Asia Morning Bites For Friday, February 16

Image Source: Unsplash

Global Macro and Markets

- Global markets: US Treasury yields made further small declines yesterday, in response to some weaker-than-expected retail sales numbers and industrial production from the US. But the declines were very small. Yields on the 2Y Treasury went down less than a basis point and those on the 10Y bond only fell 2.5bp taking the yield down to 4.23%. EURUSD crept a little higher, rising to 1.0776, though again, a relatively small move from the previous day. The AUD has also managed to make gains, despite what was a fairly soft labour report yesterday. Cable also rose, even as the UK was confirmed in a technical recession, and USDJPY eased back below the 150 level. Asian FX didn’t do much yesterday, but the G-10 moves probably set it up for some early gains today. US equities rose, but in line with other markets, the gains were fairly modest. The S&P 500 rose 0.58%, while the NASDAQ rose just 0.3%.

- G-7 macro: As mentioned earlier, the US retail sales report for January was soft. The headline figure registered a decline of 0.8% MoM, and the December figure was revised down from +0.6% to +0.4%. The control group, which has a better correlation with consumer spending in the GDP release, fell 0.4% MoM. There was also some slight weakness in the industrial production report for January, which showed a decline of 0.1% and also a revision to 0% for the December reading (initially 0.1%). This weakness was more evident in the manufacturing data, which fell 0.5% MoM. See our US economist’s note for more on this. The other G-7 news was on UK 4Q23 GDP, which showed the UK drifting back into a technical recession. GDP in 4Q23 declined by 0.3% QoQ. Gross fixed capital formation was the only bright note in an otherwise downbeat set of figures. Along with limited room for tax cuts, this release won’t be welcome news for PM Sunak’s government ahead of what is expected to be an autumn election. Today, the UK also releases January retail sales figures. Today's US data is focussed on the construction sector, with housing starts and permits for January. January PPI and University of Michigan consumer confidence round off the day.

- Singapore: Non-oil domestic exports (NODX) for January were tipped to expand 4.3%YoY and up 0.5% from the previous month. Actual data blew past expectations, up sharply by 16.8%YoY driven by an outsized jump in non-electronic exports (21.2%YoY). By country, exports to China picked up strongly, which was unexpected given China's apparent eocnomic weakness. We'll have to see if this spike becomes a trend as it would bode well for growth prospects.

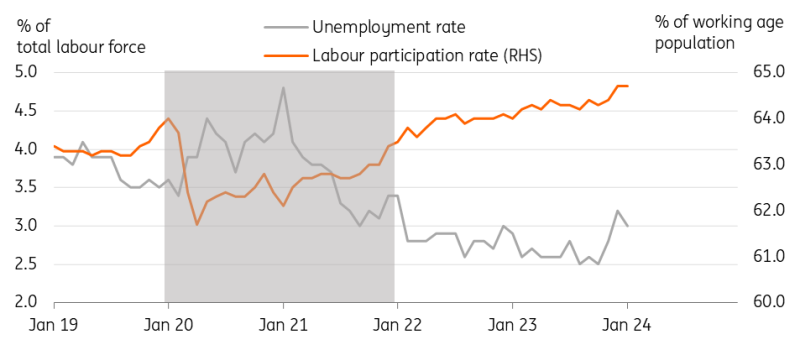

- South Korea: The jobless rate dropped more than expected to 3.0% in January (vs revised 3.2% in December, 3.2% market consensus) while the labour participation rate stayed at 64.7% for a second month. These figures are fully recovered from pre-pandemic levels. Labour market conditions have remained tight for several months which implies that demand-side pressures can contribute to inflationary pressure. By industry, manufacturing shed jobs (-36k) but construction (11k) and service jobs gained. Health & Social work gained the most (55k), and recreation-related jobs also rebounded (34k). However, business facilities and support jobs have now fallen for the past three months. Hotel and restaurant jobs also fell. In a separate report, import prices (KRW basis) increased 2.2% MoM nsa in January mainly due to the weak KRW combined with rising global oil prices. On a contract currency basis, import prices gained modestly by 0.8%. From a year ago, import prices rose 0.2% YoY in January (vs -4.0% in December). Today’s results show that inflationary pressures will likely stay for a while, and this will remain a concern for the BoK. Given that household lending growth reaccelerated in January, the BoK’s rate cut timing could be delayed to 3Q24. Currently, we expect the first rate cut in May.

Korea: Labour market conditions continue to tighten

Source: CEIC

What to look out for: Fed speakers and US housing data

- South Korea unemployment (16 February)

- Singapore NODX (16 February)

- Malaysia GDP (16 February)

- US housing starts and building permits (16 February)

- Fed’s Daly speaks (17 February)

More By This Author:

Rates Spark: Bund Yields Have Some Catching Up To DoUK Growth Outlook Improving Despite Fourth Quarter Setback

Weak Start To The Year For U.S. Retail Sales And Manufacturing

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!