Korea: Export Growth Slowed More Than Expected In September

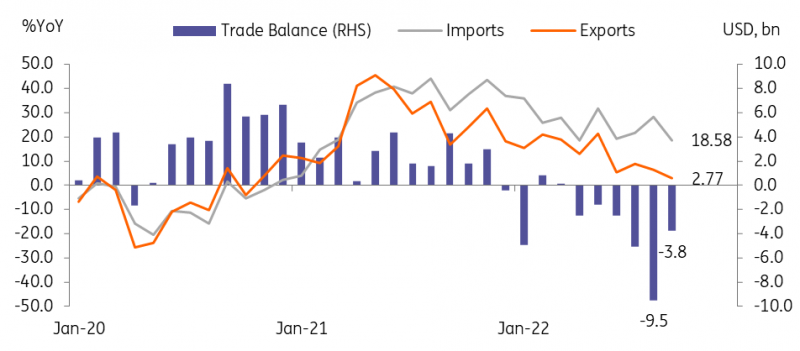

The trade balance in September recorded a six-month deficit while the trade deficit narrowed to -USD3.7 billion (vs -USD9.4 billion in August) as import growth decelerated at a faster pace than exports. We expect the trade deficit to continue to narrow until the year end and possibly turn into a surplus early next year.

Exports rose 2.8% YoY in September, the slowest pace in about two years

Weakening global demand appears to have put pressure on Korea's exports, which recorded a 2.8% year-on-year rise in September (vs 6.6% in August), missing the market consensus of 3.3%. By product, semiconductor exports dropped by -5.7% in September (vs -7.8% in August) and performances of other IT products such as wireless phone (-7.0%) and computers (-23.6%) were also weak. Steel products made a sudden drop of -21.1% mainly due to a typhoon-triggered shutdown, which will be normalized fully by the year end; thus the slowdown is expected to continue. Meanwhile, petroleum product exports were solid with a 52.7% gain, and automobiles (34.7%)/auto parts (8.7%) exports rose for three consecutive months. By country, exports to the US (16.0%), Japan (2.5%), and ASEAN (7.6%) were solid while exports to China (-6.5%), the EU (-0.7%), and Vietnam (-6.4%) dropped.

Meanwhile, imports rose 18.6% YoY in September (vs 28.2% in August), slowing down due to the drop in global commodity prices. We expect import growth to decelerate further during the winter time, mainly due to the high base last year.

Trade deficit narrowed in September

Source: CEIC

Exports Automobiles vs IT products

Source: CEIC, ING estimates

Trade outlook and the Bank of Korea policy reaction

Most of Korea's exports are intermediate goods processing trade. Therefore, if global external demand weakens, imports of raw materials and components will decrease. In addition, imports tend to weaken more quickly when domestic demand is weak, which is our base case scenario over the coming quarters, which could eventually lead to a trade surplus. We think that the current trade deficit trend will continue until early next year, but after that, as both external and internal demand weakens, the trade balance is expected to turn to a surplus again.

As the inflation is expected to stay above 5% for a few months, the Bank of Korea will likely continue to stay on the hiking path and frontload a 50bp hike at its October meeting. However, recent data releases from hard activity data to soft survey data suggest a sharp contraction of the economy in near term and real-estate markets already show a quite rapid price correction and liquidity concerns on mortgages and Jeonsei (yearly rent contract) deposits. Thus, we expect the BoK to put a break eventually early next year.

c

More By This Author:

Key Events In Developed Markets For The Week Of Oct. 3Key Events In EMEA For The Week Of Oct. 3

U.S.: The Worst Combination Of Sticky Inflation And Slower Growth

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more