Markets Face Major Paradigm Shifts As Recession Approaches

Over the past 25 years, the budget process has tended to assume that the external environment will be relatively stable. 2008 was a shock at the time, of course, but many have now forgotten the near-collapse that occurred. Yet if we look around us, we can see that a number of major paradigm shifts are starting to occur in core markets – autos, plastics and others – which means that ‘business as usual’ is highly unlikely to continue.

In turn, this means we can no longer operate a budget planning cycle on the assumption that demand will be a multiple of IMF GDP forecasts. Our business models will have to change in response to today’s changing demand patterns. Of course, change on this scale is always uncomfortable, but it will also create some major new opportunities.

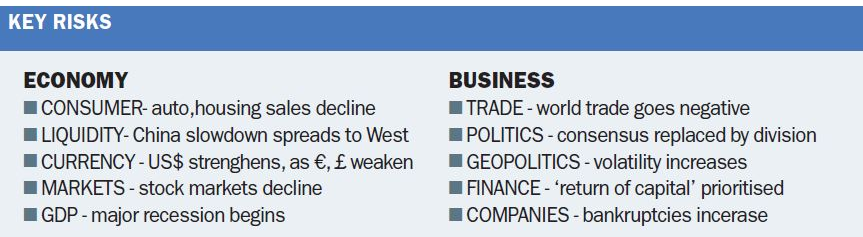

The transition periods created by paradigm shifts are never easy, however, due to the level of risk they create. The table gives my version of the key risks – you may well have your own list:

- Global auto markets are already in decline, down 5% in January-August versus 2018, whilst the authoritative CPB World Trade Monitor showed trade down 0.7% in Q2 after a 0.3% fall in Q1

- Liquidity is clearly declining in financial markets as China’s slowdown spreads, and Western political debate is ever-more polarised

- The US$ has been rising due to increased uncertainty, creating currency risk for those who have borrowed in dollars; geopolitical risks are becoming more obvious

- Some of the main “bubble stocks” such as WeWork, Uber and Netflix have seen sharp falls in their valuations, leading some investors to worry about “return of capital”

- Chemical industry capacity utilization, the best leading indicator for the global economy, has been in decline since December 2017, suggesting recession is close, and that bankruptcies among over-leveraged firms will inevitably increase

AUTOS PARADIGM SHIFT

The paradigm shift now underway in the global auto industry typifies the scale of the potential threat to sales and profits. Hundreds of thousands of jobs will likely be lost over the next 5-10 years in auto manufacturing and its supply chains as consumers transition to electric vehicles (EVs). The issue is that EVs have relatively few parts. And because there is much less to go wrong, many servicing jobs will also disappear.

The auto industry itself was the product of such a paradigm shift in the early 19th century, when the horse-drawn industry mostly went out of business. Now it is seeing its own shift, as battery costs start to reach the critical $100/kWh levels at which EVs become cheaper to own and operate than an internal combustion engine (ICE) on a total cost of ownership basis.

China currently accounts for two-thirds of global EV sales and sold nearly 1.3 million EVs in 2018 (up 62% versus 2017). They may well take 50% of the Chinese market by 2025, as the government is now focused on accelerating the transition via the roll-out of a national charging network. Importantly, though, Europe is likely to emerge as the main challenger to China in the global EV market.

VW is likely to be one of the winners in the new market. It plans to spend €80 billion to produce 70 EV models based on standardized motors, batteries and other components. This will enable it to cut costs and accelerate the roll-out:

- Its new flagship ID.3 model will go on sale next year at a mid-market price of €30k ($33k)

- Having disrupted that market segment, it will then expand into cheaper models

- And it expects a quarter of its European sales to run on battery power by 2025

The risk for suppliers to the auto industry is that the disruption caused creates a new playing field. Those who delay making the investments required are almost certain to become losers. The reason is simple – if today’s decline in auto sales accelerates, as seems likely, the investment needed for EVs will become unaffordable for many companies.

Nothing lasts forever. ‘Business as usual’ was a great strategy for its time. But it is clear that future winners will be those who recognize that the disruptive paradigm shifts now underway require new thinking and new business models. Companies who successfully transition to focus on sustainability and affordability will be the great winners of the future

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more

I don't know any consumers in America who will be switching to EVs. Maybe in China, but not here.

Gary that's exactly my point. China and Europe are set to dominate the global market. Trucks/vans/public vehicles will be the early adopters in the US now that the total cost of ownership is starting to fall below that of conventional engines. They have set routes each day, and can easily recharge in the depot overnight. Consumers will be much later.