Is The Bank Of Canada Setting The Table For A Rate Cut?

In its April 2016 Monetary Policy Review, the Bank of Canada (BoC) highlighted a number of areas in which the Canadian economy continues to underperform. Collectively, these weak conditions raises the question: is there a bank rate cut in the wings?

In its most recent rate announcement the BoC took no action in this regard, yet the underlying conditions point to an economy that is, at best, limping along without any real signs of meaningful growth. The BoC, like all other central banks, retain a certain degree of optimism for the near term. However, in reviewing the BoC latest report there are number of disquieting developments that can shake one’s optimism.

Lets look at some of the major findings in the report.

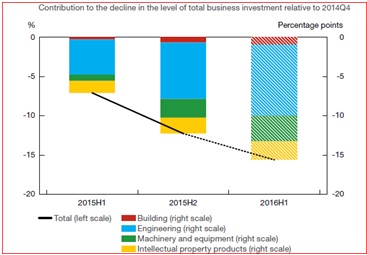

Business Investment is very weak. The collapse in the price of commodities continues to take a heavy toll on capital investment and there are further declines expected as excess inventories have to be reduced before any new investment can be considered. The BoC is forthright in pointing out that the weakness in capital investment is broad-based, not just confined to the resource sector. Overall, the weakness in investment is expected to cut the GDP growth rate in half in 2016.

Excess Slack. The BoC measures slack in terms of the “output gap”. That is the difference between actual output and the potential output. It finds that the gap has “widened since the onset of the terms-of-trade shock and currently point to material excess capacity “ ( the terms of trade shock refers to the huge decline in oil and other commodity prices). That output gap has widened recently to 1-1.5 percent. Moreover, business surveys confirm that there are no capacity pressures, especially in Western Canada. Slack is also measured by the unemployment rate which now sits at over 7 percent. As expected there is a total absence of any wage pressures.

Significant Decline in Resource Development. The Bank estimates that the level of investment in that sector in 2016 is likely to decline sharply for a second year in a row, to about 60 per cent below its 2014 level.

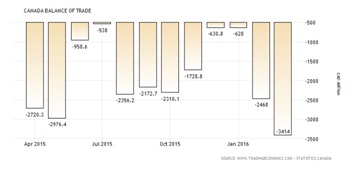

Current Account Deficit Widens. Despite the depreciation of the Canadian dollar in 2015, Canada’s continues rack up significant trade deficits; the non-resource exports have not picked up the slack created by the slump in oil exports.

Inflation Remains Tame. Core inflation is expected to be 2 percent or less as the disinflationary effects of a weak economy and low energy prices keep a lid on the CPI. In the Bank’s eyes, these disinflationary pressures more than offset the inflationary pressures from a depreciated Canadian currency.

Canada seems to be caught between a rock and a hard place. The two pillars of the economy—the trade balance and business investment are underperforming and that is been felt throughout all sectors. What will motivate the BoC to cut the bank rate? For one thing, the Canadian dollar, now trading in the range of 76-78 cents US is relatively too high to have an impact in turning the trade balance around. Lowering the bank rate would result in a further depreciation of the Canadian dollar and the inflationary impact coming from higher cost imports would be offset by the relatively low inflation within the domestic economy. As for business investment, the lower bank rate would improve the outlook for corporate profits and give the business sector encouragement to expand.