Australian Dollar Edges Higher Following Moderate Jobs Figures

Image Source: Unsplash

- The Australian Dollar recovers daily losses after the release of the moderate jobs data.

- The commodity-linked AUD faced challenges as reduced demand and a surplus of commodities put pressure on market prices.

- The US Dollar experienced losses following a moderate Consumer Price Index data released on Wednesday.

The Australian Dollar (AUD) appreciates following the moderate employment data release on Thursday. However, the Aussie Dollar faced challenges against the US Dollar (USD) due to declining copper and iron ore prices. The drop is exacerbated by worsening credit data from China, which, combined with reduced demand and a surplus of commodities, has put further pressure on the markets.

The AUD/USD pair is under downward pressure as investors evaluate the Reserve Bank of Australia's (RBA) monetary policy stance. Despite elevated wage growth in the second quarter, which has kept the RBA's outlook hawkish, RBA Governor Michele Bullock has dismissed any possibility of rate cuts in the next six months. Bullock stressed that the Australian central bank remains vigilant about inflation risks and is prepared to increase rates further if needed.

The US Dollar faces challenges after Wednesday's Consumer Price Index (CPI) data showed a moderate increase in July's annual US inflation rate. Investors are likely debating how much the Federal Reserve (Fed) will cut rates in September. While traders are leaning towards a more modest 25 basis point reduction, with a 60% probability, a 50 basis point cut remains a possibility. According to CME FedWatch, there is a 36% chance of the larger cut occurring in September.

Daily Digest Market Movers: Australian Dollar edges higher after jobs data

- Australian Employment Change is reported at 58.2K for July, surpassing the expected 20.0K and the previous reading of 52.3K. However, the Unemployment Rate increased to 4.2%, exceeding the market expectation of remaining steady at 4.1%. Additionally, Consumer Inflation Expectations for August rose to 4.5%, up from the prior reading of 4.3%.

- Federal Reserve Bank of Chicago President Austan Goolsbee expressed growing concern on Wednesday about the labor market rather than inflation, noting recent improvements in price pressures alongside weak jobs data. Goolsbee added that the extent of rate cuts will be determined by the prevailing economic conditions, per Bloomberg.

- US headline Consumer Price Index (CPI) rose 2.9% year-over-year in July, slightly down from the 3% increase in June and below market expectations. The Core CPI, which excludes food and energy, climbed 3.2% year-over-year, a slight decrease from the 3.3% rise in June but aligned with market forecasts.

- On Tuesday, Atlanta Fed President Raphael Bostic stated that recent economic data has increased his confidence that the Fed can achieve its 2% inflation target. However, Bostic indicated that additional evidence is required before he would support a reduction in interest rates, according to Reuters.

- The US Producer Price Index (PPI) rose 2.2% YoY in July from 2.7% in June, falling short of the market expectation of 2.3%. Meanwhile, the Core PPI rose by 2.4% year-on-year in July, against the previous reading of 3.0%. The index fell short of an estimate of 2.7%. The Core PPI remained unchanged.

- Australia's Westpac Consumer Confidence rose by 2.8% in August, swinging from a 1.1% fall in July. Meanwhile, the Wage Price Index remained steady with a 0.8% rise in the second quarter, slightly below the market expectation of a 0.9% increase.

- On Monday, Reserve Bank of Australia (RBA) Deputy Governor Andrew Hauser attributed persistent inflation to weaker supply and a tight labor market. Hauser also noted that economic forecasts are surrounded by significant uncertainty.

- On Sunday, Federal Reserve Governor Michelle Bowman stated that she continues to see upside risks for inflation and ongoing strength in the labor market. This suggests that the Fed may not be prepared to cut rates at their next meeting in September, according to Bloomberg.

Technical Analysis: Australian Dollar falls to near 0.6600

The Australian Dollar trades around 0.6590 on Thursday. The daily chart analysis indicates that the AUD/USD pair tests the lower boundary of an ascending channel, which suggests a weakening bullish bias. Additionally, the 14-day Relative Strength Index (RSI) is positioned slightly below the 50 level, confirming the reinforcement of a bearish momentum.

In terms of support, the lower boundary of the ascending channel around 0.6590 serves as an immediate support level for the AUD/USD pair. A break below this level could lead to testing the nine-day Exponential Moving Average (EMA) at 0.6580, followed by the throwback level at 0.6575. If the pair falls below this support region, it could reinforce a bearish outlook, potentially driving it toward the throwback level at 0.6470.

On the upside, the AUD/USD pair might explore the area around the upper boundary of the ascending channel at the 0.6690 level. A breakout above this level could push the pair toward its six-month high of 0.6798, reached on July 11.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

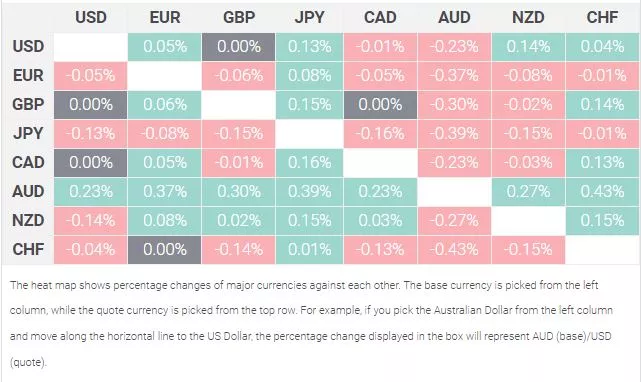

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Swiss Franc.

More By This Author:

GBP/JPY Rises To Near 189.00 Despite A Downbeat UK Inflation ReportUSD/CHF Holds Minor Losses Near 0.8650 Due To Dovish Fed, Rising Middle-East Tensions

EUR/GBP Price Forecast: Breaks Below 0.8550; 14-day EMA Appears As A Next Support

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more