Key Events In EMEA For The Week Of Feb. 19

Image Source: Pixabay

In the coming week, Poland will see a number of data releases, with retail sales being the highlight. We expect a positive reading for January. Over in Hungary, we see further increases in both the unemployment rate and average wage growth. Meanwhile, the Central Bank of Turkey is likely to keep its policy rate at 45%.

Poland: Positive expectations regarding future retail sales

Retail sales (Jan): 2.6% YoY

Consumers remain under pressure and seem hesitant to spend, despite the ongoing improvement in real disposable income. The Christmas season was poor for retailers, but we still expect a gradual improvement in household consumption over the course of this year. We forecast a positive retail sales reading in January. Improving consumer sentiment also gives some grounds for positive expectations regarding future retail sales and household consumption.

Wages (Jan): 11.7% YoY

As we expected in December, wage growth moderated to a single-digit pace, but we believe this is only temporary. The shift in bonus payments in large state-owned enterprises from December to October last year translated into lower average wages at the end of 2023. In January, we expect a return to double-digit wage growth as the minimum wage went up to PLN4242 from PLN3600 (gross monthly). In the pipeline are wage hikes for teachers (30%) and civil servants (20%), so we may witness yet another year of robust wage growth close to or above 10%, especially because the unemployment rate remains close to an all-time low and is among the lowest in the EU.

Employment (Jan): -0.2% YoY

Employment in the corporate sector is expected to continue shrinking in annual terms. The January forecast is subject to exceptionally high uncertainty as the StatOffice updates the statistical sample of polled enterprises at the beginning of each year. The potential for employment growth in Poland is limited given the shrinking working-age population.

Unemployment (Jan): 5.4%

We expect a seasonal upswing in the unemployment rate in January. The preliminary estimate of the Ministry of Family, Labour and Social Policy is in line with our 5.4% January unemployment rate forecast. We do not expect any significant increase in unemployment this year, especially given the expected acceleration in economic growth.

Industrial output (Jan): 3.1% YoY

In line with our expectations, industrial output growth turned negative in December amid unfavourable calendar effects and soft external demand, but in January we expect a rebound to positive territory again as we had one more working day than in January last year. Still, the rebound in global manufacturing remains slow so far and Poland’s main trading partner (Germany) continues to underperform vs. European and global industrial developments.

Hungary: Further increase in the unemployment rate in January

Next week's focus is on the labour market statistics in Hungary. Due to seasonal factors and based on the latest statistics from the National Employment Service, we expect a further increase in the unemployment rate in January 2024. As far as wage growth is concerned, due to the minimum wage increase in December and its spillover effects, we see an accelerating rise in average wages, reaching the 15% year-on-year mark. The combined impact of rising unemployment and higher wages on the economy remains to be seen, but the fourth quarter GDP growth statistics suggest that the negative impact may prove to be stronger, pointing to a more gradual path of economic recovery.

Turkey: Policy rate at 45% in February MPC

Last month, the Central Bank of Turkey concluded that the monetary tightness required to establish disinflation has been achieved. The bank also reiterated that the monetary tightening required for sustained price stability would be maintained for as long as necessary. Accordingly, we expect the bank to keep the policy rate at 45% in February MPC, remaining on hold until the fourth quarter of the year.

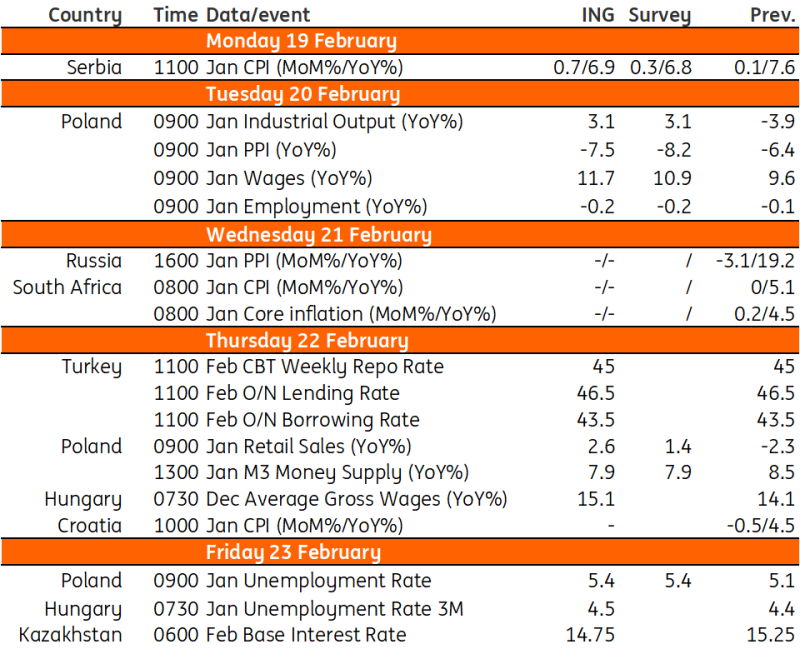

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

UK Retail Sales Surge After Shock December Plunge

FX Daily: Patience Is A Central Banker Privilege

Asia Morning Bites For Friday, February 16

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more