Key Events This Week: All Eyes On The CPI

Photo by Maxim Hopman on Unsplash

After what DB's Jim Reid describes as "a week for the ages" this week should be calmer until of course US CPI comes along on Thursday.

As the Deutsche strategist notes, in his look back at a hell of a week, what made last week so fascinating was the rare interplay between macro and micro. Not only did the rates world shake and reverberate (2yr bunds +35.9bps and the worse week since 2008), but on successive days we saw the biggest market cap fall in history for any company (Meta), followed by the biggest rise ever (Amazon). We have 83 S&P 500 companies reporting this week but no Goliath sized ones, so it'll be a more normal week for earnings. The macro and micro last week was enough to push the Russian/Ukraine tensions into the background but they are clearly still there so we have to watch out for that as well.

Over the weekend ECB governor Knott (a hawk) became the first ECB official to confirm what we reported last week, when he endorsed a 2022 hike by suggesting that he expects a hike around Q4 and another in Spring 2023, and that they are most likely to be in 25bps increments. He also suggests bond purchases should end as soon as possible and that Euro Area inflation will remain above 4% all this year. There will be excitement about the comments in markets today - manifested itself in a continuation of surging yields - but pricing is already above 50bps before year-end so as the ECB catch up with the market, will the market now go another step further?

Looking ahead, we will soon move on to US CPI on Thursday. In terms of what to look out for, note that 8 of the last 10 CPI releases have seen the monthly headline figure come in above the consensus estimate on Bloomberg. DB's economists are projecting that monthly headline CPI growth will slow to +0.36% in January, with core inflation also slowing to +0.36%. However, this would still push YoY readings to 7.2% and 5.8% (consensus at 7.3% and 5.9%) respectively the highest since 1982 for both. There are plenty of wildcards in the release but watch rents/OER most as this makes up around 40% of core and around a third of the headline number. Since last summer it's been clear from our reporting that this was going to continue going up and up and given its weight it's very difficult for inflation to mean revert without it also doing so. It's showing no sign of this at the moment and likely won't for several months at least.

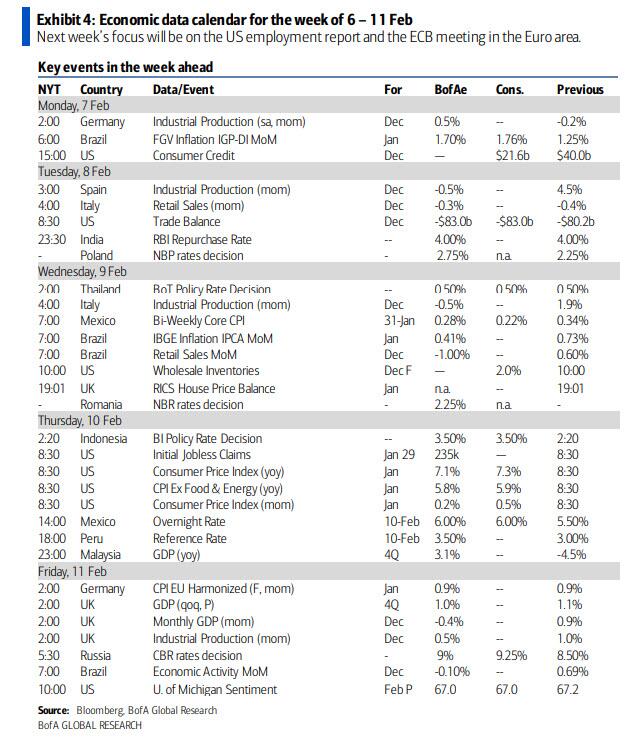

Otherwise it’s a fairly quiet week on the data front, though it’ll be worth looking out for the University of Michigan’s consumer sentiment index for February on Friday. January saw the measure fall to its lowest level in a decade, whilst longer-term inflation expectations have been picking up as well, so one to keep an eye on. Elsewhere, we’ve got the UK’s GDP release for Q4 coming out on Friday as well.

(Click on image to enlarge)

Earnings season is past the peak but will continue to be busy, with a further 83 companies in the S&P 500 and 89 in the Stoxx 600 reporting. Among the highlights to look out for will be Pfizer, BP and BNP Paribas tomorrow. Then on Wednesday, we’ll hear from Disney, L’Oréal, GlaxoSmithKline, Uber and Toyota. Finally on Thursday, there’s reports from The Coca-Cola Company, PepsiCo, AstraZeneca, Philip Morris International, Linde, Siemens, Unilever, Crédit Agricole, Société Générale, Twitter and Credit Suisse. See the day-by-day calendar for more on the week ahead.

Here is a day-by-day calendar of events, courtesy of Deutsche Bank:

Monday February 7

- Data: China January services and composite PMI, Japan preliminary December leading index, Germany December industrial production, US December consumer credit

Tuesday February 8

- Data: Italy December retail sales, US December trade balance

- Central Banks: ECB’s Villeroy speaks

- Earnings: Pfizer (PFE), BP (BP), BNP Paribas (BNP.PA)

Wednesday February 9

- Data: Japan preliminary January machine tool orders January PPI (23:50 UK time), Germany December trade balance, Italy December industrial production

- Central Banks: Reserve Bank of India monetary policy decision, Fed’s Mester and Bowman, Bank of Canada Governor Macklem and BoE’s Pill speak

- Earnings: Disney (DIS), L’Oréal (OR.PA), GlaxoSmithKline (GSK), Uber (UBER), Toyota (TM).

Thursday February 10

- Data: US January CPI, weekly initial jobless claims, monthly budget statement

- Central Banks: Monetary policy decisions from Bank Indonesia and the Bank of Mexico, BoE Governor Bailey and ECB’s Villeroy speak

- Earnings: The Coca-Cola Company (KO), PepsiCo (PEP), AstraZeneca (AZN), Philip Morris International (PM), Linde (LIN), Siemens (SIE.DE), Unilever (UL), Crédit Agricole (ACA.PA), Société Générale (GLE.PA), Twitter (TWTR), Credit Suisse (USOI)

- Other: European Commission publishes economic forecasts

Friday February 11

- Data: UK Q4 GDP, US preliminary February University of Michigan consumer sentiment index

- Central Banks: Central Bank of Russia monetary policy decision

Finally, looking at just the week ahead, Goldman notes that the key economic data release this week is the CPI report on Thursday. There are several speaking engagements from Fed officials this week, including discussions with Governor Bowman and Cleveland Fed President Mester.

Monday, February 7

- There are no major economic data releases scheduled.

Tuesday, February 8

- 06:00 AM NFIB small business optimism, January (consensus 97.5, last 98.9)

- 08:30 AM Trade balance, December (GS -$84.2bn, consensus -$83.0bn, last -$80.2bn): We estimate that the trade deficit increased by $4.0bn to $84.2bn in December, reflecting a larger increase in imports than in exports in the advanced goods report.

Wednesday, February 9

- 10:00 AM Wholesale inventories, December final (consensus +2.1%, last +2.1%)

- 10:30 AM Fed Governor Bowman (FOMC voter) speaks: Fed Governor Michelle Bowman will discuss the economy at an event with the Independent Community Bankers of America. A moderated Q&A is expected.

- 12:00 PM Cleveland Fed President Mester (FOMC voter) speaks: Cleveland Fed President Loretta Mester will discuss the economy and monetary policy in a virtual speech at an event with the European Economics and Financial Center. Audience and moderated Q&A are expected.

Thursday, February 10

- 08:30 AM CPI (mom), January (GS +0.50%, consensus +0.4%, last +0.5%); Core CPI (mom), January (GS +0.52%, consensus +0.5%, last +0.6%); CPI (yoy), January (GS +7.30%, consensus +7.3%, last +7.0%); Core CPI (yoy), January (GS +5.97%, consensus +5.9%, last +5.5%): We estimate a 0.52% increase in January core CPI (mom sa), which would boost the year-on-year rate by 0.5pp to 6.0%. Our forecast reflects a further rise in used car auction prices and related upward pressure on new car prices. We also expect a boost from start-of-year price hikes in physicians services, pharmaceuticals, and some consumer services categories. However, our forecast embeds an Omicron-driven drag on hotel and airfare prices. We estimate rent +0.39% and OER +0.40%, reflecting the strength in our shelter tracker in recent quarters. Health insurance prices also likely rose again, reflecting the gradual flow-through of the annual source data. We estimate a 0.50% increase in headline CPI, reflecting rising food prices.

- 08:30 AM Initial jobless claims, week ended February 5 (GS 230k, consensus 230k, last 238k); Continuing jobless claims, week ended January 29 (consensus 1,618k, last 1,628k): We estimate initial jobless claims declined to 230k in the week ended February 5.

- 07:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Thomas Barkin will discuss the economy in a virtual event hosted by the Stanford Institute for Economic Policy Research. In his last public appearance, on January 31, President Barkin said that the labor market was “about as tight as you can imagine.” He added that he would “like the Fed to get better positioned” and that “we’ve got a good part of the year to get there.”

Friday, February 11

- 10:00 AM University of Michigan consumer sentiment, February preliminary (GS 66.7, consensus 67.5, last 67.2): We expect the University of Michigan consumer sentiment index declined by 0.5pt to 67.2 in the preliminary February reading, reflecting weaker signals from other consumer confidence measures.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more