Is This The New Normal For Markets?

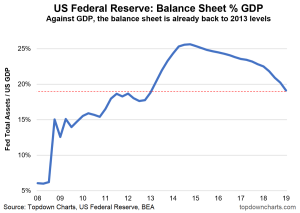

It’s human nature to adapt to changes and quickly think of them as the new normal. An obvious example is behaviour from our politicians that is now generally accepted but would have ended careers 15 or 20 years ago. The chart below provides another example that is relevant to investors. It describes the size of the Fed balance sheet as a percentage of US GDP since the financial crisis of 2008.

The first observation from the chart is that the Fed has reined in Quantitative Easing (QE), shrinking the Fed balance sheet by some 20% since its peak in 2014. It is currently at levels generally seen in the 2011-13 period. As noted in the first paragraph, there is a tendency to think of recent events as constituting normal conditions. So, it is with the Fed balance sheet, with many market observers noting the Fed’s recent efforts at Quantitative Tightening (QT).

Those of us who choose to take a longer perspective will note that after the recent QT the Fed’s balance sheet as a percentage of GDP remains almost 400% higher than it was before the financial crisis of 2008! To my mind, this is the most pertinent message of this chart, that current economic conditions in the United States, and the developed world, remain far from normal compared to historical norms.

Most telling of the fragile nature of the global economy is that despite the unprecedented intervention by the Fed, European Central Bank (ECB), and Bank of Japan et al have produced a weaker than average economic expansion. It should be said that the central bank intervention was warranted both from an economic and social standpoint, but the mediocre economic response to such a massive stimulus effort portends future problems for the global economy.

Despite the actions of the Fed to raise interest rates and shrink their balance sheet, global central bank policy remains very accommodative. Interest rates in the United States remain low in historical terms, while interest rates in the EU and Japan remain negative! Mounting evidence of a slowing world economy suggests that central bank policies may begin to ease again soon, even from the traditionally highly stimulative levels of today.

The Fed deserves credit for its attempt to raise interest rates to more normal levels to develop a tool to combat the next recession. Unfortunately, they appear to have run out of time. Their colleagues in Europe and Japan didn’t even try. The next recession will push US rates lower and interest rates in the EU and Japan even further into negative territory. The effect of such an unprecedented economic environment remains to be seen but the law of unintended consequences will surely assert itself. It is likely that both economies and markets will behave in unanticipated ways.

It has long been our contention at the Global Investment Letter that the factors that ...

more

The Federal Reserve is much better off getting QE off its balance sheet than raising rates. I agree with the author that it is getting hard for them to raise rates now. They should keep reversing QE while they can. The sad fact is the next downturn will spark cries for more QE again. It's a genie in a bottle that can't be put back once opened.

Yes, a never ending catch 22.