EUR/USD Stalls Below 1.1650 As Dollar Firms Ahead Of Fed Decision

Image Source: Pixabay

The Euro edges lower against the US Dollar on Monday, with EUR/USD reversing earlier gains as the Greenback stages a rebound from recent lows, weighing on the shared currency. At the time of writing, EUR/USD is trading near 1.1623, close to a one-week low, after touching an intraday high of 1.1672 during the European session.

The US Dollar Index (DXY), which tracks the Greenback against a basket of six major currencies, is trading around 99.20, after dipping to 98.79 earlier in the Asian session.

Despite the pullback, the broader fundamental backdrop remains supportive for the Euro. The Federal Reserve (Fed) is widely expected to deliver another interest rate cut on Wednesday, while the European Central Bank (ECB) is seen keeping rates unchanged at its upcoming policy meeting later this month. The diverging central-bank outlook keeps downside in EUR/USD somewhat contained, even as short-term flows favour the Dollar.

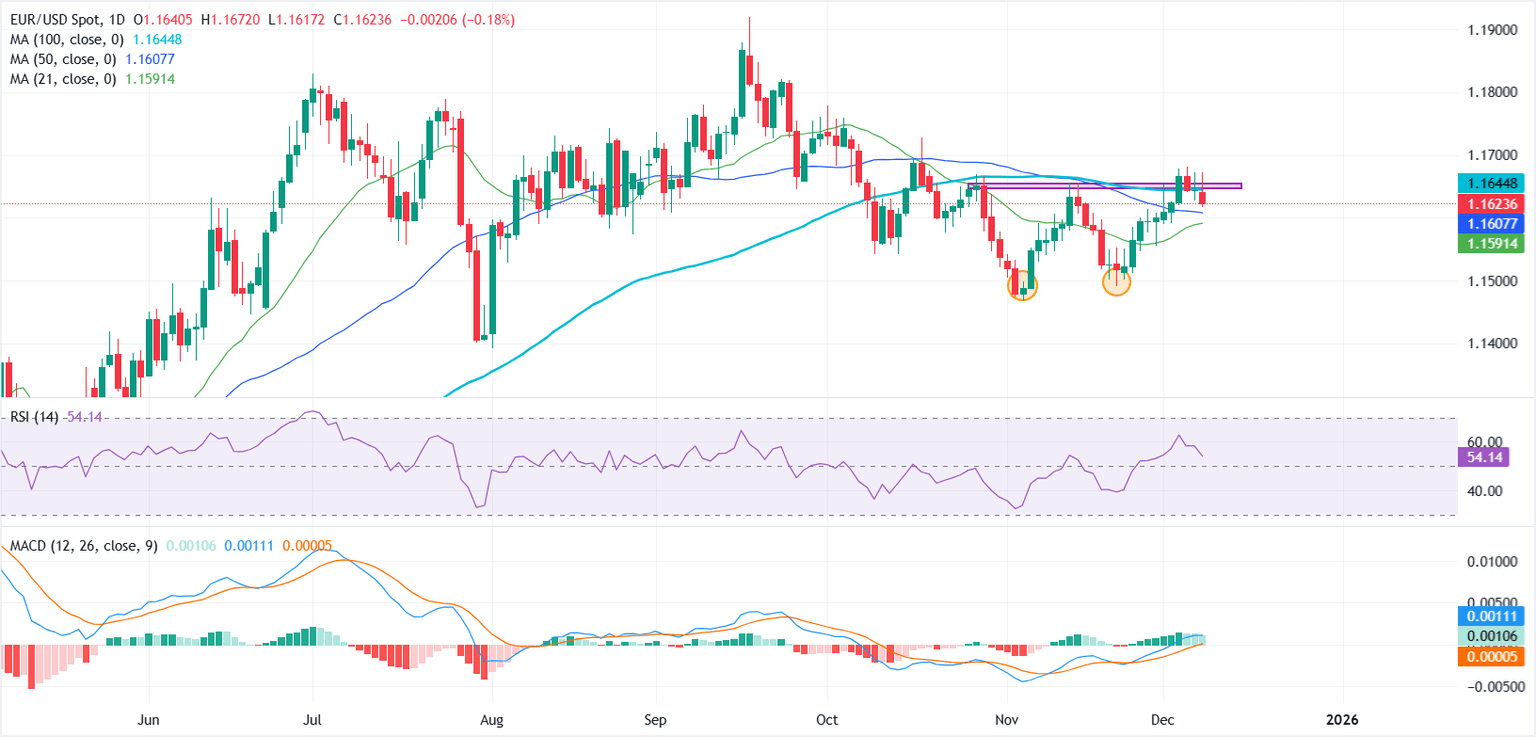

From a technical perspective, the daily chart shows EUR/USD posting consecutive green candles in recent days, steadily climbing above the 21-day and 50-day Simple Moving Averages (SMAs).

The advance followed a clean double-bottom formation around the 1.1500 psychological zone in late November. However, bulls continue to struggle at the neckline of that pattern, where the 100-day SMA intersects, creating a strong confluence barrier near 1.1650.

A decisive close above this region would reinforce bullish momentum and open the door toward 1.1700 and 1.1750. On the downside, the 21-day and 50-day SMAs provide immediate support.

Sustained trade above these averages keeps the near-term bias constructive, while a break below them would expose fresh downside pressure, potentially dragging EUR/USD back toward 1.1500.

Momentum signals remain broadly supportive but lack strong conviction. The Moving Average Convergence Divergence (MACD) histogram stays positive, indicating the MACD line above the Signal line, though its recent contraction suggests moderating momentum.

Meanwhile, the Relative Strength Index (RSI) sits near 54, reflecting a neutral bias after cooling from recent highs. A shift toward the 60 level would suggest strengthening buying interest and could help validate a continued push higher if price action breaks above the key 1.1650 resistance zone.

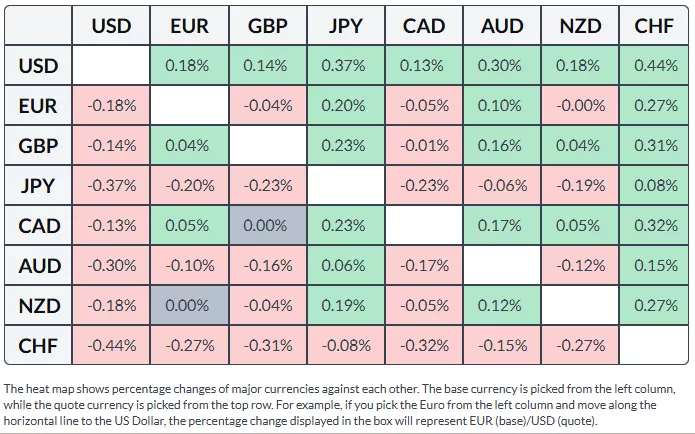

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Swiss Franc.

More By This Author:

USD/CAD Extends Slide As Steady BoC Expectations Clash With Fed Easing BetsNasdaq Futures Hold Key Structure As Price Compresses

Canadian Dollar Soars After Upbeat Labor Report

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more