Metals Speculators Raise Gold Bullish Bets For 5th Week To 61-Week High

Image Source: Unsplash

Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC). The latest COT data is updated through Tuesday, March 8, and it shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets.

Highlighting the COT metals data is the continued gains in the gold futures bets. The speculative net position in the gold futures has risen for five consecutive weeks and in six out of the past seven weeks. Gold bets have now increased by a total of +102,246 contracts over just these past five weeks, as bullish sentiment has increased due to inflation and the war in Ukraine.

The current speculator position has now ascended to the most bullish level (+274,388) in the past sixty-one weeks, dating back to Oct. 15, 2021, when bullish bets totaled +279,318 contracts.

All the metals markets we cover saw higher speculator bets, with silver (7,349 contracts), gold (16,766 contracts), copper (9,726 contracts), platinum (8,943 contracts), and palladium (632 contracts) all rising for the week.

Data Snapshot of Commodity Market Traders | Columns Legend

| WTI Crude | 1,896,974 | 5 | 361,665 | 11 | -408,809 | 80 | 47,144 | 81 |

| Corn | 1,487,815 | 19 | 498,033 | 94 | -456,684 | 7 | -41,349 | 19 |

| Natural Gas | 1,085,853 | 0 | -138,413 | 37 | 97,671 | 62 | 40,742 | 82 |

| Sugar | 837,413 | 5 | 151,076 | 68 | -190,856 | 32 | 39,780 | 57 |

| Soybeans | 743,566 | 32 | 216,577 | 84 | -189,219 | 21 | -27,358 | 25 |

| Gold | 638,502 | 57 | 274,388 | 75 | -306,946 | 24 | 32,558 | 57 |

| Heating Oil | 349,618 | 31 | 6,455 | 52 | -32,434 | 37 | 25,979 | 88 |

| Wheat | 342,996 | 4 | 12,625 | 58 | -5,496 | 35 | -7,129 | 72 |

| Coffee | 224,222 | 3 | 52,113 | 86 | -56,074 | 16 | 3,961 | 16 |

| Copper | 198,844 | 26 | 31,819 | 65 | -40,070 | 32 | 8,251 | 73 |

| Brent | 196,832 | 37 | -11,712 | 92 | 10,814 | 11 | 898 | 21 |

| Silver | 168,283 | 33 | 52,297 | 74 | -69,609 | 31 | 17,312 | 44 |

| Platinum | 72,496 | 43 | 25,833 | 39 | -32,358 | 63 | 6,525 | 53 |

| Palladium | 7,631 | 5 | -272 | 20 | -563 | 73 | 835 | 94 |

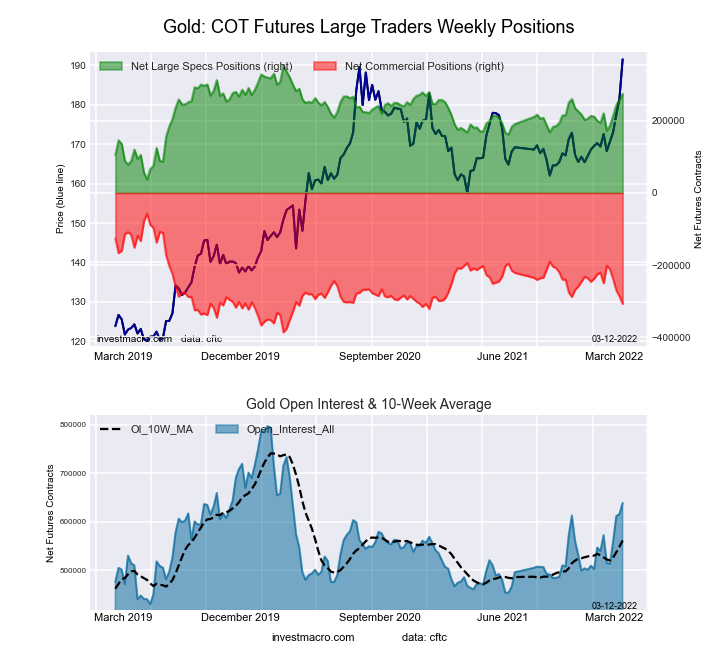

Gold Comex Futures:

The gold Comex futures large speculator standing this week reached a net position of 274,388 contracts in the data reported through Tuesday. This was a weekly lift of 16,766 contracts from the previous week, which had a total of 257,622 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 74.9%. The commercials are Bearish with a score of 24.0%, and the small traders (not shown in chart) are Bullish with a score of 56.6%.

| Gold Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 57.1 | 21.8 | 8.8 |

| –% of Open Interest Shorts: | 14.1 | 69.9 | 3.7 |

| – Net Position: | 274,388 | -306,946 | 32,558 |

| – Gross Longs: | 364,618 | 139,397 | 55,964 |

| – Gross Shorts: | 90,230 | 446,343 | 23,406 |

| – Long to Short Ratio: | 4.0 to 1 | 0.3 to 1 | 2.4 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 74.9 | 24.0 | 56.6 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 17.1 | -17.4 | 8.4 |

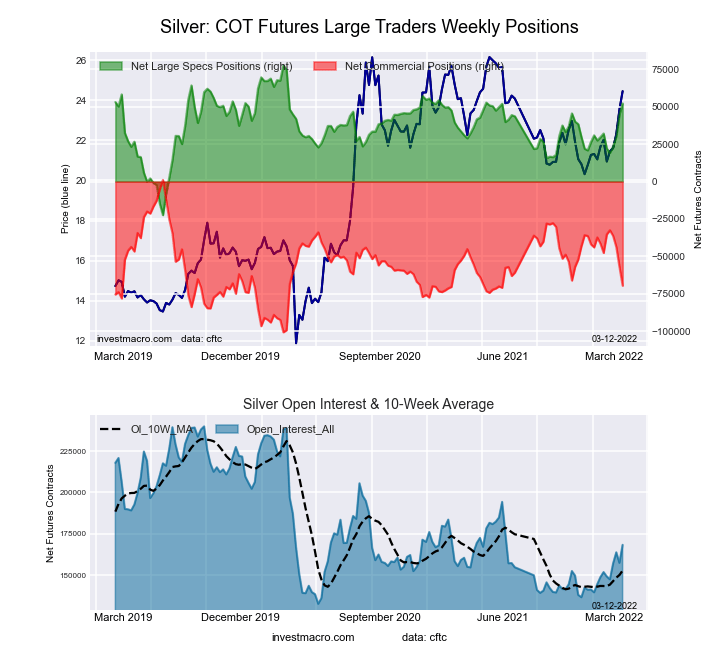

Silver Comex Futures:

The silver Comex futures large speculator standing this week reached a net position of 52,297 contracts in the data reported through Tuesday. This was a weekly lift of 7,349 contracts from the previous week, which had a total of 44,948 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 74.5%. The commercials are Bearish with a score of 30.6%, and the small traders (not shown in chart) are Bearish with a score of 43.7%.

| Silver Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 45.5 | 29.0 | 17.0 |

| –% of Open Interest Shorts: | 14.4 | 70.4 | 6.7 |

| – Net Position: | 52,297 | -69,609 | 17,312 |

| – Gross Longs: | 76,565 | 48,816 | 28,583 |

| – Gross Shorts: | 24,268 | 118,425 | 11,271 |

| – Long to Short Ratio: | 3.2 to 1 | 0.4 to 1 | 2.5 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 74.5 | 30.6 | 43.7 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bearish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 20.1 | -21.5 | 10.3 |

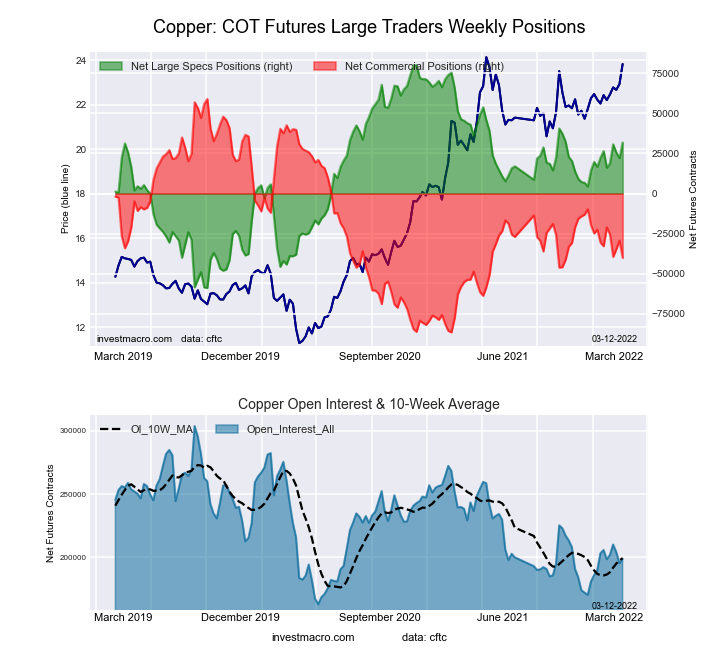

Copper Grade #1 Futures:

The copper Grade #1 futures large speculator standing this week reached a net position of 31,819 contracts in the data reported through Tuesday. This was a weekly gain of 9,726 contracts from the previous week, which had a total of 22,093 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 65.3%. The commercials are Bearish with a score of 31.9%, and the small traders (not shown in chart) are Bullish with a score of 73.0%.

| Copper Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 44.1 | 37.7 | 9.6 |

| –% of Open Interest Shorts: | 28.1 | 57.9 | 5.4 |

| – Net Position: | 31,819 | -40,070 | 8,251 |

| – Gross Longs: | 87,744 | 74,975 | 19,023 |

| – Gross Shorts: | 55,925 | 115,045 | 10,772 |

| – Long to Short Ratio: | 1.6 to 1 | 0.7 to 1 | 1.8 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 65.3 | 31.9 | 73.0 |

| – Strength Index Reading (3 Year Range): | Bullish | Bearish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 3.8 | -5.0 | 11.0 |

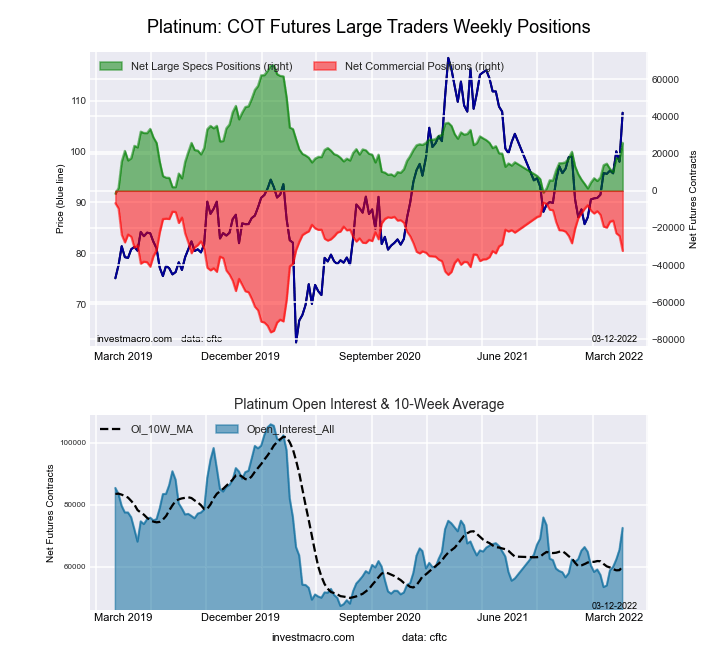

Platinum Futures:

The platinum futures large speculator standing this week reached a net position of 25,833 contracts in the data reported through Tuesday. This was a weekly gain of 8,943 contracts from the previous week, which had a total of 16,890 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 39.2%. The commercials are Bullish with a score of 62.7%, and the small traders (not shown in chart) are Bullish with a score of 53.1%.

| Platinum Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 57.6 | 26.1 | 12.5 |

| –% of Open Interest Shorts: | 22.0 | 70.8 | 3.5 |

| – Net Position: | 25,833 | -32,358 | 6,525 |

| – Gross Longs: | 41,758 | 18,935 | 9,082 |

| – Gross Shorts: | 15,925 | 51,293 | 2,557 |

| – Long to Short Ratio: | 2.6 to 1 | 0.4 to 1 | 3.6 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 39.2 | 62.7 | 53.1 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 17.5 | -18.8 | 15.2 |

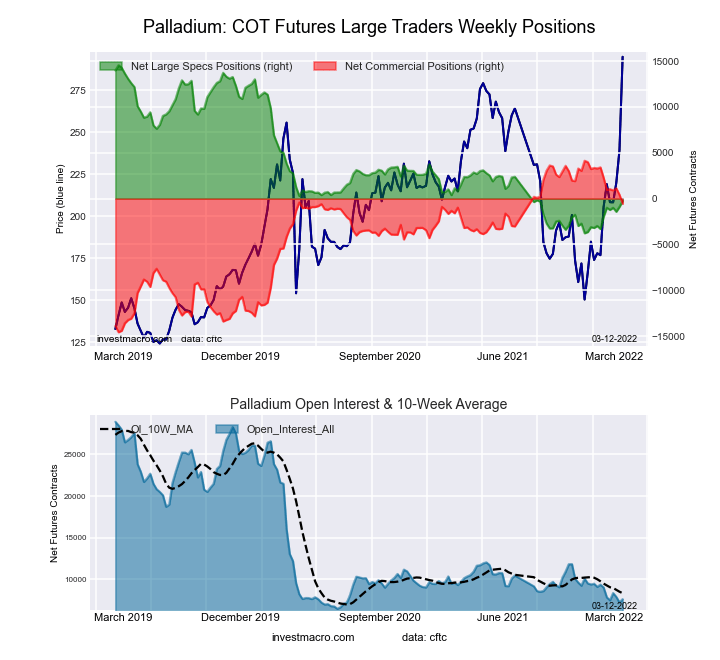

Palladium Futures:

The palladium futures large speculator standing this week reached a net position of -272 contracts in the data reported through Tuesday. This was a weekly boost of 632 contracts from the previous week, which had a total of -904 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 20.0%. The commercials are Bullish with a score of 73.2%, and the small traders (not shown in chart) are Bullish-Extreme with a score of 93.8%.

| Palladium Futures Statistics | SPECULATORS | COMMERCIALS | SMALL TRADERS |

| –% of Open Interest Longs: | 34.4 | 42.6 | 22.1 |

| –% of Open Interest Shorts: | 38.0 | 49.9 | 11.2 |

| – Net Position: | -272 | -563 | 835 |

| – Gross Longs: | 2,624 | 3,247 | 1,686 |

| – Gross Shorts: | 2,896 | 3,810 | 851 |

| – Long to Short Ratio: | 0.9 to 1 | 0.9 to 1 | 2.0 to 1 |

| NET POSITION TREND: | |||

| – Strength Index Score (3 Year Range Pct): | 20.0 | 73.2 | 93.8 |

| – Strength Index Reading (3 Year Range): | Bearish | Bullish | Bullish-Extreme |

| NET POSITION MOVEMENT INDEX: | |||

| – 6-Week Change in Strength Index: | 9.8 | -16.2 | 66.0 |

Article By InvestMacro – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators) as well as their open interest (contracts open in the market at time of reporting). See CFTC criteria here.

Disclosure: Foreign Currency trading and trading on margin carries a high level of risk and can result in loss of part or all of your investment.Due to the level of risk and market volatility, ...

more

trade view - stop loss

where all this?? just foggy bla bla speach???