Is Canada’s Booming Housing Market Primed For A Financial Crash

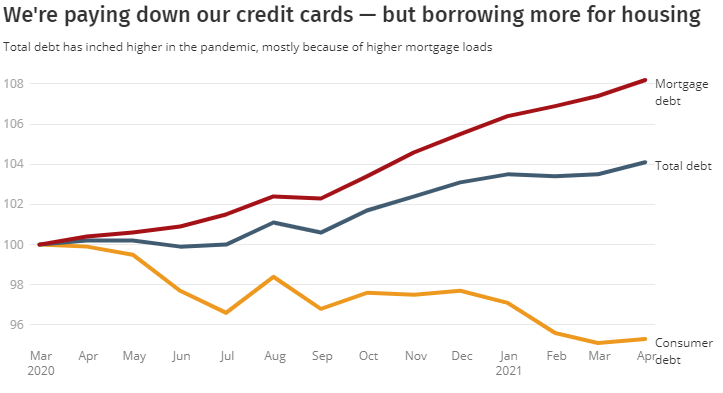

“During the pandemic, Canadians have been paying down their household debt (mostly credit cards), though their increase in mortgage debt more than offset the decline in consumer debt. With household debt rising so sharply since mid-2020, this leaves Canada’s extremely hot housing market and Canadian households very vulnerable to any economic shocks once mortgage rates start to increase.”

Since early 2020, Canada’s real estate market has defied gravity despite the global pandemic and the nationwide lockdown of the economy. Indeed, as of the second quarter of 2021, the Canadian housing market is still booming in terms of new construction, high prices, and escalating sales.

Photo by Eugene Aikimov on Unsplash

The construction boom is taking place in an environment of extremely steep housing prices and soaring construction costs, the latter especially centered in sky-high lumber prices. Building permits are also very elevated, which suggests that there are further strong near-term increases in store for a single and multi-family unit starts.

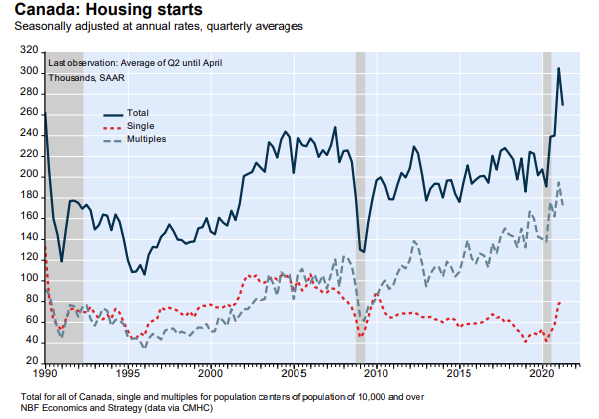

As one of the following charts illustrates, Canadian housing starts, which are a combination of single-detached and multiple urban units, fell sharply in April of 2021 to 268,631 (SAAR) units.

Despite the apparent steep decline in April, new housing starts remaining extremely elevated in April and are substantially above the previous longer-term norm which trended at about 200,000 annual starts.

Not surprisingly, most of the new construction activity is concentrated in urban multiple units. Thus, in April multiple urban starts accounted for 251,504 units, while single-detached urban starts decreased slightly to 78,918 units

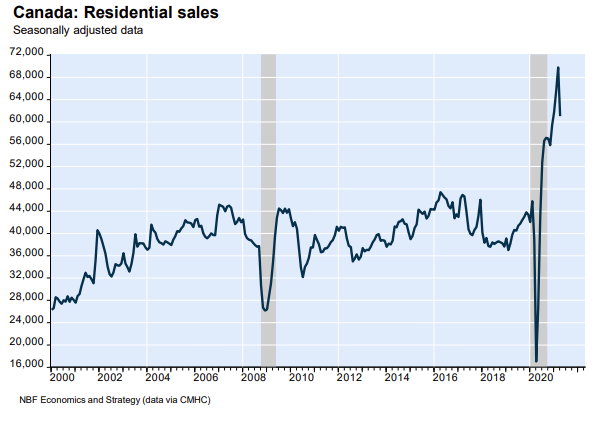

Turning to the sales picture, house sales in Canada have been extremely strong since early 2020. As one of the following charts indicates, home sales have for the past five months been exceeding the former historical high level of 60,000. As well, the inventory of homes for sale is also historically low across Canada.

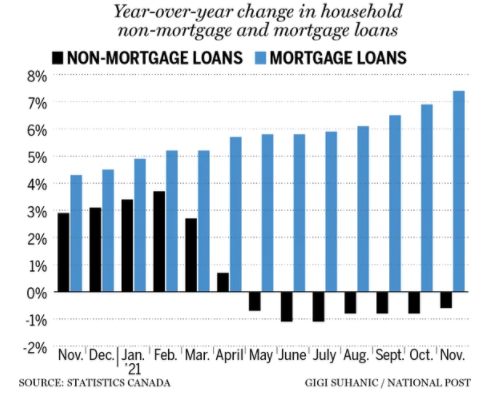

Finally, Canadians have been taking on more and more mortgage debt despite the ongoing COVID-19 pandemic, as borrowers scrambled to keep up with a housing market that took off in the latter half of 2020 and has yet to slow down.

As of November 2020, Canadian household mortgage debt increased 7.4% compared to a year earlier, pushing the total up to nearly $1.66 trillion.

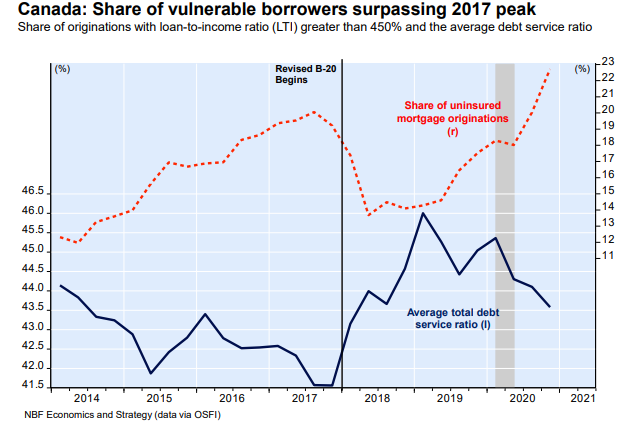

In addition, the share of newly issued mortgages with a loan-to-income ratio above 450% rose substantially in the second half of 2020 and accounted for 22% of all new mortgages. That figure is above the range seen in 2016-17, before Canada's financial regulator introduced mortgage stress tests intended to cut out risky lending.

Not surprisingly, the Canadian government’s housing agency (the CMHC) recently raised its risk assessment for the Toronto housing market to high, while generally warning of the dangers of overheating at the national level.

The other four major markets which are identified as having a “high degree of vulnerability” are Ottawa, Halifax, Hamilton, and Moncton.

In conclusion, at some point in the distant future, interest rates and mortgage rates will start increasing in Canada. Whether or not there is a soft landing for Canada’s housing market very much depends on the future course of the economic recovery and Canadian monetary policy.

Sometimes one does not need mortgage insurance, because of ones financial situation. And always, the interest on a mortgage is far les than the interest on a credit card debt.