Korea: Consumer Confidence Holds Despite Increasing Global Risks

Consumer sentiment in Korea has risen despite the war in Ukraine

Consumer sentiment index edged up to 103.2 in March (vs. 103.1 in February)

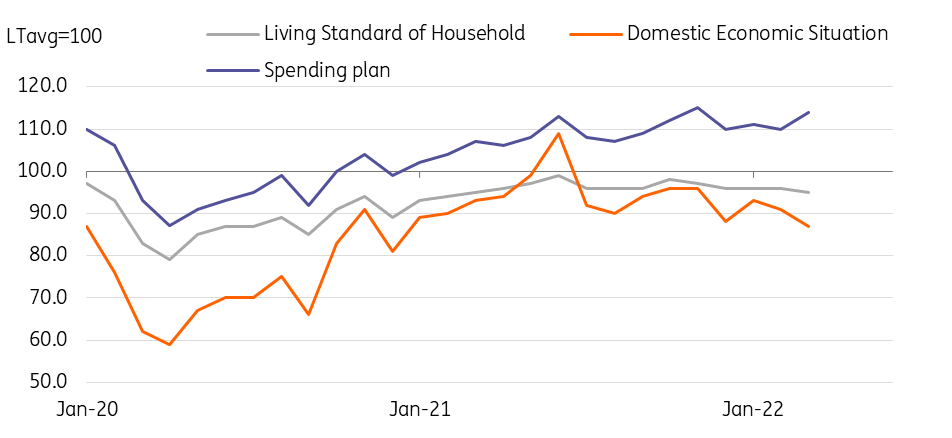

The Bank of Korea released the March CSI, which showed that consumer confidence held up relatively well despite increasing global risks. Given the survey was conducted during the third week of March, the early impact of the Russia/Ukraine war has been reflected. Looking at the details, consumers were concerned about the ongoing war and its aftermath as the current status (-4) and outlook (-4) for economic conditions deteriorated. However, consumers appeared to be more confident in their spending, presumably as social distancing eased and amid optimism about real estate market policy changes. Spending plans for the next six months on durable goods (+2), apparel (+2), eating out (+3), travel (+4), and transportation (+5) are all up. One interesting note is that housing price expectations rebounded strongly (+7), as the government is planning to soften some of the taxation rules and housing market regulations.

Consumers were concerned about the economic situation, but not hurting the future spending yet

Source: CEIC

Inflation expectations are on the rise

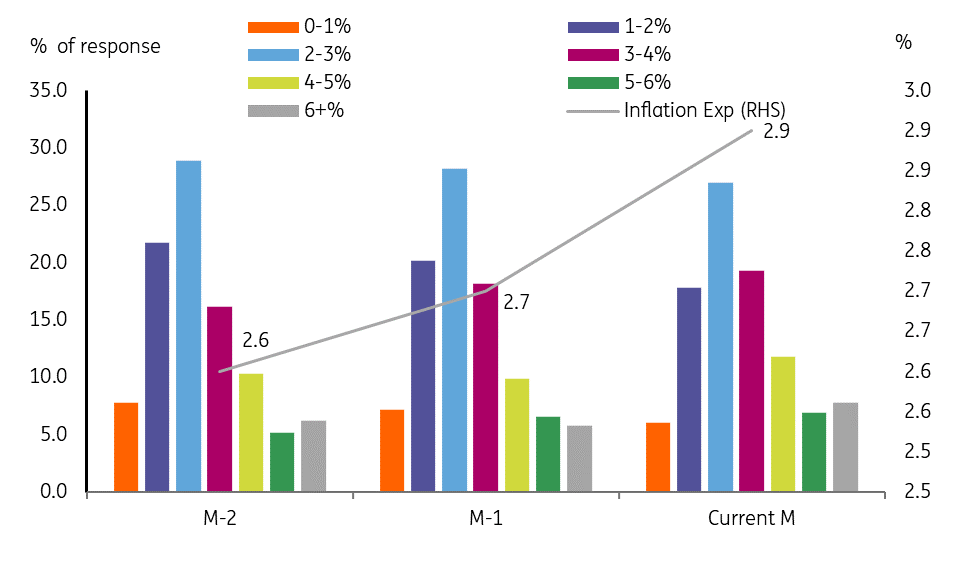

Meanwhile, inflation expectations for the next 12 months rose to 2.9% (vs. 2.7% in February), reaching the highest level since 2014. The government’s efforts to curb inflation are continuing, as KEPCO announced that it would freeze the adjusted unit fuel cost for 2Q22 despite the recent surge in commodity prices. Yet, the electricity bill will go up 6.9won per khw from April, reflecting last December’s price hike decision associated with climate change and other costs.

Inflation expectation is on the rise

Source: CEIC

Monetary and fiscal policies will add more pressures on KTBs

With inflation expectations hitting a recent high and clear signs of inflationary pressures, the BoK is expected to resume rate hikes in May. The new governor candidate, Rhee Chang-yong, will begin the confirmation process soon, but he is likely to miss the 14 April MPC meeting. But regardless of whether Rhee joins or not, the BoK is expected to stay on hold in April to monitor how the previous rate hikes have affected the economy and to assess how the ongoing war is progressing, while maintaining its hawkish stance.

On Monday, President Moon and President-elect Yoon Suk-yeol met and agreed on the need for an extra budget. Details have not yet been delivered, but both parties will likely push the bill before the 1 June local elections. The president-elect and the transition committee favour restructuring current expenses, but in reality, there is no alternative other than the issuance of KTBs, unless the size of the extra budget is substantially smaller than what the president-elect pledged (50 trillion KRW) during his campaign. In sum, macro policy conditions will put more pressure on the KTBs for a while.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more