Gold Shines Again With An End To The Fed’s Tightening Cycle In Sight

Gold climbed to its highest level in two months, buoyed by weakness in the US dollar and lower Treasury yields while cooling inflation boosted optimism the US Federal Reserve’s tightening cycle is close to the end.

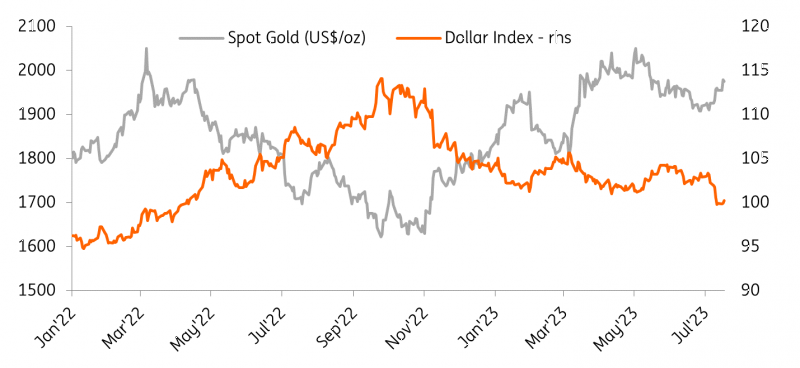

Gold climbs as the dollar dips

Image Source: Refinitiv Eikon, ING Research

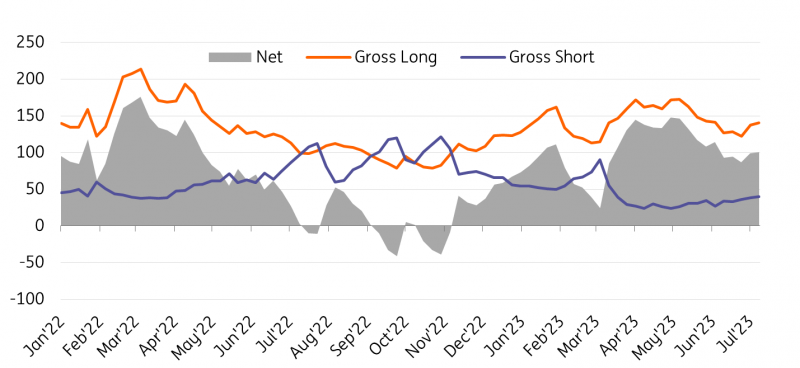

Speculators boost gold longs

Money managers increased their bullish gold bets by 1,414 net-long positions to 100,619 – a five-week high, reflecting healthy appetite for gold, according to weekly CFTC data.

Speculators had already increased their positioning towards the back end of last year and the start of this year – on the expectation that the Fed is not too far from the peak Fed funds rate.

Net long positioning strengthens

Image Source: CFTC, WGC, ING Research

June sees ETF outflows

However, global physically-backed gold exchange-traded funds (ETFs) experienced net outflows in June, calling a halt to their three-month inflow streak, with the majority of the outflows occurring when the gold price fell during the second half of the month amid hawkishness from central banks due to inflationary pressures. All regions except Asia experienced outflows during the month. June’s outflows caused global gold ETF demand during the first half of 2023 to turn negative at 50 tonnes, equivalent to fund outflows of $2.7bn, according to data from the World Gold Council (WGC).

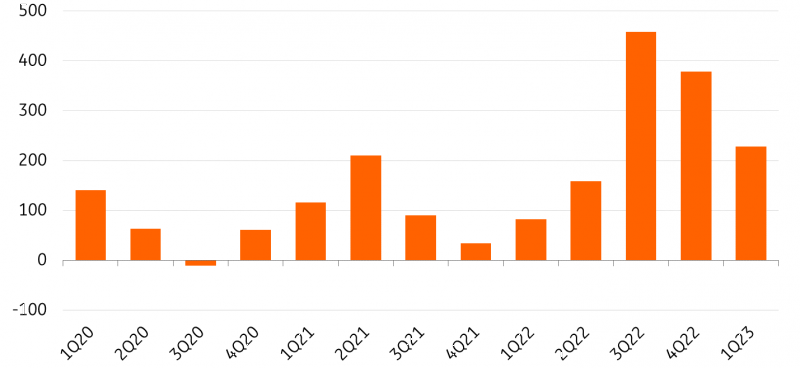

China continues to boost gold reserves

Meanwhile, the Chinese appetite for physical gold should remain a supportive factor for gold this year. The People’s Bank of China (PBoC) announced buying 16 tonnes in May, its seventh consecutive month of purchases. Its gold reserves now stand at 2,092 tonnes.

China’s gold imports also rebounded in May. China’s gold imports totaled 148 tonnes in May, a 24-tonne month-on-month rise, according to data from the WGC. This amounts to a 121 tonnes surge compared with May 2022, at which time key cities were under Covid-19 lockdowns.

Other central banks also continued to boost their reserves. The National Bank of Poland added 19 tonnes during the month, lifting its gold reserves to 263 tonnes. The central banks of Singapore (4 tonnes), Russia (3 tonnes), India (2 tonnes), the Czech Republic (2 tonnes), and the Kyrgyz Republic (2 tonnes) were the other notable buyers in May.

Gold tends to become more attractive in times of instability and demand has surged over the past year. Last year, global central banks purchased a record 1,078 tonnes of gold, mostly driven by a flight towards safer assets amid soaring inflation. We expect central banks to remain buyers, not only due to geopolitical tensions but also due to the economic climate.

Central bank buying remains at a high level

Image Source: WGC, ING Research

Interest rate cuts to boost gold prices

Gold prices recovered in the past week from three-month lows following the release of the US consumer price index for June, which could ease the pressure on the Fed to keep raising rates to slow rising prices.

Rising interest rates have been a significant headwind for gold for over two years now. As a non-yielding asset, gold normally benefits from a more dovish US monetary policy.

Last week’s CPI report showed consumer prices growing by just 0.2% in June, the slowest monthly pace since August 2021.

The US data this week showed retail sales rose by 0.2% in June from the prior month, below May’s rise of 0.3% and consensus expectations for a 0.5% rise.

Our US economist believes that with the activity backdrop for the US looking more mixed and the inflation story looking more favorable, the data seemingly supports the narrative of the Fed hiking rates again in July, but pausing again in September, perhaps for several months.

We believe that for gold, the Fed policy is still key for gold over the medium term. We believe the downside remains limited for gold as the Fed is close to the end of its monetary tightening cycle, with the expected hike at the Fed's meeting next week already priced in for bullion.

We see prices moving higher over the second half of next year, given that the Fed should start to pause its rate hiking cycle, while geopolitical instability will also provide headwinds for gold prices looking forward.

We forecast prices to average $1,900/oz in the third quarter and $1,950/oz in the fourth quarter. We expect prices to move higher again in the first quarter of 2024 to average $2,000/oz with the assumption around this that the Fed starts cutting rates in the first quarter of next year.

More By This Author:

FX Daily: Tiptoeing Back Into The Dollar

Hydrogen Sparks Change For The Future Of Green Steel Production

The Commodities Feed: Middle Distillates Firm Up

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more