enlarge)

The above 1 year wage growth chart tells part of the story. QE as it was fashioned does not work but only for a very few, and it's temporary distortion. Current Fed policies will also hurt the 'ultra rich' in time as well.

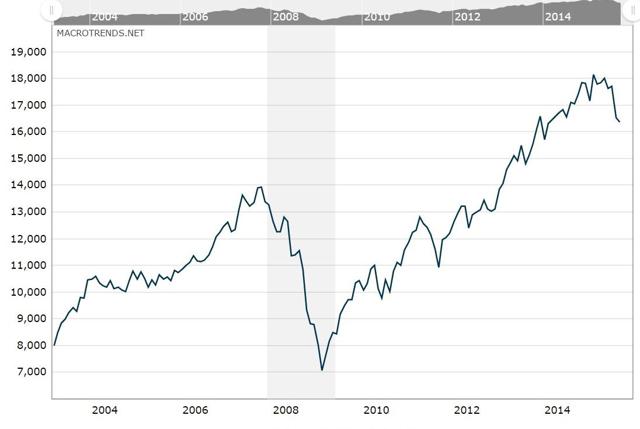

(click to enlarge)

The above chart is U.S. wage growth over 10 years. We can see it's been flat. Compare this to the growth of the stock market over the same time period, especially during the last 5 years.

(click to enlarge)

We can see from above how QE has distorted markets. This is not even mentioning the money companies are borrowing to engage in share buy backs, which basically manipulate their earnings to look better than they actually are.

Note the highs from 2007 - this is where I believe we are headed on a technical basis before the FED engages a new round of QE + negative interest rates.

The velocity of wage growth is stale at best while the stock market has seen a kind of super velocity in growth. The stock market growth has not been fueled by economic growth, but by a huge amount of debt spending that is not creating the velocity in the main street economy that we need to see to actually have a real boom.

- The FED only knows The Keynesian way and will engage a negative fund rate after the current economy falls into recession and the stock market hits the 2007 highs.

If a balloon is filled to capacity, air has to be let out else the balloon will pop, and no amount of air will ever fill it again. Once a balloon is filled to the max and a good amount of air is let out, it has more elasticity to take on even more air the next time it's filled.

How do we know this current market cannot go higher without a mild crash/air let out?

(click to enlarge)

We can see the answer above -- there are 3 tops that the market stalled out on. There simply is not enough leverage in the system, and with China greatly slowing down and getting caught in their own form of 'financial engineering," this puts further stress on the system, notwithstanding all the other points I have made in this write-up.

The FED follows a Keynesian mindset that wrongly favors a supply side economic model over the real and true economic model -- demand. Real demand comes when the average person feels ok with his/her job, finances, etc, etc. This is because the current FED believes as Dr. Keynes taught, that recessions can be avoided by forcing savers to spend. This has created excessive personal debt, without solid average individual and family financial asset growth.

Savers these days receive next to nothing in their bank accounts interest wise. So, the theory of Keynes basically says that these consumers will spend because they are dissuaded from saving, thus avoiding a recession. Then, supply side comes in with expanding the monetary base and leverage (QE). I strongly feel this is the heart of "voodoo economics" and has proven not to work. In fact, it's end is destructive quite like a drug addict who cannot get off the drug -- he/she will eventually overdose and die.

Every healthy economy has natural cycles that should be respected. When people want to save, let them save. When booms hit a peak, it's time to slow down and pay down the debt that caused the growth, then reissue new debt, and not rolled-over debt.

Sadly, because the FED is stuck in Keynesian economics, they will likely increase the monetary base more (QE), and create a negative fed fund rate. In essence, savers will be charged to deposit money in banks, forcing even more leverage upon an even future larger monetary base. Stocks will likely inflate to record levels in a fast rise and an even quicker end. The main street economy may enjoy a very short time of a boom, in part from a very-easy-to-borrow-from new batch of subprime lenders

Stock speculators and huge HFT firms will actually be paid to park money at the Fed overnight. The Fed discount rate will drop considerably, allowing for more levering of junk assets -- inter-lending between banks (Glass-Steagall, who art thou?) will skyrocket, and debt, both public and private will be even more massive then it is now.

Without real quality jobs being created, the average person will just get into more debt, and the eventual end game of a negative interest fund rate will not be good.

Because there is no regulation on 'derivative insurance' we can expect even more mal-investment, more leverage, more risk taking and more euphoria from the ultimate hot dose of an even easier monetary drug induced hysteria. After that point, the FED will be totally out of bullets, and the entire global financial system will likely be destroyed.

- My solution to fix U.S economy

The real fix is to take our medicine now, and wind down slowly from our drug induced economy. Even if it causes a big market crash, we and future generations will be better off.

1. Raise in small increments the fed fund rate to 2% - This will discourage mal-investment and excessive risk taking which would slow down stock markets to reasonable pace that matches the velocity of main street growth.

2. Lower the interest on excess reserves (IOER) to 0%. This will give incentive for banks to loan to Main Street and make their money the old fashioned way - over time instead of quick and easy money (The FED controls 3 interest rates, the fund rate, discount rate and IOER, the markets set the rest.)

However, both of the above will not work unless Congress passes a real infrastructure bill. What I'm getting at is a bill that would require states via private business to upgrade roads, bridges, transportation; to modernize power grids. Additionally, congress should pass a bill that will create a United States high speed monorail system + more.

Banks can then lend to private businesses that will take part in this endeavor which would create a huge amount of decent paying jobs -- demand for engineers, computer techs, electricians, you name it!

Sadly, the odds of Congress and the FED doing this are very low. That's a big shame because I think it can work. However, current human greed nature and addiction to its quick and easy monetary 'drug' policies won't allow it.

- Something traders and investors should take serious note of

There is also a potential big problem coming in either late October to early December. This is the debt ceiling debate theater certain to come when the government runs out of "extraordinary means to finance the government." Any perceived default threat could cause massive chaos in an already illiquid bond market.

This would not be good as former Pimco (NYSEARCA:BOND) boss Bill Gross points out in this article written a couple of months ago. Traders and investors need to be made aware of this potential and adjust risk accordingly.

- Conclusion

Instead of dealing with these issues head on and Congress passing real regulation to deal with what Buffet calls "weapons of mass financial destruction," it has passed weak regulations that simply require banks to have a certain amount of excess reserves, and does not count derivative exposure as any part of a threat to that. Furthermore, Congress and President Obama have failed (in accordance with the FED) in passing real legislation that would upgrade our entire infrastructure from our roads, bridges, transportation, to power grids and computer security -- and this is only touching the surface.

I expect this current market is see a mild crash which helps cause an economic recession, then QE4+ negative interest rates which will cause another stock market run. When that run is over, then it's game, set, and match.

Disclaimer: This article/video is intended for informational and entertainment use only, and should not be construed as ...

more

Great article and good discussion, thanks.

Your two points for helping the economy, cut interest on excess reserves, and raise the funds rate to 2 percent are good, but I think you have to take long treasury bonds out of usage as collateral. Otherwise the long end will stay low yield, high priced.

I agree, but these are things the current fed won't do. Personally, I don't buy they are increasing balance sheet. I think they have unwound a good deal of it. But how can we know, unless someone audits the fed now we aren't aware of!?

Hi Scott, I don't see long bonds ever going up in yield that much and that won't give banks motive to lend unless they just throw that benchmark away. There is insatiable demand for the long bond. My article today explores that. I wish you would look at it.

I'll look in a bit after I get back from working out, thanks!

Great article, except that supply side is hardly Keynesian. Supply side is tax cuts and private hot money. Keynes would say fix the roads, fix the real economy. And we aren't doing it!

Ok, let me correct that. " Supply side with today's MODERN keynesians".. Better?

Lol, thanks.