Korea: February Trade Balance Returns To Surplus With Solid Exports

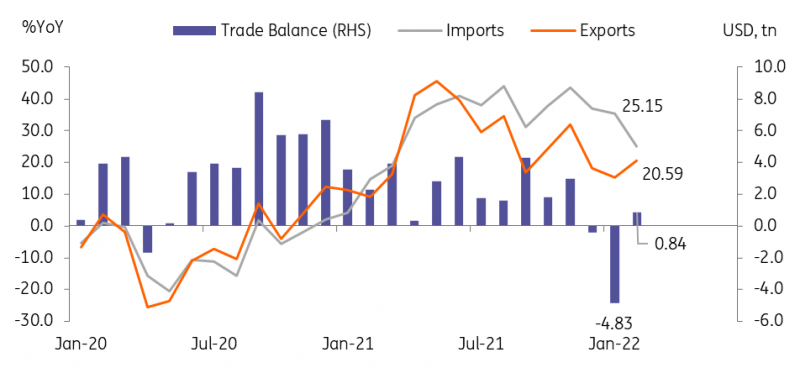

Export growth accelerated meaningfully to 20.6% year-on-year (vs. 15.2% in January) due to robust global demand amid mounting geopolitical risks.

Exports continued to grow supported by strong demand for almost all key export items

Among 15 major product exports, 14 increased, of which 11 registered double-digit growth in YoY terms. Petroleum exports (66.2%) surged on the back of high refining margins while petrochemical (24.7%) rose with higher oil prices and improved global demand. IT exports including semiconductors (24.0%), displays (39.2%), and computers (44.5%) recorded double-digit growth amid the continued expansion of global investment in the tech sector. Auto exports (9.1%), despite the ongoing chip shortage, improved mostly due to strong e-auto exports (95.5%). On a sequential term (% month-on-month, seasonally adjusted), exports accelerated to 2.4% m/m sa (vs. 1.7% in January), posting a gain for two straight months. By destination, exports to nine major destinations increased.

Imports registered high growth again of 25.1 % YoY (vs. 35.5% in January). The seasonally-adjusted sequential trend (% 3m/3m sa) of imports decelerated slightly to 4.2% 3m/3m sa (vs. 6.0% in January) though. The February trade balance posted a small surplus of US$ 0.8bn after registering deficits for the past two months (US$-4.8$bn in January, US$-0.4bn in December).

Korean trade remained resilient

Source: CEIC

Export sanctions on Russia should have limited impact on Korean exports in the short term

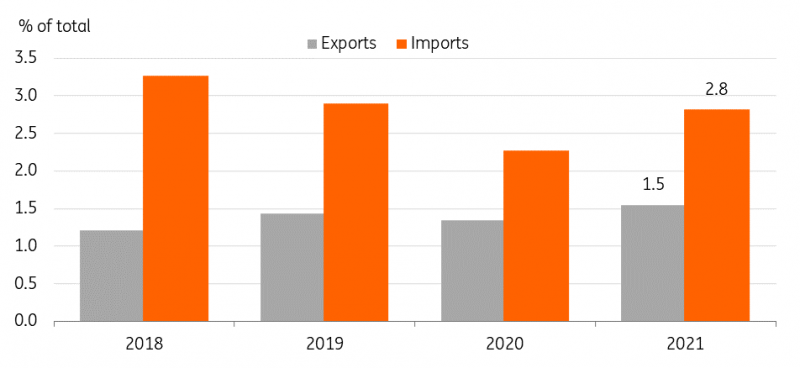

The government has banned the shipments of strategic goods to Russia and it is likely that some non-strategic goods will be included in the near future. Yet, Korean exports to Russia accounted for only 1.5% of the total in 2021, thus the direct impact of partial export sanctions should be minimal unless the ongoing dispute escalates significantly. However, concerns will rapidly grow if another wave of supply chain disruption in key commodities were to hit the market.

Korean exports to Russia

Source: CEIC

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more