London Silver Shortage Spreads To Royal Mint

Image Source: Pixabay

Have we reached the point yet where we should just start assuming that $100 gold and $1 plus silver up moves are just the norm now?

Maybe that’s going a little overboard, but that’s what it’s felt like lately. And certainly again today.

After surging $100 earlier in the day, the gold futures had been hanging around the $3,405 mark for most of the afternoon, before then shooting another $40 higher to the current level of $4,344.

I’m not sure I remember the gold futures ever being up as much as $143 in a single day, and I’ll work on tracking down whether that actually is the record.

But either way, in this next chart, you can see that the low for the gold futures last Thursday, October 9, was $3,961, which means that the price has risen $383 in a week. Which of course, is just absolutely stunning.

Although not to be outdone, the silver pricing also had another staggering surge higher on Thursday as well, as the silver futures were up another $2.05 to $53.43, leaving them $4.17 higher than just two days ago on Tuesday.

The silver spot price rallied another $1.16 to $54.15, leaving London spot trading 72 cents over the Comex futures.

The big news on Thursday was that the Royal Mint in England has now warned of silver delivery delays.

A rush of orders from retail investors has prompted a ramp-up in output, but the 1,100-year-old institution is warning of possible delays in silver deliveries as it races to replenish its reserves.

A global surge in demand for precious metals has boosted silver prices by more than 80% in London’s wholesale market this year, with a fresh wave of orders from banks and other institutional buyers culminating in a historic squeeze this week. Inventories in London’s vaults are critically low, and fresh stock is being flown in from as far as New York.

I talked with someone today who’s familiar with the Royal Mint, who mentioned that the majority of the products that the Royal Mint produces is sold to people in England. Which means that there has been at least some degree of surge in demand there as well.

Buyers have been flooding into London’s street-level bullion outlets too, with voracious demand for small bars and coins prompting the Royal Mint to run its presses harder. Still, the institution is warning buyers of possible delays in silver deliveries.

London’s institutional silver market — the epicenter of the global bullion trade — has been squeezed this week, pushing prices to unprecedented levels and raising concerns about liquidity. At the retail level, demand for physical precious metals has been “exceptional” in recent weeks, both in the UK and internationally, said Royal Mint spokesperson Carly O’Donnell.

Hopefully, they’re not calling in Dave Ramsden from the Bank of England as a consultant.

I’ve been careful to distinguish between a global silver shortage, and perhaps what you would call a silver shortage in India, where last week they had to stop taking new inflows into Indian silver ETFs because they didn’t have enough silver to add more shares. They said they expected to have what they needed in the next shipment, although so far it does not appear as if the halt has been lifted.

It would presume that some of the metal that has left the Comex in recent days will head there, either directly, or via London. But it will be quite telling to see if that’s sufficient to quell the demand. And now we’re seeing a delay in London as well.

When people generally talk about a silver shortage, often they talk about an industrial user like Samsung or Apple not being able to get what they need to make their products. Well, here’s a different type of business, that may be based on retail investment demand, but that still counts on having a supply of silver to manufacture the products it sells. And now they’re saying they can’t get what they need right now.

So it’s not just India anymore, and it’s fascinating how at the same time that the US has indicated that silver will be officially recognized as a critical mineral, the majority of the silver is here, while other locations in the world are now facing a shortage.

It’s also worth considering what happens when silver does return to India, as you also now have some pent-up demand. I’m sure you remember what happened in 2020 when people were worried about whether they would be able to get toilet paper from Costco. And there’s that human wiring where if you tell people they can’t have something they want, that often that makes them want it even more.

So I would have to think that there’s at least an elevated probability that in the middle of a surge, which occurred at a time when prices were already near record highs in an Indian market that is traditionally a price-sensitive buyer, that the shortage there in and of itself could actually create an even higher level of demand than otherwise would have been the case.

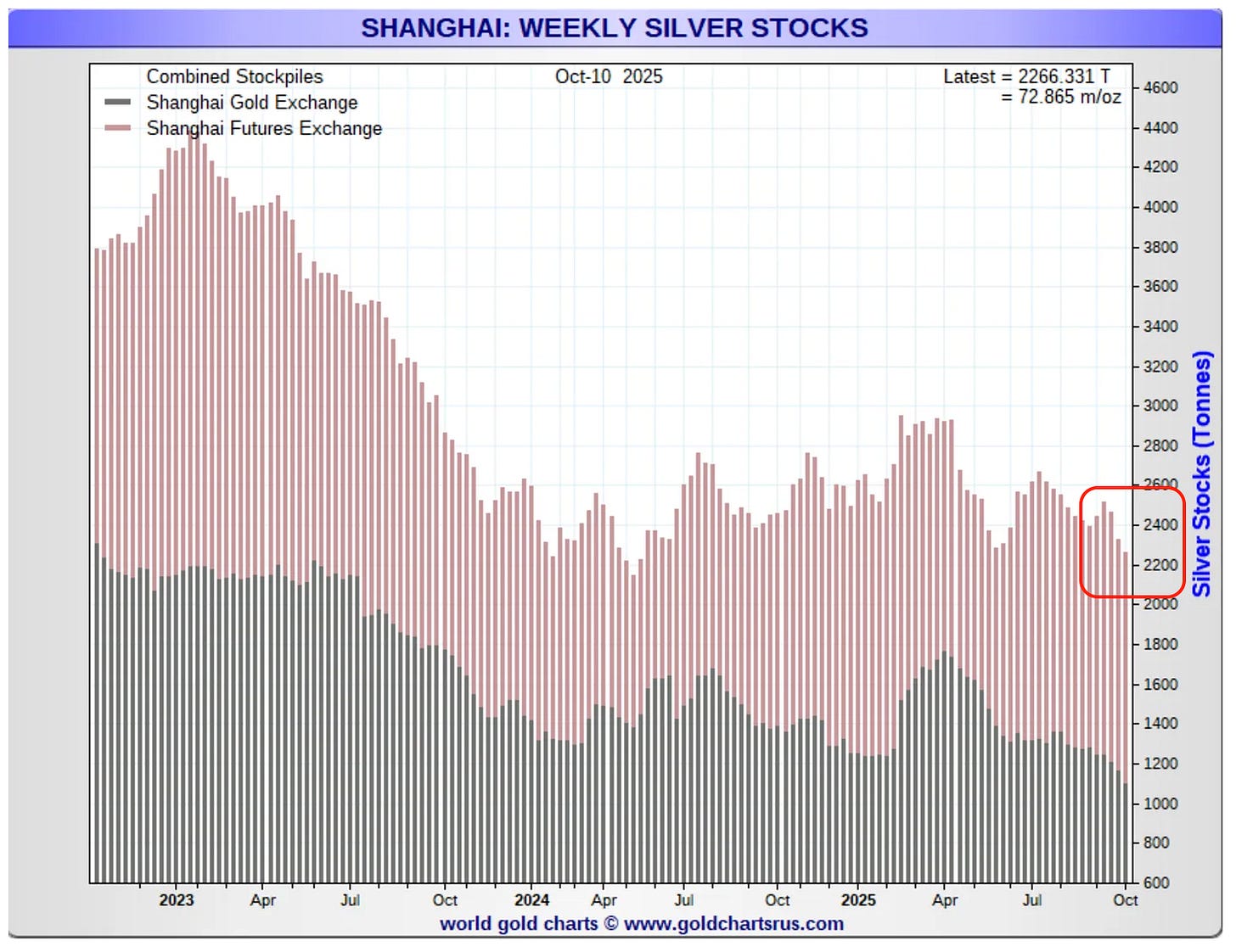

Bai Xiaojun in China notes here how the Shanghai silver inventories have also been declining.

Here you can see the combined inventories, and while it’s not an avalanche just yet, they did recently start declining right at the same time that London has run into problems.

We can see that there were more withdrawals from the Comex yesterday, although the pace slowed, and this time the net amount withdrawn was less than a million ounces, whereas it had been two to four million ounces per day over the past week.

I also recorded a 10-minute update about my thoughts on the latest activity, which you can see here.

Lastly, this was a note from the Financial Times this morning about Donald Trump and his family allegedly making more than $1 billion in pre-tax profits from crypto-related investments over the past year.

I won’t claim to be an expert on what exactly he did or did not do, and what the current technical legal code is on something like this at the current moment. But at least from a headline perspective, it doesn’t sound good if this occurred as reported, while the Trump administration was moving forward crypto-friendly policies.

Again, I’m only responding to what’s published here, and don’t know the details. Yet thought it was at least worthwhile enough to pass along.

But somehow it’s already Thursday evening, and there’s only one trading day left in the week. Hard to remember a week that flew by faster than this one. But like I’ve said before, you’re seeing history be made, and hopefully you’re just enjoying being a part of it.

More By This Author:

Silver Surges Back Over $53, Gold Nears $4,300

Gold & Silver Surge Again As Powell Admits Inflation's Going Higher

Silver Breaks $52 Per Ounce As Historic Short Squeeze In London Intensifies