Japanese Yen Appreciates As Economic Growth Raises Odds Of Another Rate Hike By The BoJ

Image Source: Pixabay

- The Japanese Yen advances due to rising odds of a further rate hike by the BoJ.

- Due to political uncertainty, the Yen may face challenges; Prime Minister Fumio Kishida will not seek re-election in September.

- The US Dollar faces pressure from declining US Treasury yields and increasing bets on a Fed rate cut.

The Japanese Yen (JPY) bounced back against the US Dollar (USD) on Friday, potentially due to the recent growth in Japan’s second-quarter GDP, which lends support to the possibility of a near-term interest rate hike by the Bank of Japan (BoJ).

However, the JPY might encounter challenges due to political uncertainty in Japan, sparked by reports that Prime Minister Fumio Kishida will not seek re-election as party leader in September, effectively concluding his term as prime minister.

The USD/JPY pair edges lower as the US Dollar loses ground amid lower Treasury yields. Additionally, traders fully price in a 25 basis point rate reduction by the US Federal Reserve for September, according to the CME FedWatch tool.

However, the Greenback received support as recent better-than-expected US economic data eased market concerns about a recession in the United States (US). Furthermore, the preliminary US Michigan Consumer Sentiment Index for August and Building Permits for July will be eyed later in the North American session.

Daily Digest Market Movers: Japanese Yen advances due to a hawkish mood surrounding the BoJ

- On Thursday, the US Census Bureau reported that US Retail Sales climbed 1.0% month-over-month in July, a sharp turnaround from June's 0.2% decline, surpassing the projected 0.3% increase. Moreover, Initial Jobless Claims for the week ending August 9 reached 227,000, lower than the forecast of 235,000 and down from 234,000 the previous week.

- On Thursday, Japanese Economy Minister Yoshitaka Shindo stated that the economy is anticipated to recover gradually as wages and income improve. Shindo also added that the government will collaborate closely with the Bank of Japan to implement flexible macroeconomic policies.

- Japan's Gross Domestic Product (GDP) grew by 0.8% quarter-on-quarter in Q2, surpassing market forecasts of 0.5% and rebounding from a 0.6% decline in Q1. This marked the strongest quarterly growth since Q1 of 2023. Meanwhile, the annualized GDP growth reached 3.1%, exceeding the market consensus of 2.1% and reversing a 2.3% contraction in Q1. This was the strongest yearly expansion since Q2 of 2023.

- Federal Reserve Bank of Chicago President Austan Goolsbee expressed growing concern on Wednesday about the labor market rather than inflation, noting recent improvements in price pressures alongside weak jobs data. Goolsbee added that the extent of rate cuts will be determined by the prevailing economic conditions, per Bloomberg.

- US headline Consumer Price Index (CPI) rose 2.9% year-over-year in July, slightly down from the 3% increase in June and below market expectations. The Core CPI, which excludes food and energy, climbed 3.2% year-over-year, a slight decrease from the 3.3% rise in June but aligned with market forecasts.

- Japanese Prime Minister Fumio Kishida announced at a press conference on Wednesday that he will not seek re-election as the leader of the Liberal Democratic Party (LDP) in September. Kishida emphasized the need to combat Japan's deflation-prone economy by promoting wage and investment growth and achieving the goal of expanding Japan's GDP to ¥600 trillion.

- Rabobank's senior FX strategist, Jane Foley, observes that this week's series of US data releases, along with next week's Jackson Hole event, should provide the market with clearer insights into the potential responses of US policymakers. However, their main expectation is that the Fed will reduce rates by 25 basis points in September and likely cut them again before the end of the year.

Technical Analysis: USD/JPY falls toward 148.50; next support at nine-day EMA

USD/JPY trades around 148.80 on Friday. According to the daily chart analysis, the pair is above the nine-day Exponential Moving Average (EMA), signaling a short-term bullish trend. Still, the 14-day Relative Strength Index (RSI) remains below 50, and an additional rise would confirm the bullish momentum.

In terms of support levels, the USD/JPY pair may encounter immediate support at the nine-day EMA, around 148.09. If the pair falls below this level, it could strengthen the bearish outlook and push the pair toward the seven-month low of 141.69 recorded on August 5. A continued decline could bring the pair closer to the next support level at 140.25.

On the upside, the USD/JPY pair could aim for the 50-day EMA at 153.08, with the possibility of testing the resistance level at 154.50, which has transitioned from previous throwback support to current pullback resistance.

USD/JPY: Daily Chart

Japanese Yen PRICE Today

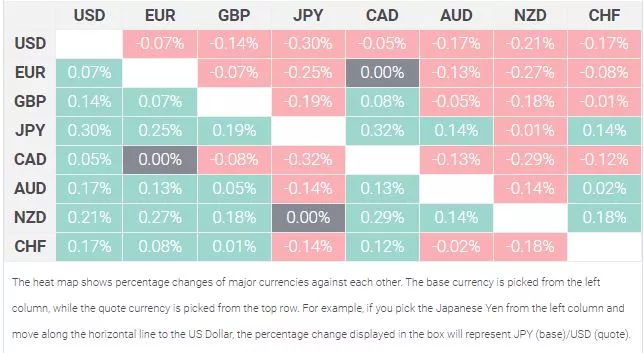

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Canadian Dollar.

More By This Author:

Australian Dollar Edges Higher Following Moderate Jobs Figures

GBP/JPY Rises To Near 189.00 Despite A Downbeat UK Inflation Report

USD/CHF Holds Minor Losses Near 0.8650 Due To Dovish Fed, Rising Middle-East Tensions

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more