Is It Time To Buy Oil Companies Again?

If it isn’t, it’s certainly a good place to begin nibbling… Oil prices may take yet another dip and take oil and gas stocks down with them. I hope so – I want to buy much more than the small amount I own today. Knowing that we cannot possibly catch the exact highs or exact lows, in times of market over-exuberance if there is a quality sector providing an essential product that has already been in its own private bear market hell, it is likely the best place to begin our search for value.

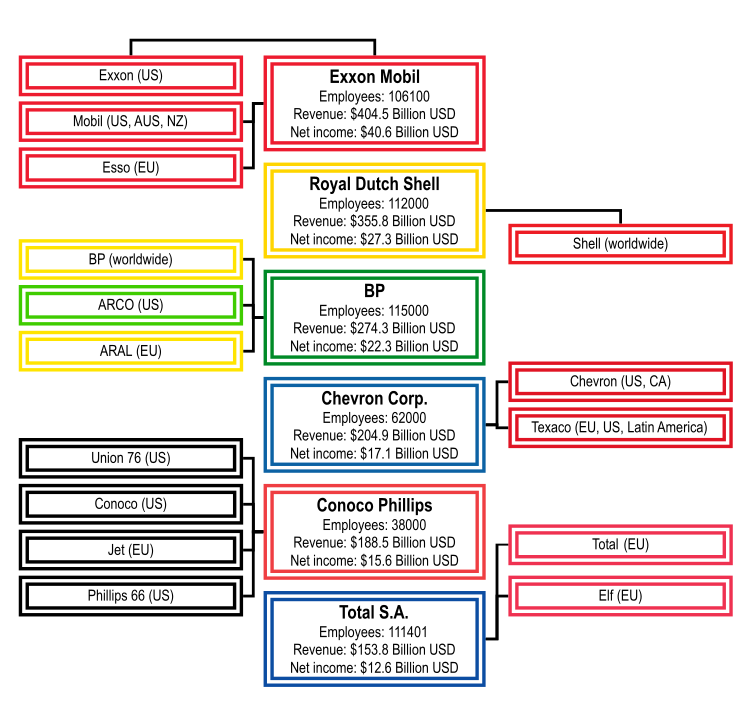

Three oil and gas top-tier firms come immediately to mind: Royal Dutch Shell (we prefer the RDS-B shares), Total Petroleum (TOT,) and BP. That’s not to disparage their even larger brethren, Exxon Mobil (XOM) and Chevron (CVX), but those two have not fallen as much. If they should, they’ll be on our buy list as well. (When I discuss big oil, I don’t include any Russian or Chinese firms which are de facto state-owned or oligarch-owned.)

The benefit of sticking with these major integrated energy firms is that we have virtually zero risk of default or bankruptcy. No matter how low oil prices tumble, their diversification into both upstream (exploration and production) and downstream (refining and distribution/retail sales) keeps them in good stead. When oil and gas prices are high, they make the most money, of course. But even when prices of the commodity itself are low, that just reduces the big integrated firms’ cost of feedstock for their refineries and chemicals and plastics businesses.

I’ve done the math and, assuming the dividends of these giants aren’t cut, they look pretty good in any scenario. If the market continues to leap ahead this year, it’s likely these companies will be carried along with the general euphoria, and with considerably less volatility than most other stocks along the way. If the market is flat, they’ll likely stay roughly where they are (though a serious elevator shaft drop in oil prices would force us to remind ourselves daily that these are long-term investments!) And if the market is down but oil doesn’t plunge to Citicorp’s (C) projection of $20 a barrel, they will bump along but, paying us more than 5.5% each to stick with them, give us a nice cushion against a 10% or so correction.

Let’s take a look at each of these three favorites of mine, then briefly mention the next tier down:

Wall Street is all agog over the idea that BP is a wounded bird and some clever hawk like Exxon Mobil or Chevron will swoop in and make us all rich via a possible takeover. I suppose it could happen but I am in London this week and I can assure you that the current and likely future government of the UK considers BP to be a national treasure, strictly off-limits to any takeover.

Mr. Cameron et al have been quite clear that they consider BP their franchise player. OK, he didn’t use the term “franchise player,” but you get the idea. When one company resists another’s advances, they may lose. But when a sovereign government says no, they can tie you up for years and make it clear that you will be far the worse for wear. The British are a very civil people, well-mannered and kind to a fault. But if you rile them, you will be reminded that these pleasant folk are descendants of decidedly truculent Picts, Celts, Scots, Angles, Saxons, Jutes, Belgics, Bretons, Vikings, Normans and Britons. Unless the Brits decide on their own to allow BP to be acquired, I don’t think there is a company quite up for this fight. So, perhaps alone among analysts, I am buying BP on the fundamentals, not any takeover rumors.

All three companies have a higher weighted average cost of capital (WACC) than their return on capital (ROC) for the past quarter or two, of course, but longer term, over the past five years, BP’s ROC has averaged 14%, well above its mid-single-digit WACC — and that includes the entire time after the April 2010 Deepwater Horizon fiasco. This event caused BP to divest significant assets but did not include a sizable retrenchment from the USA. Although BP is clearly a British firm, its largest employee base and biggest investments remain in the US. BP is a company with $359 billion in revenues as of 2014.

More than half the liabilities from Deepwater Horizon have been dealt with and the remainder may yet be reduced. Anyone avoiding BP because they believe the maximum of $18 billion in remaining possible civil fines and liabilities, subject to downward revision, will drive the company into the ground are mistaken. My colleague Jim Rickards and I made a bet in 2010, with Jim saying BP would be bankrupt within a year. I’m looking forward to my dinner, Jim! More importantly, we are pleased to own both shares in and options on a fine company at a fine price.

Total is France’s largest company by revenues (about $235 billion, depending upon where the Euro is when you read this — though the chart above does not reflect this updated amount) and is France’s entrée into the world of the energy super-majors. Embracing French bureaucracy wholeheartedly, TOT has, at last count, 898 subsidiaries. (In fairness, every time they enter into a j.v. or extend their finance arm into a new nation, they set up separate subsidiaries.)

What sets Total apart is its decision to embrace LNG. The company now has LNG projects in Indonesia, Qatar, the United Arab Emirates, Oman, Nigeria, Norway, Russia, Yemen, Angola and Australia. If Europe is ever to break the stranglehold of Russian natural gas, I believe it will be because they have built the essential infrastructure for LNG. Total seems to agree with me. (By the way, the first LNG re-gasification plant in Europe is just now up and running in Lithuania — with LNG supplied by our old favorite and portfolio holding Statoil.)

Now we come to Royal Dutch Shell, under fire recently for its decision to pay up for BG Group to the tune of roughly $70 million. Many analysts believe Shell is overpaying for BG. I’m not so sure. Shell has a couple dozen huge projects that will be bringing in substantial revenue in 3-5 years; its problem is immediate cash flow. That’s something BG can provide from its current operations. Further, BG is a great fit for Shell in that Shell has made the geostrategic decision that the developed world and, increasingly, China, India and other emerging nations want nothing to do with coal.

Natural gas is the, well, “natural” alternative, being much cleaner-burning and more environmentally acceptable. So Shell is hitching it’s wagon to two spirited horses: deepwater drilling, where elephant fields may yet produce massive gains, and natural gas, specifically (like TOT) LNG. This deal rockets Shell, already the 4th-largest company in the world by revenues (as of 2014) way ahead of Total and, for that matter, Exxon and Chevron in racing to build large market share in the LNG arena.

As China, India and others move toward cleaner burning fuels like natural gas instead of coal, this is a gamble that Asian markets will come to rely on U.S. exports of the product, when the first shipments leave the country—expected sometime later this year. (Exxon estimates that global LNG will triple through 2040, to some 100 billion cubic feet a day, which would be half again the entire current U.S. gas output. It’s a gamble — but I believe it is a smart one.

Whether it makes rational sense or not, the rush is on to demonize the fossil fuels that light, cool and heat our homes and offices and allow us to transport cool stuff from Amazon (AMZN) to our front doorstep. Oxford University students just got Oxford to consider divesting it’s oil and gas companies; Stanford University has already begun the process, as has the World Council of Churches. Just yesterday the Church of England agreed to divest all coal and oil sands firms. The fire sale is on; I’m happy to benefit long term from this short term thinking...

Who Is Next After BG?

Of course, there are plenty of other firms just below the top tier, weakened by low oil and gas prices, that are likely to be considered by the super-majors as they decide that it is cheaper to buy proven reserves in the stock market than it is to wildcat for more reserves in unproven areas.

I have no inside information, of course, but if I were to take a wild guess as to which companies might be big enough to make a difference to the big integrated firms and still cheap enough to swallow without indigestion, I would have to include companies like Apache (APA), Anadarko (APC), Hess (HES), Marathon (MRO), Suncor (SU), Occidental (OXY), Devon (DVN), EOG (EOG), Canadian Natural Resources (CNQ), Noble Energy (NBL), EnCana (ECA), Cenovus (CVE), and Canadian Oil Sands (COSWF).

Conoco (COP) would be a big gulp even for an Exxon or Chevron but it’s still a distant possibility. And my favorite next-level oil and gas firm, Statoil (STO) is effectively controlled by the Norwegian government and Norwegian sovereign wealth fund — if they don’t want to see anyone buy it, they could easily block the attempt. If you are interested in any of these you might consider the speculation of buying calls if and as prices decline once again. That’s my plan!

Disclosure: The author is long TOT, STO, BP and RDS-B. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. ...

more

Since mid May, oil has continued to be a volatile ride with ups and downs. If the Iran nuclear deal is approved by Congress, we can surely see further steep declines in oil as millions of extra barrels of oil are released into the global market once the US embargo is lifted. Further declines in oil will also most likely lead to further declines in oil stocks. Total, and RDS-B are both down about 10% since May along with the other big names. A better bet perhaps are oil refining companies who benefit when oil prices drop. One good example and a Buffett pick is PSX. Yesterday, it jumped over 3% reaching a high of 84.24 and is now trading within reach of its 52 week high.

Thanks, J Town. FYI, we recommended MPC and VLO as our choices among the refiners. And we still like the big integrateds. Nothing is certain with the Iran deal once Congress and now-snubbed US allies in the Gulf weigh in...

You think Congress will see it through?

Speaking from my bias as a geopolitical analyst rather than portfolio manager, I certainly hope not. Enriching a government sworn to destroy Western civilization is hardly the coup the administration has painted. Bring them into the family of nations? Wishful thinking. Expect the first lifted-sanctions windfall to go straight to Hizbollah...

Surprisingly oil seems to be in the positive today up about 0.5%, and oil stock Exxi was up over 5% today. What gives?

I share your view, I am heavy into energy sector in XOM, CVX and RDSA.L. This is for long term investment/hold, my view, despite overall oil over supply in the market, I serious doubt this scenario will last:-

1) Major suppliers are hurting badly. Russia, Saudi and other suppliers are eating into their reserves at price below $60-80.

2) China, since the last 15 years, energy has always remain a critical issue to them, despite after building a mega hydro-dam and multiple nuclear power stations. Numerous of my chinese suppliers are still running their generators for their factories 2-3 times a week, simply till today there still insufficient supply. The recent turn of events and US international policies, had enable China to gain Russia and winning over Saudi.

3) I believe China growth has always limit by the shortage of energy, plenty of cheap labor (even cheaper than Vietnam) outside China's major industrial areas and major cities. Now China harbored the intention to build a super high speed train to the west(Europe) and to south(Singapore), armed with AIIB.

4) The best is Obama's oil policy seem to be driving Middle East countries to war rather than the peace policy he preached about.

In term of oil and commodities, if not because of present oil price war, oil giant like XOM, CVX and others at present price? I totally agreed with your assessment, oil stock is great for investment play at present price, not great for trade or short. More for longer term play. Oil is critical to keep the world moving but at the ever increasing rate of consumption, it is good equities to invest in.

I consider oil and gas to be Nature's Batteries, compacted long ago to be used wisely until we can make the transition to renewables...

Agreed, however the rate the increase in demand is scary.

I agree there is possibly considerable upside gains in the energy sector. However, you mentioned investing in TOT, XOM, and others because of their high dividends of around 5% in order to offfset possible future losses. If its dividends you want, there are plenty of stocks out there with vastly greater dividends with less volatility than oil. I found the following (dividends in parens) Tribune Media TRCO (49.94%), Sand Ridge Permian Trust PER (30.20%), Chesapeake Granite Wash Trust CHKR (22%), and Cornerstone Progressive Return CFP (22%)

Hi Joe E,

Yes, dividends are nice but I want them as icing on the cake. I seek companies that are likely to increase their dividends as their businesses grow. Regrettably, in my analysis the four you mention look most likely to slash their (what I consider, reviewing their fundamentals) unsustainable dividends rather than increase them!