Is China About To Devalue The Yuan? Local Banks Start Dumping Yuan

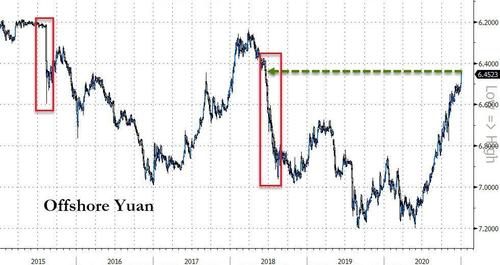

In our market wrap note yesterday, we said that the Chinese Yuan surged to its strongest against the dollar since June 2018, rising above 6.50, and was now "at a critical level that has prompted volatility-inducing devaluations in the past."

This was only the latest time in the past few weeks we have speculated that the recent surge in the dollar has put Beijing in the very unpleasant position of being forced to decide just how it will let some steam out of the soaring yuan, which is rapidly becoming a lead deflationary anchor dragging down the broader Chinese economy.

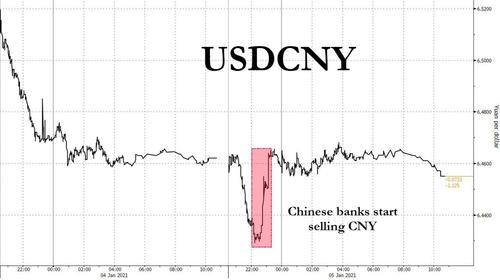

We didn't have long to wait to get a very clear signal that Beijing is now actively contemplating a devaluation. In fact, it took just a few hours for China’s yuan to abruptly erase its overnight advance in a move early on Tuesday, when big state banks were seen suddenly dumping the yuan for the first time in years.

The yuan erased a gain of about 0.5% within an hour in late morning trade, and was at 6.4577 per dollar as of 2:21 p.m. in Shanghai. As Bloomberg first reported, the move came as a few big Chinese state banks actively offloaded the currency against the greenback after the yuan hit 6.43. Bloomberg was also kind enough to provide a translation for the cheap seats: "while the lenders could be taking profits on long-yuan positions, they could also be acting on behalf of the authorities to rein in the appreciation."

For those who are confused about the significance of what just happened, all Chinese banks are effectively state-owned entities (SOEs), and everything they do is with the explicit preapproval of Beijing, which knows very well that the entire global community is scouring its market for signals such as this. This is important because Chinese banks always start intervening in FX when Beijing is seeking to telegraph to the world that it is now displeased with the strength of its currency, and any further gains will not be tolerated.

In other words, a sighting such as this, is usually a clear and present signal that a far more aggressive devaluation is imminent.

To be sure, while the recent plunge in the dollar has sent most emerging-market currencies higher recently, the yuan has also been bolstered by China’s fundamentals. The country’s economic recovery from the coronavirus pandemic has been solid, and China is attracting strong capital inflows chasing the yuan’s wide yield premium over the rest of the world. The currency is now trading near a two-year high. Which however, is not at all what Beijing wants as it is scrambling to extend its export trade-driven rebound: after all, the stronger the yuan, the less competitive the country's products on the global trade arena.

Pointing out the obvious, Dariusz Kowalczyk, senior emerging-markets strategist at Credit Agricole CIB said that "the pace of gains has been unsustainable and probably unacceptable to policy makers," adding that he "wouldn’t be surprised if this correction was driven by agent banks buying the dollar."

Translation: this is a mini state-mandated FX intervention. And if the yuan continues to rise - read, the dollar continues to tumble - then the mini intervention will mutate into a maxi devaluation.

That said, Beijing doesn't have to go all August 2015 on the yuan, as China has several other tools at its disposal which increase in order of severity - starting with weaker fixings and ending with relaxation of capital curbs (and allowing bitcoin to trade again) - if it wishes to slow the rally. Just late last year, the authorities made it cheaper for traders to bet against the currency and allowed onshore investors to buy more overseas assets. That move, however, did not have much impact against a US currency that has been sliding at a spectacular fashion.

As such, this is Beijing's official warning to the Fed: stop what you are doing, or the trade war will rapidly transform into a currency war as well.

Which is paradoxical, because looking ahead, the yuan will likely be supported by a potentially more stable relationship between Beijing and Washington under Joe Biden's staunchly pro-China administration. Liu Li-gang, chief China economist at Citigroup Inc., said he expects the Chinese currency to appreciate to 6 per dollar by end-2021, a level unseen since 1993. Needless to say, Beijing will not be happy if Liu is right.

Disclaimer: This is not investment advice.

If anything, its because of the heavy handed actions in Hong Kong.

Is any currency doing worse than the dollar?