Japanese Yen Struggles To Build On Intraday Gains As Traders Await Fed Decision

Image Source: Pixabay

The Japanese Yen (JPY) sticks to modest intraday gains that followed the release of Japan’s Corporate Goods Price Index, which exceeded expectations and reaffirmed bets for an imminent rate hike by the Bank of Japan (BoJ). Apart from this, the cautious market mood assists the safe-haven JPY to snap a three-day losing streak against its American counterpart and drags the USD/JPY pair away from a two-week high, touched on Tuesday.

Meanwhile, hawkish BoJ expectations mark a significant divergence in comparison to bets for more rate cuts by the US Federal Reserve (Fed), which keeps the US Dollar (USD) depressed and further benefits the lower-yielding JPY. However, concerns about expansionary fiscal measures in Japan and growth worries might hold back the JPY bulls from placing aggressive bets. Traders also seem reluctant ahead of the crucial FOMC rate decision.

Japanese Yen remains on the front foot vs USD amid divergent BoJ-Fed expectations

- Data published by the Bank of Japan on Wednesday showed that the Corporate Goods Price Index rose 2.7% YoY in October, down slightly from 2.8% in the previous month. The data, although it was in line with consensus estimates, indicated that inflation in Japan remains well above the historic levels.

- Moreover, BoJ Governor Kazuo Ueda reiterated on Tuesday that the likelihood of the central bank's baseline economic and price outlook materialising had been gradually increasing. This backs the case for further BoJ policy normalization and offers some support to the Japanese Yen during the Asian session.

- Ueda added that the BoJ plans to ramp up government bond buying if long-term interest rates rise sharply. In fact, the yield on the benchmark 10-year Japanese government bond touched an 18-year high this week on the back of Japanese Prime Minister Sanae Takaichi's big spending plans to boost sluggish growth.

- Japan's revised Gross Domestic Product report released this week revealed that the economy shrank 0.6% in the third quarter compared with initial estimate of 0.4%. On a yearly basis, the economy contracted by 2.3%, or its fasted pace since Q3 2023, vs a fall of a 2.0% expected and 1.8% reported originally.

- Nevertheless, traders are still pricing in over a 75% chance that the BoJ will raise interest rates at its upcoming policy meeting on December 18-19. This marks a significant divergence in comparison to expectations for further policy easing by the US Federal Reserve and benefits the lower-yielding JPY.

- The US central bank is expected to lower borrowing costs by 25 basis points at the end of a two-day policy meeting later today. Hence, traders will scrutinize updated economic projections and Fed Chair Jerome Powell's comments during the post-meeting presser for more cues about the future rate-cut path.

- The outlook will play a key role in influencing the near-term US Dollar price dynamics and provide some meaningful impetus to the USD/JPY pair. The market attention will then shift to the BoJ policy meeting next week, which should help determine the next leg of a directional move for the currency pair.

USD/JPY weakness towards 156.00 could be seen as buying opportunity and remain limited

The overnight breakout through the 155.30 confluence – comprising the 100-hour Simple Moving Average (SMA) and the top end of a short-term descending trend-channel – was seen as a key trigger for the USD/JPY bulls. Furthermore, oscillators on hourly and daily charts are holding in positive territory and back the case for a further near-term appreciating move. Some follow-through buying beyond the 157.00 round figure will reaffirm the constructive outlook and lift spot prices to the 157.45 intermediate hurdle en route to the 158.00 neighborhood, or a multi-month peak, touched in November.

On the flip side, any further slide towards the 156.00 mark could be seen as a buying opportunity. This, in turn, should limit the downside for the USD/JPY pair near the 155.35-155.30 confluence resistance breakpoint, now turned support. However, some follow-through selling, leading to a subsequent weakness below the 155.00 psychological mark, might negate the positive outlook and shift the near-term bias in favor of bearish traders.

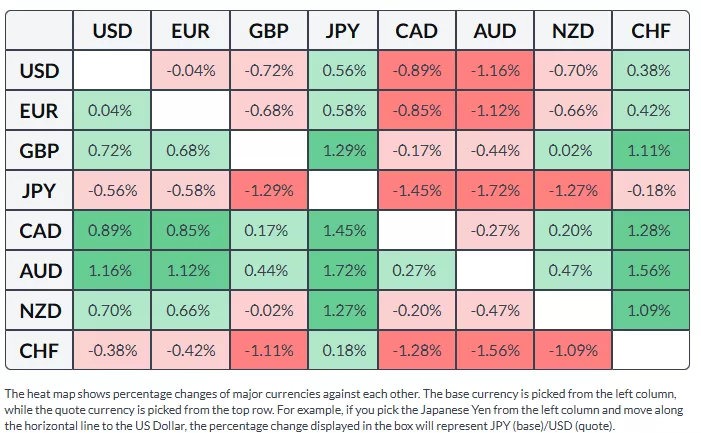

Japanese Yen Price Last 7 Days

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies last 7 days. Japanese Yen was the strongest against the Swiss Franc.

More By This Author:

Gold Lacks Direction With Fed Meeting Looming

EUR/JPY Retreats After Multi-Year High As Eurozone Resilience Contrasts With JPY Weakness

EUR/USD Stalls Below 1.1650 As Dollar Firms Ahead Of Fed Decision

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more