Key Events In Developed Markets And EMEA For The Week Of July 24

Image Source: Pixabay

US inflation has moved lower, but as the jobs market remains tight and activity holds up, another 25bp hike still looks to be the most likely course of action for the Fed next week. In the EMEA region, all eyes will be on the Bank of Hungary's upcoming rate decision, where we're expecting the base rate to be kept at 13%.

US: The Fed starts slowing the pace of rate hikes as inflation moves lower

After ten consecutive interest rate hikes over the last 15 months, the Federal Reserve left the Fed Funds target rate unchanged at 5-5.25% in June. However, the central bank has characterized this as a slowing in the pace of rate hikes rather than an actual pause, with two further hikes signaled for the second half of 2023 in their individual forecast projections. Since then, inflation has moved lower, but the jobs market remains tight and activity has held up well. As such, commentary from officials has broadly indicated that they feel the need to hike again on July 26th, which would bring the Fed funds to range up to 5.25-5.5%. We suspect that the accompanying press conference will acknowledge encouraging signs of inflation, but also a desire not to take any chances that could allow it to re-accelerate. We expect the door to be kept open for further policy tightening later in the year.

In terms of data, the highlight will be the second quarter of GDP. The first quarter posted a firm 2% annualized growth rate, led by consumer spending. We suspect that the second quarter will be slower at around 1.5%, with inventories as the main contributor to growth. Meanwhile, durable goods orders should be lifted by very strong figures from Boeing, which received 304 aircraft orders in June, up from 69 in May. Outside of transportation, the data will be softer given that the ISM manufacturing new orders series has been in contraction territory for the last ten months. We will also get the June reading of the Fed’s favored inflation measure, the core personal consumer expenditure deflator. As with the CPI report, we expect it to slow quite markedly with broadening signs of disinflation in more categories.

Hungary: National Bank of Hungary expected to keep the base rate at 13%

The highlight over the next week in the EMEA region will be the upcoming rate decision by the National Bank of Hungary. With the central bank keeping the market and price stability issues separated, we don't see any reason for the Monetary Council to change its mindset regarding the base rate. While inflation's direction of travel has been favorable, it remains elevated and we, therefore, expect the NBH to keep the base rate at 13%, pushing the expected change into the not-too-distant future.

In contrast, the decision regarding the effective rate will be exciting. Should we see renewed weakening in the HUF, we can imagine the central bankers sitting on their hands and keeping the effective rate unchanged. However, with the forint strengthening since the June inflation data release, we're instead betting on the continuation of the 100bp rate cut cycle. As a result, we see the effective rate being lowered to 15%. Meanwhile, we're also expecting to see strong labor market data – much like the rest of the EU – as shortages keep wage growth elevated and deter companies from lay-offs despite the challenging economic environment.

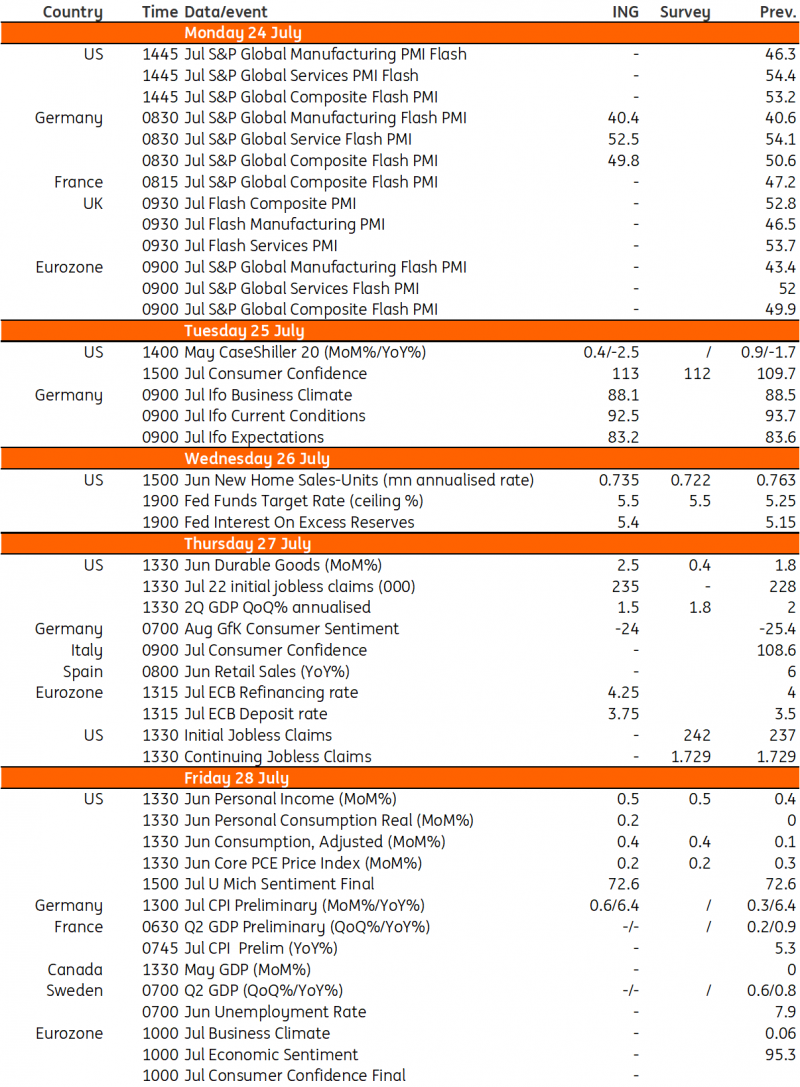

Key events in developed markets next week

Image Source: Refinitiv, ING

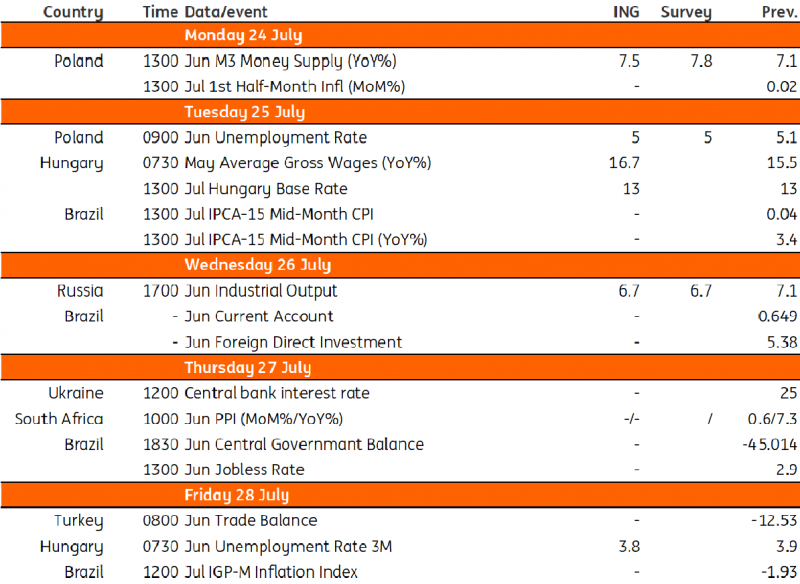

Key events in EMEA next week

Image Source: Refinitiv, ING

More By This Author:

FX Daily: Dollar Bears Being Asked For Patience

Continued Disinflation In Poland Supports Prompt Central Bank Easing

Gold Shines Again With An End To The Fed’s Tightening Cycle In Sight

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more