Hydrogen Sparks Change For The Future Of Green Steel Production

Steel might exist as a crucial product in modern societies, but it's also a major source of CO2 emissions. So what kind of a role could green steel play in the path towards net zero? While it's currently twice as expensive as less climate-friendly alternatives, it brings a multitude of benefits – and only a small price increase for steel-heavy products.

Steel’s sustainability dilemmas

Here’s the dilemma: steel is a key material in modern societies. It provides us with houses, bridges, modes of transport and essential equipment and products. It isn't simply a relic of the old industrial revolution – steel is also crucial in a low-carbon economy. Green modes of transportation like electric vehicles, electric buses and trains require vast amounts of steel, as do wind turbines and electrolyzers. So it is a pity that steel production is also a major source of global greenhouse gas emissions.

Greener alternatives still have to prove themselves and are often viewed as prohibitively expensive in a highly competitive market. Thoroughly transforming production processes takes years, so change is often desperately slow.

Steel is an integral part of our modern society

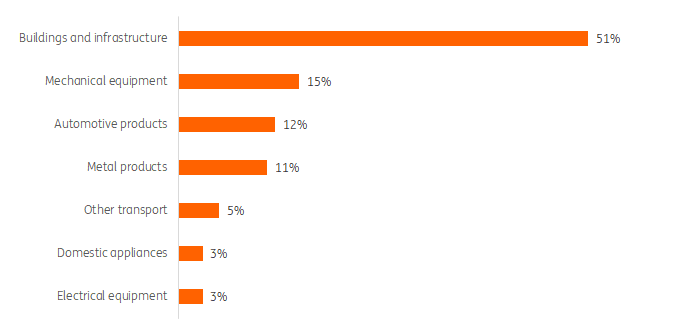

Global use of steel in 2022

Worldsteel and BNEF

Steelmaking is a very energy intensive process and the current technology is mostly based on coal. Today, it accounts for 2.7 billion tons of CO2 every year, which represents 7% of yearly emissions globally. The shares are roughly doubled to 15%, 14% and 12% for China, South Korea and Japan respectively.

With the consensus view of a rising global population and increased prosperity, steel demand is expected to grow by 35% by 2050, according to Bloomberg New Energy Finance. While the sector is improving in terms of energy efficiency, emissions are likely to increase if steel continues to be produced predominantly with coal.

That's not exactly in line with the goal of creating a net zero economy. So, we’re going to look at the business case of possible technology fixes to reduce carbon emissions in the steel sector. We’ll assess where we are right now and the various pressures that companies are currently under to meet net zero targets. We'll also examine which alternative fuels could prove frontrunners in technology as science improves and adapts.

There are three main strategies for reducing emissions:

1. Tempering the demand for steel

A difficult task, given the consensus view of rising demand towards 2050 and alternatives for steel like aluminum and concrete which are also very carbon intensive. Substituting steel for another product that emits a lot of carbon isn't exactly a big step forward in helping the climate.

2. Improving the energy efficiency of existing steel plants

This is especially helpful for old coal-based steel plants where emissions can be reduced by up to 30% using higher grade ores, or more efficient technologies to inject coal into the furnace. Material efficiency can also be improved by using more recycled steel – but with 85% of used steel being recycled globally, recycling rates are already high. Most steel products also remain in use for decades before they can be recycled. As a result, there's not enough recycled steel to meet growing demand and the world continues to need large volumes of ‘primary steel’.

3. Applying technology fixes to the process of steelmaking

For example, by electrifying parts of the process with electric arc furnaces that run on clean electricity, or by capturing and storing the carbon emissions from conventional coal-based steel production. This technology is called carbon capture and storage (CCS) and leaves the current coal-based process intact, while it can reduce emissions by 75-90%. The replacement of coal with a synthetic fuel like hydrogen is another technology fix, which can greatly reduce carbon emissions. If the hydrogen is produced in a clean way (that is with blue hydrogen or green hydrogen from low carbon power sources such as solar panels, wind turbines, hydro power or nuclear power). While technology fixes are an important enabler of the transition to a net zero economy they run the risk of rebound effects and the Jevons paradox: demand for steel might go up once its climate impact is reduced.

Given the limitations of demand reduction and improved energy efficiency – and despite the Jevons paradox – we believe that CCS and hydrogen are likely to play a crucial role in the transition pathway of the steel sector to a net-zero economy.

Hydrogen coupled with electrification is the ultimate form of green steelmaking in a net zero economy. CCS is a key way to drastically lower carbon emissions from the many existing coal-based steel mills across the globe, especially the younger ones that are likely to stay in business for many years to come.

Note that we haven’t explored gas-based steelmaking for two reasons. Firstly, gas is generally seen as a transition fuel only, not as a major energy source in a net zero economy. That role is generally attributed to synthetic fuels like hydrogen. Secondly, we had to limit the modelling options for practical reasons as they are fairly complex. It then makes sense to focus on coal-based routes, which account for about 70% of global steel production, as well as taking a look into the ultimate form of green steel production.

However, we do believe that gas-based steelmaking will act as an intermediate technology and could be a stepping stone towards hydrogen-based steelmaking. In fact, the latest gas-based steel mills are often dual fuel plants which can switch from gas to hydrogen easily once green hydrogen is abundantly available in the future. Experts believe that this could be the case from 2035 onwards.

Could CCS and hydrogen provide a magic fix?

Steel is made from iron, one of the most familiar metals. It has been in use since ancient times and historians have even named a 650-year period to the use of iron (the Iron Age, dating back to 1.200-550 BC). The industrial revolution made it possible to turn iron into high quality steel and that triggered the many steel applications of our modern societies.

Steelmaking consists of two steps, beginning with the reduction of iron oxide (mined from the earth) into pure iron, which then is turned into steel. There are hundreds of different forms of steel, but all are made from iron.

The process of turning iron ore into iron and subsequently steel requires very high temperatures and an energy source is therefore needed to generate the heat. In the conventional process, coal is both used as a feedstock to reduce iron ore to iron and as an energy source to generate heat.

The first step of turning iron ore into iron is by far the most energy and carbon-intensive stage and accounts for roughly 80% of the carbon emissions in the case of coal-based steelmaking.

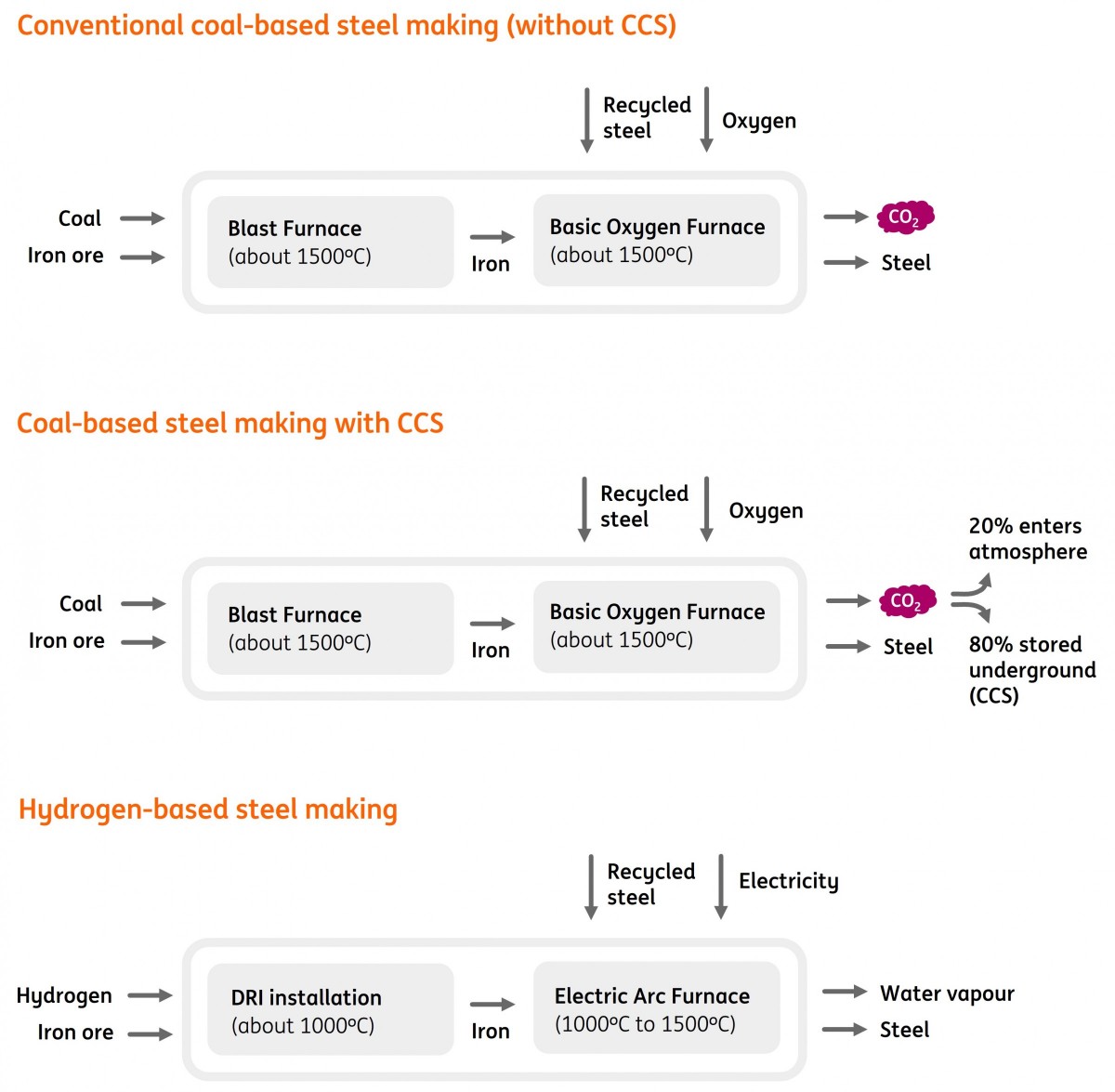

Coal-based versus hydrogen-based steel making

The three steel production technologies at the center of this article

ING Research

The benefits of carbon capture and storage

Carbon emissions can be captured and stored underground (CCS) or used in other parts of the economy (carbon capture utilization and storage, or CCUS). With the use of this kind of technology, 75% to 90% of emissions do not enter the atmosphere and therefore do not contribute to global warming.

Carbon capture and storage is a relatively cost-effective technology in the fight against global warming. End of pipe CO2 concentrations are often very high, which makes it reasonably easy and cheap to capture them. CCS costs in steel production range from €60-€100 per ton of carbon. This is much cheaper than technology such as electric vehicles, home renovations and hydrogen-based solutions, which costs hundreds of euro per ton of carbon that is reduced.

Even so, CCS has not been applied a lot in steelmaking yet as it is not mandatory, and carbon is often not priced sufficiently across the globe. The European carbon price of around €85 per ton CO2 starts to bite – but steel producers still enjoy a number of free allowances, and prices have seen a recent increase, while investments in CCS take years to materialize.

The transformative hydrogen route

Hydrogen provides the possibility to completely redesign the process of steelmaking. The magic of hydrogen is that it can make the entire process almost carbon-free!

By reacting hydrogen directly with iron ore, iron and water are produced in place of iron and CO2. This process is called Direct Reduced Iron (DRI) and is already being used with natural gas instead of hydrogen. An additional benefit of DRI steelmaking is that the main reaction runs at a lower temperature and therefore requires less energy.

The reduction of iron ore takes place in a shaft furnace at a relatively low temperature of about 1,000°C. The reduced iron is then further processed into liquid hot metal in an electric furnace. As in other sectors, electrification is an important strategy for greening the steel sector, through both the production of green hydrogen with electricity and the electrification of furnaces.

DRI technology offers many advantages and can significantly reduce CO2 emissions. Scrap or recycled steel can also be used in the process, which enhances circularity. Production with DRI technology also offers increased flexibility, as the process is easier to start and stop. DRI technology can produce high-quality steel, so it also offers a green pathway to steel plants that focus on the higher end of the steel market. Energy plants can also run on hydrogen instead of coal. While CO2 is formed when coal is burnt, hydrogen turns into water when it reacts with oxygen. Finally, since iron ore can be reduced at lower temperatures (about 1,000°C instead of 1,500°C), the process still requires lots of energy, but less than it would otherwise.

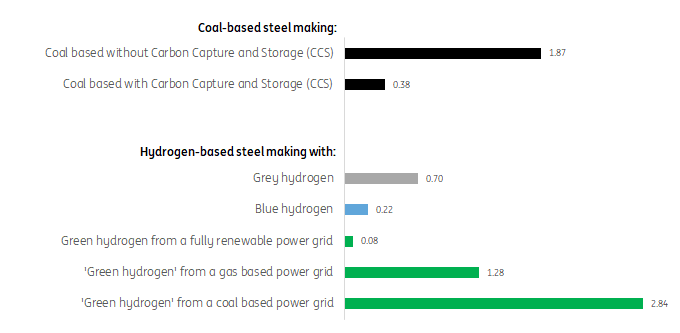

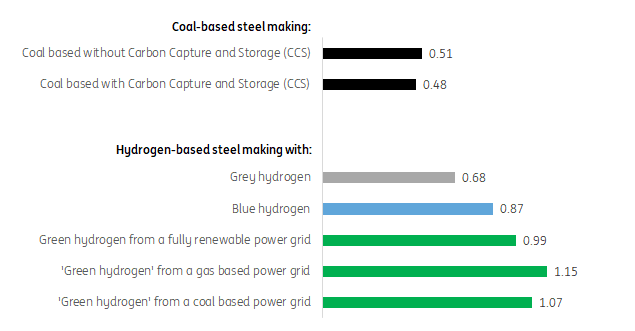

The graphic below shows the carbon emissions of a kilogram of steel for different steelmaking technologies.

CO2 emissions of steel production varies widely across different production technologies

Indicative emissions for different steel production technologies in kilogram CO2 per kilogram steel

ING Research

Indicative emissions to produce a kilogram of steel. We look at scope-1 and scope-2 emissions only, so not the scope-3 emissions from the use of steel by other companies or consumers. The CCS capture rate is assumed to be 80% for coal-based steel making and 85% to produce blue hydrogen. We have taken grid emissions from Sweden to resemble a fully renewables-based power grid (10 kgCO2/MWh), the Netherlands to resemble a gas-based power grid (325 kgCO2/MWh) and Poland to resemble a coal-based power grid (735 kgCO2/MWh). We show emissions per kilogram of steel so that numbers are comparable across production techniques and fuel types. Note that we have not explored gas-based steelmaking as gas is generally seen as a transition fuel only, not as a major energy source in a net zero economy. That role is attributed to fully green hydrogen (hydrogen from solar, wind, hydro or nuclear power).

Without delving into all the technicalities and complexities of both routes, there are two key points worth noting.

Firstly, CCS provides a way to radically lower carbon emissions from the conventional coal-based way of steelmaking. Our indicative calculations point to an 80% emission reduction – an impressive result, given the carbon content of one kilogram of steel is reduced from about 1.87 kilograms of CO2 to 0.38 kilograms.

Secondly, hydrogen provides a way to radically change the production process in such a way that it hardly emits any CO2 at all. The carbon content of steel is reduced to nearly zero if ‘fully green’ hydrogen is used – by which we mean hydrogen produced with an electrolyzer which is fully powered by zero carbon technologies such as solar panels, wind turbines, hydropower plants, nuclear power plants (or a combination of these).

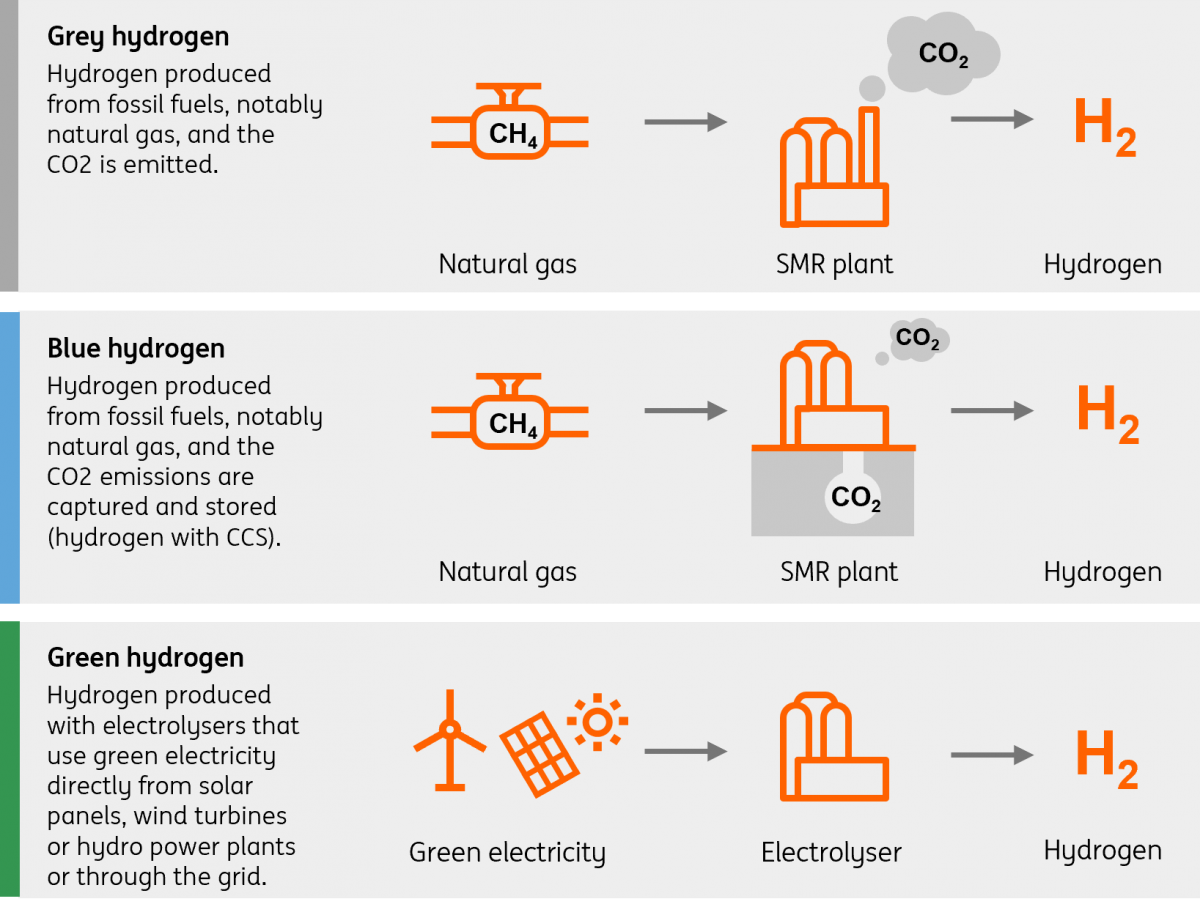

The definition of green hydrogen implies that the power on which the electrolyzer runs comes from renewable sources only (solar and wind energy). In practice, however, this is not yet the case as solar and wind power is not always available and power grids in many countries are still predominantly fossil-based. The 'green' in green hydrogen currently means that the hydrogen is made with renewable electricity and an electrolyzer, compared to grey and blue hydrogen which are made from natural gas in a steam methane reformer for the most part.

If the electrolyzer is powered by a grid that predominantly runs on gas-fired power plants, the carbon content of the steel is reduced by 30%, from 1.87 kilograms CO2 per kilogram of steel to 1.28 kilograms. This is a notable improvement – but still worse by far than the conventional coal-based production method using CCS which results in an 80% reduction. electrolyzers that are connected to the power grid will decarbonise in line with the decarbonisation of the entire power system.

Finally, the carbon content of steel increases by more than 50% if the electrolyzer is powered by a grid that predominantly runs on coal-fired power plants. So, one has to be careful with hydrogen from electrolyzers. electrolyzers and green hydrogen are not green by definition! The power source plays a crucial role, and doing the climate a disservice with traditional fossil-based power sources is a very real possibility at such an early stage in the energy transition.

Hydrogen does not have to be made with electrolyzers though. In fact, over 95% of current hydrogen use in the world is produced with natural gas, mostly without CCS (grey hydrogen). In the pursuit of reducing carbon emissions of grey hydrogen, blue hydrogen is needed, which shifts the CCS process from the steel sector to the hydrogen sector. The carbon content from steel made with blue hydrogen is quite similar to conventional coal-based steel with CCS (0.38 kilogram CO2 per kilogram steel versus 0.22). Blue hydrogen pollutes the environment slightly less than coal-based steel with CCS, as the gas needed to produce it emits less carbon than coal.

Last but certainly not least, steel from grey hydrogen has a much lower carbon footprint compared to conventional coal-based steelmaking. So, steelmakers don’t have to wait until their power systems fully run on solar panels, wind turbines or nuclear power plants. The hydrogen source in the early stage of the sector’s hydrogen transition also shouldn't be too much of a concern, as long as electrolyzers are not powered by electricity from coal plants.

Hydrogen use in steelmaking must be blue or green to substantially reduce carbon emissions

Different methods of hydrogen production

ING Research

SMR stands for Steam Methane Reforming; the chemical process of creating hydrogen by reacting steam (water) with natural gas.

The benefits of hydrogen-based steel go beyond carbon emissions

Our calculations focus on the carbon impact of steel production, as CO2 is the root cause of global warming. However, hydrogen-based steel production comes with important additional benefits. Substances of Very High Concern (SVHCs), which may include lead or polycyclic aromatic hydrocarbons (PACs), nitrogen oxides (NOX), sulfur dioxide (SO2), particulate matter (PM10), and odor are also reduced and there might be less noise involved. This leads to an improved living environment and greatly reduces the negative impact on both the environment and local communities.

So, it's clear that both CCS and hydrogen can both play a role in greening the hard-to-abate steel sector and stimulate progress on the pathway to net zero emissions. Hydrogen even comes with benefits that go beyond the reduction of carbon emissions. The necessary condition is that the required hydrogen is produced with few carbon emissions, with blue or ‘truly green’ hydrogen. One obvious question then remains: why hasn’t it already happened?

The answer is pretty simple: the technology of hydrogen-based steelmaking is still in its infancy. Swedish steel maker SSAB was the first company to produce hydrogen-based steel in 2018. Today, there are only a handful of small pilot projects available worldwide.

The production of hydrogen is very energy intensive, even with mature technology, and hydrogen-based steel is about twice as expensive as coal-based steel as a result.

Steel from ‘green’ hydrogen cannot compete with coal-based steel

Indicative unsubsidized and pre-tax cost of steel in €/kg for different steel production technologies

ING Research

Costs are calculated from a European perspective and based on the following assumptions. Hydrogen costs are calculated based on a gas price of €45/MWh, a power price of €110/MWh for the gas-based grid (benchmark), €99/MWh for the coal-based grid (-10%) and €88/MWh for the renewables-based grid (-20%). Power price differences are based on actual power prices for the countries mentioned from 2015-2023. electrolyzer efficiency is set at 70% with a 95% capacity factor. This yields green hydrogen prices of roughly €6.00/kg, €5.50/kg and €5.00/kg respectively. We’ve used a CO2 price of €85/ton and assume that all CO2 is taxed (no free allowances). Gas and carbon prices result in grey hydrogen costs of €2.40/kg and blue hydrogen costs of €2.55/kg. The coal and oil price are set at $100/ton and $75/barrel with an exchange rate of 1$=0.93€ and iron ore pellets cost €110/ton. Note that this represents spot and future prices (for 2023) in the Northwest European energy market as of early June 2023. We have applied a CCS capture rate of 85% for blue hydrogen and 80% for coal-based steel production in blast furnaces. The discount rate is set at 8%, inflation on operational expenses (OPEX) at 3%. Note that we have not explored gas-based steelmaking as gas is generally seen as a transition fuel only, not as a major energy source in a net zero economy. That role is attributed to fully green hydrogen (hydrogen from solar, wind, hydro or nuclear power).

Steel is a very cheap product. With coal-based technology, it only costs about 50 euro cents per kilogram – cheaper than a kilogram of potatoes or a litre of milk.

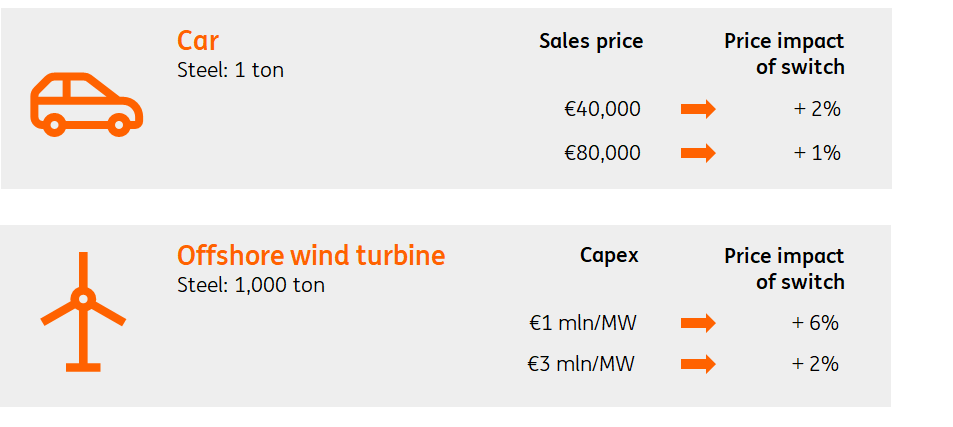

Another surprising fact about steel is its marginal role in the price of the end product. Take, for example, a car and an offshore windmill. Both contain a vast amount of steel – about one ton of steel per car and 1,000 tons for a windmill. Switching from conventional steel to green steel doubles the cost, but it makes hardly any difference in the final pricing of steel-heavy products. It raises the price of a car by just 1% to 2%, depending on the sale price. The capital needed for the investment in the windmill increases by 2% to 6% depending on the location of the wind farm (shallow or deeper waters).

Switching to green steel has little impact on product prices

Indicative price impact of a switch from conventional coal-based steel to hydrogen-based steel which is assumed to be twice as expensive

ING Research

For a typical car, the price increase from green steel translates into a couple of hundred euro only. That doesn't seem such a big deal, given the thousands that consumers spend by ticking the options list in the showroom. If ‘green steel’ was an option, it would cost far less than the option of additional features like alloy wheels. An increasing amount of consumers indicate their willingness to pay more for green products. The cost increase for a car and offshore windmill falls well within estimates for the green premium.

In this view, the steel sector is very different than transportation sectors. Steel often represents a minor share of the total cost of the end product. Flight tickets in aviation or shipping rates in marine shipping are much more sensitive to fuel costs. Take aviation as an example. Substituting traditional jet fuel by a hydrogen-based synthetic fuel would raise the cost of a two-way ticket from Amsterdam to London by about +150%, to New York by +400% and to Sydney by +450%.

Taking this into account, it isn't too surprising to see companies like Volkswagen partnering up with large steelmakers like Salzgitter AG to source green steel. Volkswagen plans to use the low-CO2 steel from the end of 2025 in important future projects such as the Trinity1 e-model, which will be produced in Wolfsburg from 2026 onwards.

Steel majors invest in green steel, but change might be driven by contenders

This transformation of the steel industry is not simply a theoretical exercise and the largest steel makers in the world are now setting themselves on a pathway of reaching net zero emissions. According to Bloomberg New Energy Finance (BNEF), over 615 million tons of steel or 18% of global production is under a net zero target and most aim to be carbon neutral by 2050.

Company analyses by BNEF show consensus in the near term. Almost all steelmakers agree that the focus should be on increasing recycling rates and improving the energy efficiency of the conventional coal-based process while piloting deep decarbonization technology like CCS and hydrogen.

There is less consensus looking further ahead, with long-term technology choices differing between companies. Diversified majors like Baowu (China) and ArcelorMittal (Luxembourg), the two largest steel companies in the world, are testing both the CCS and hydrogen routes.

ThyssenKrupp (Germany), Posco (South Korea) and TataSteel IJmuiden (the Netherlands) plan to fully convert their fleets to hydrogen-based production. They are developing new equipment to accommodate lower-grade iron ore in hydrogen-based steelmaking. SSAB (Sweden) is at the forefront of hydrogen-based steelmaking but plans to primarily rely on purer forms of iron such as recycled steel.

Nippon Steel and JFE (both from Japan) aim to reduce emissions by applying CCS to existing coal-based blast furnaces but have recently started to investigate hydrogen too. While US Steel is somewhat lagging behind its peers, it will likely roll out pilots for both CCS and hydrogen on the back of increased policy support in the US for both hydrogen and CCS.

But the real change might not come from the steel majors who have billions of dollars worth of coal-based steel assets on their balance sheets. On a positive note, that provides them the capital to develop CCS and hydrogen. On a more negative note, it could limit real change as current assets may become stranded once hydrogen technology takes over.

Disruptive change might be driven by Tesla-style new entrants. Vulcan Green Steel from Oman is a new company in the industry that is planning to build a hydrogen-based steel plant from scratch. Blastr is doing similar things in Norway and Finland. GravitHy in France focuses on the production of green iron. Van Merksteijn is planning to build a green steel facility to produce a specialized steel product (wire rod) at the Eemshaven in the Netherlands. The H2 Green Steel mill in northern Sweden is currently the most advanced green steel project in Europe.

Finally, Ukraine could be a country driving the change in the sector. As the ongoing war persists, the financial focus of politicians and financiers is on short-term funding issues. But slowly, they're beginning to look at long-term reconstruction efforts too. The World Bank estimates Ukraine's reconstruction will cost more than $400 billion. Ukraine is seeking up to $40 billion to fund the first part of a Green Marshall Plan to rebuild its economy. The main priority will be on the iron and steel industry, with a vision to build a green steel industry of 50 million tonnes.

Green steel transition could trigger changes in the supply chain

As companies begin to drive change, they are likely to change the business models in the steel industry too. Currently, most steel plants take care of the entire steelmaking process. Iron ore is turned into iron and steel at almost every production site.

The first step of turning iron ore into iron is by far the most energy and carbon-intensive step, accounting for around 80% of emissions in coal-based steelmaking. In future, this process may be relocated from regions with high energy and hydrogen costs towards those with lower costs. Australia, the Middle East and the US, for example, are likely to have a competitive advantage in the production of hydrogen. Production of iron may be concentrated in these regions and then shipped to higher-cost regions such as Europe as Hot Briquetted Iron (HBI). Alternatively, it may be relocated within Europe to regions with low electricity prices from green sources such as the northern parts of Norway and Sweden, which have ample space available and a large supply of hydropower that can act as a baseload for green steel production. In that respect, it isn't surprising that the most advanced plans for a green steel mill are in the city of Boden in Sweden.

HBI is a compact form of Direct Reduced Iron (directly turning iron ore into iron with hydrogen instead of coal). The briquettes are made to be shipped over long distances and in such a way that they can be melted and turned into steel easily. This second step can be done in electric arc furnaces, which electrifies and greens the process of steelmaking further – provided that the furnace is powered with low-carbon power sources such as solar panels, wind turbines, hydropower plants or nuclear power plants.

While steelmaking is for the most part an integrated business, the supply chain might evolve towards more global production hubs of pure forms of iron and local sites that specialize in the last step of turning iron into different qualities of steel.

Slow progress but more opportunities ahead

The steel sector is widely regarded as a conservative sector that is characterized by large incumbents that rely on coal-based technology. Entry barriers are high and hence change has been slow.

Technology now provides important opportunities for greening the industry, either by applying CCS to the current coal-based technology or by redesigning the process of turning iron ore into iron with hydrogen instead of coal. That may sound radical, but is in fact a form of evolution rather than revolution. The technology of direct reduced iron is already applied in gas-based steelmaking. Green and blue hydrogen can take over once they are abundantly available. Electrification could further green both routes by replacing basic oxygen furnaces with electric ones.

In principle, having two available routes often triggers an intense debate about which will be the dominant one. We don't believe it's quite so black and white and see both routes being crucial for meeting the goal of a net zero steel industry. Developed countries might prefer to invest in the hydrogen route more quickly, while developing and coal-heavy countries like India and China may choose to rely more heavily on CCS technology. The climate benefits from both and the discussion should focus on the speed of change rather than a battle between technology. Finally, such debates shouldn't distract us from tempering the demand for steel, as the climate benefits most from steel that isn't produced.

Basic economics makes it clear that green steel is more expensive – although luckily, this markup seems to have a relatively small impact on the consumer price of many products that are made from steel.

Unfortunately, this price gap is not easy to close. Our calculations suggest that all else being equal, hydrogen-based steel matches the price of coal-based steel if:

- The carbon price quadruples from €85 per ton CO2 to about €340 per ton, which is unlikely to happen anytime soon and is above many forecasts for the EU-ETS carbon price of around €150 per ton by 2030

- The coal price increases tenfold from $100 per ton to about $1000, which is unlikely to happen given the vast coal reserves in the world

- The price of green hydrogen is reduced from about €6 per kg today to about €1.5 per kg, which in real terms, could be achieved somewhere between 2035 and 2040 according to Bloomberg New Energy Finance. Low-cost regions like China, Brazil, Africa, the Middle East and Australia are likely to see this sooner (around 2035) than high-cost regions like Europe (around 2040)

- A combination of these factors

With the aim of increasing the price of carbon or coal, policymakers can initiate pricing mechanisms that capture the environmental impact of coal-based steel and make green steel more competitive.

A reduction in the cost of green hydrogen could be a key reason for policymakers to aim for Research and Development (R&D) policies that lower the cost of (domestically) produced electrolyzers. It may also encourage policies which aim to lower the cost to run them, for example by increasing the share of renewables in the power grid which is likely to result in lower power prices.

Finally, steel producers may be forced to produce green steel by regulation and users of green steel might be willing to pay a premium.

If these things come together, the steel industry might begin putting the pedal to the metal sooner rather than later.

More By This Author:

The Commodities Feed: Middle Distillates Firm UpGood News On UK Inflation Bolsters Chances Of A 25bp August Hike

FX Daily: The Pound’s Big Repricing Is Finally Happening

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more