Indian Gold Imports Surged In October Despite High Prices

Image Source: Unsplash

Indian gold imports surged to record levels in October, despite high prices.

India ranks as the world's second-largest gold market behind China.

It was the fourth consecutive month of increasing gold imports, both in terms of value and tonnage.

Domestic gold prices in India hit a record in October and outperformed the dollar price. At the end of the month, gold was up 63 percent on the year and 11 percent month-on-month in rupee terms. According to the World Gold Council, “The higher domestic gains are attributed to the 3.3 percent depreciation of the Indian rupee.”

The World Gold Council said strong import numbers in the midst of record prices indicate “resilient domestic demand.”

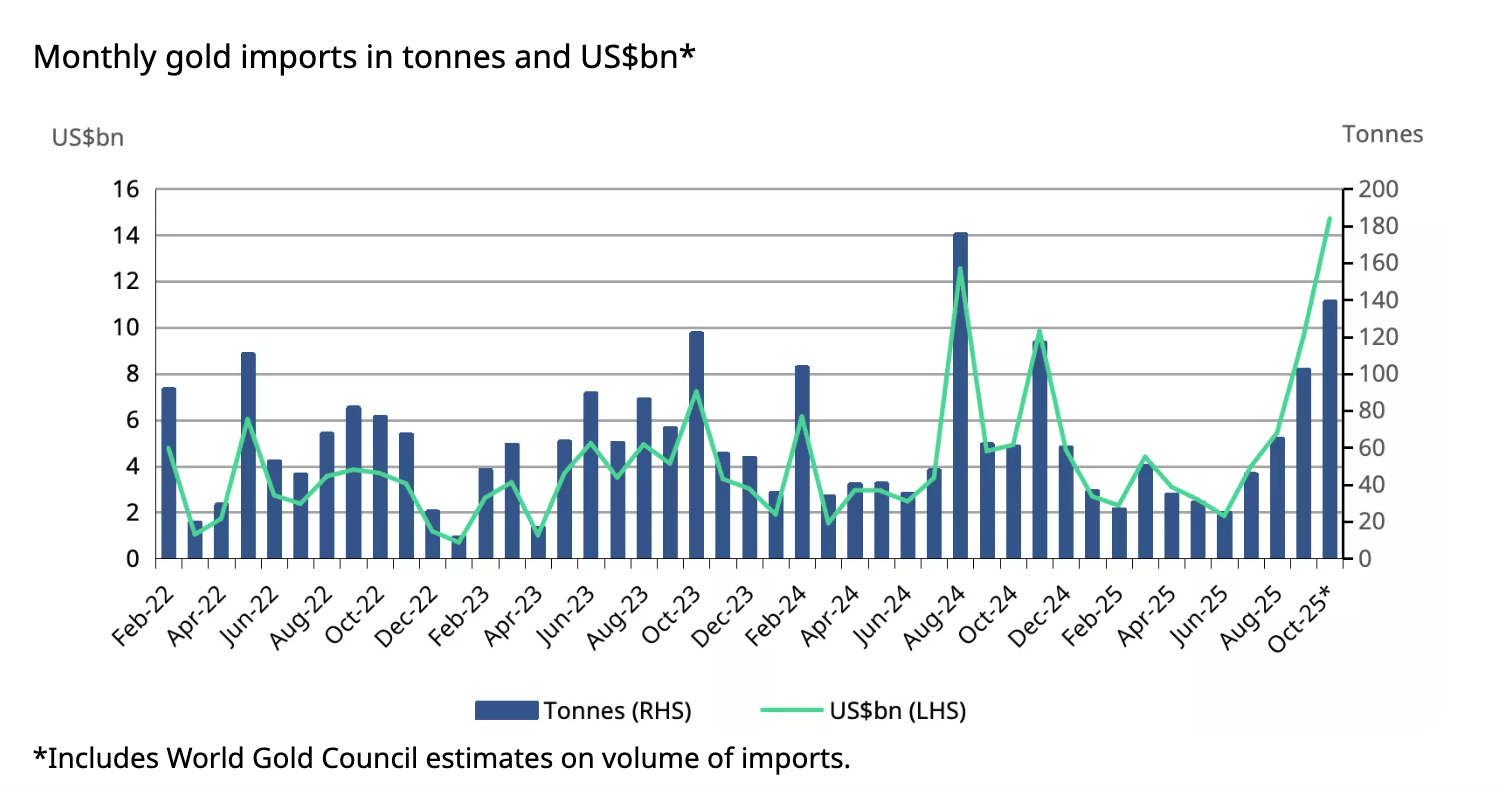

In value terms, gold imports set a record last month of $14.7 billion. That represents a ~200 percent year-on-year increase. Imports rose 53 percent from the previous month.

In tonnage terms, the World Gold Council estimates India imported between 137 and 142 tonnes of gold in October. That was up from 102 tonnes in September and 61 tonnes in September 2024.

According to the World Gold Council, “The October surge was largely driven by seasonal factors, i.e., the Diwali festivities and the onset of the wedding season.”

On a yearly basis, imports are up 16 percent in value terms. However, the WGC estimates India has imported 559 tonnes of gold this year, down about 12 percent from the same period last year. This reflects the impact of higher gold prices.

Festival and Investment Demand Shine

Gold demand was brisk during the recent festivals of Diwali and Dhanteras, the peak gold-buying season in India.

Investment buying primarily drove overall gold demand. Anecdotal reports indicate gold coin and bar purchases doubled year-on-year.

Jewelry sales also held up surprisingly well, given the high prices. According to the World Gold Council, retailers reported “healthy sales across both single-store and large multi-store formats, the latter benefitting from brand trust and promotional initiatives.”

Jewelry sales did face some headwinds from the higher prices, with overall volume down modestly. However, analysts estimate that the value of sales was up around 25 percent year-on-year.

Demand fell off later in the month as the festival season ended. This reflects the typical seasonal cycle.

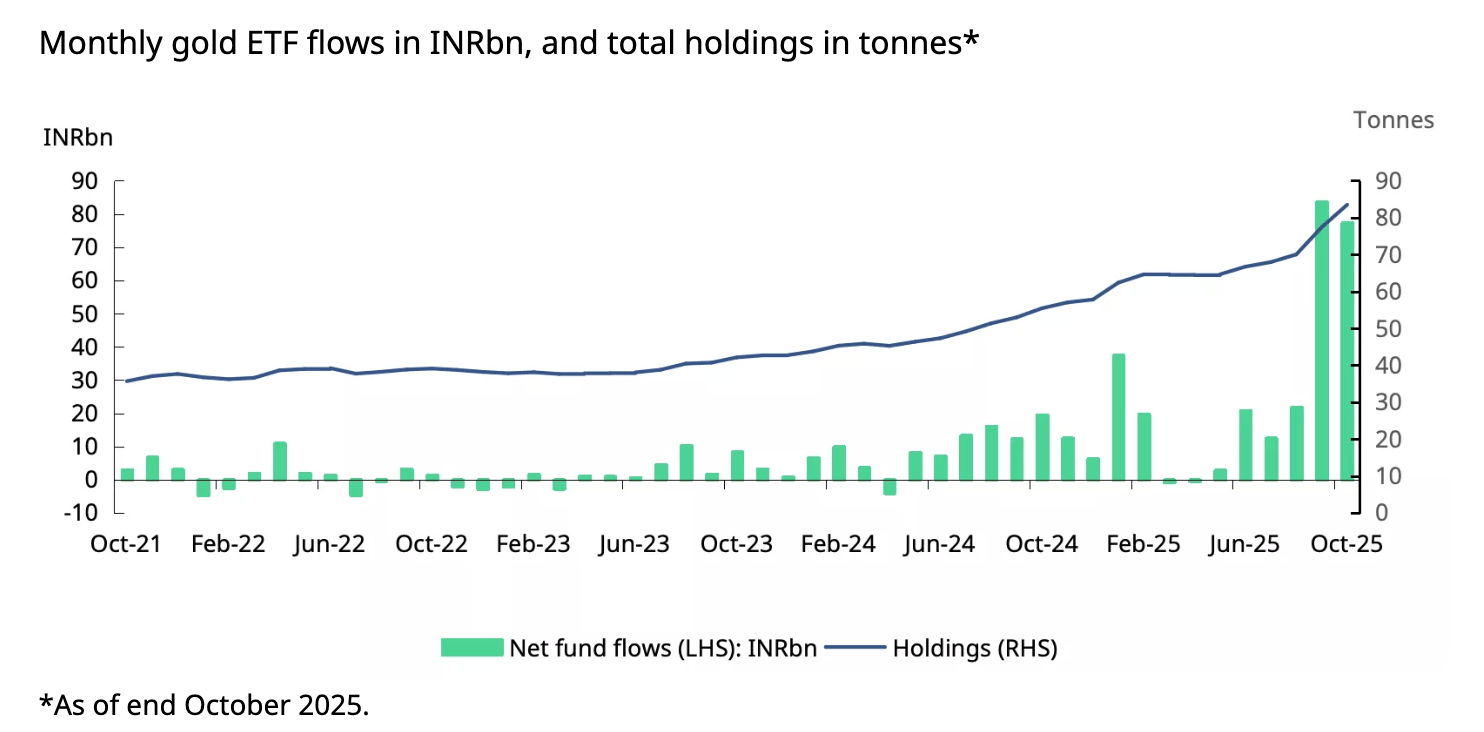

Gold also continued to flow into Indian ETFs in October. Net inflows for the month came in at ₹77 billion ($876 million), a modest 8 percent decline from the previous month. However, this was still significantly higher than the year-to-date average of ₹28 billion.

The dip was due to a sharp increase in redemptions as investors booked profits as prices surged.

So far in 2025, cumulative inflows total ₹276 billion ($3.1 billion), the highest annual inflows on record.

In October, Indian backed gold ETFs reported a record 911,000 new accounts, bringing the total number of folios to 9.57 million. That represents a 49 percent increase y-t-d.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Traditionally, Indian investors have preferred physical metal, but there is growing interest in ETFs due to the convenience.

Indians have a longstanding love affair with gold.

The yellow metal is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item.

Not in India. Even poor Indians buy gold.

According to a 2018 ICE360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government's response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

More By This Author:

Gold Is The New 20

Chinese Gold Demand Surged In October Defying Historical Seasonal Weakness

As The 60/20/20 Portfolio Strategy Gains Traction; Gold Becoming A "Core Allocation"