India: Another Solid Year Ahead For The Economy

India's economy grew by 6.7% in 2022, making it one of the fastest-growing economies in Asia. India looks set to achieve a similar rate of growth in 2023, and that comes despite a very difficult backdrop with the US and Europe close to recession or slowing, as well as the drag on purchasing power resulting from higher inflation. Another supportive budget, including a substantial boost to capital expenditures, will provide the bedrock for growth in 2023, with the private sector also providing some added impetus as private investment weathers the rise in interest rates and as inflation is brought under control by the Reserve Bank of India.

Economic growth strong and staying strong

GDP for the fourth quarter of 2022 slowed to a 4.4% year-on-year rate, down from 6.3% in the third quarter and from 13.2% in the second. However, these year-on-year figures are extremely distorted by pandemic-related volatility in 2022 and need to be treated with great care. It is perhaps better to focus on the full-year 2022 growth rate, which delivered a very solid 6.7% increase from 2021 – one of the fastest rates of economic growth in Asia.

Consumer spending and capital expenditure led economic growth in the third quarter of 2022. The pattern of growth for the fourth quarter showed business investment still in the driving seat, but less of a boost from consumer spending, and the drag from net exports diminishing.

Despite the fourth-quarter slowdown in consumer spending, we believe this component of national expenditure is likely to do much of the heavy lifting for growth in 2023 as inflation subsides and real spending power returns. But we also believe that private investment will remain a strong source of economic growth, helped along by the additional capital spending measures outlined in the latest Union budget.

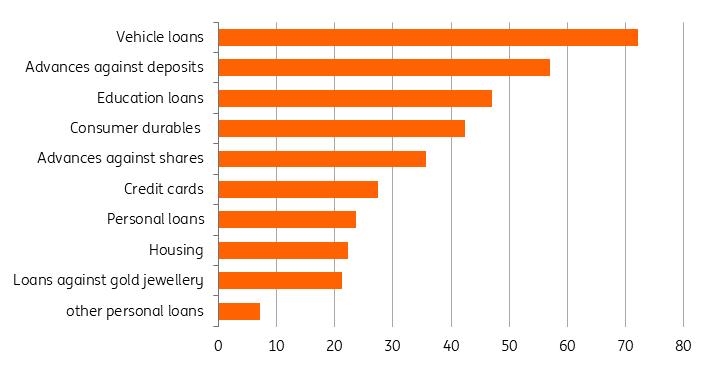

As a proxy measure for consumer spending, personal loan growth has been firming in recent months, with the January 2023 growth rate edging up to 23.7% YoY. Within this total, loans for big-ticket items such as vehicles and consumer durables are both growing strongly, signalling no shortage of consumer confidence, along with good growth in education loans. Credit card borrowing is also on the rise, though not much faster than overall personal loans.

Personal borrowing growth (YoY%)

Source: CEIC, ING

Business investment buoyed by credit growth

The outlook for private business investment also remains positive, and this is despite the increase in policy rates that the RBI has had to implement to tame inflation. In support of private investment, the banking sector is looking in decent shape despite the impact of the pandemic, with non-performing loan ratios declining across all main banking sub-groups.

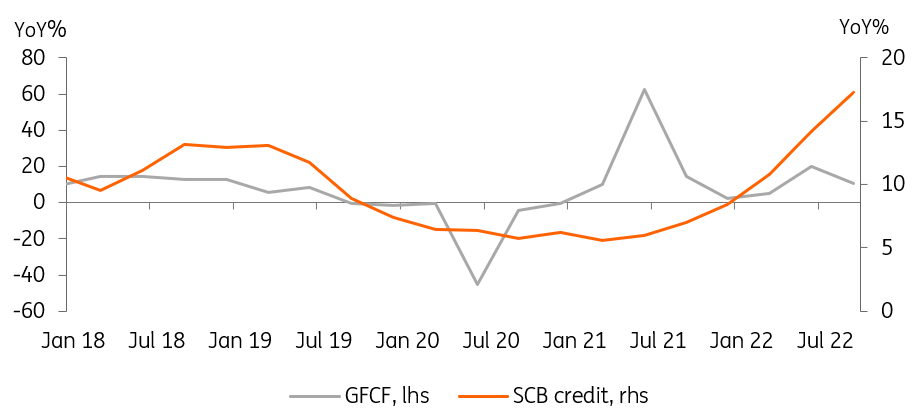

Scheduled commercial bank credit is growing strongly, and though the gross fixed capital formation series that feeds into GDP is more volatile, all indications are that it is growing robustly, and this should continue as rates peak out and the monetary environment becomes less restrictive.

Scheduled commercial bank credit growth and fixed capital formation

Source: CEIC, ING

Exports and the external balance

India’s chronic trade deficit hit its worst in September 2022, but since then it has been moderating. Export growth has slowed down reflecting the external slowdown in economies such as the US and Europe, though India has been less exposed to recent Chinese economic weakness, with much less direct trade with China than many of its Asian peers. As a result, export growth is running at only about -6.5%YoY, a much smaller decline than the 20% fall we see in economies such as Korea, Taiwan, and Singapore.

The decline in international crude oil prices may also be playing a role here, though India has also been benefitting from the much lower prices paid for Russian oil. A large proportion of India’s imports from Russia are accounted for by oil, and dollar imports from Russia have risen over the last 12 months. Deflating these dollar import figures from Russia by the price of Urals grade oil shows the extent of the increase in import volumes from Russia, which is undoubtedly aiding the improvement in the trade deficit.

That said, it is evident that much of the improvement is coming through the non-oil part of the trade deficit. And the main contribution to the improvement in the trade position is a sharp slowdown in non-oil imports, which in January fell at about a 10%YoY rate.

Indian crude oil import volumes

Source: CEIC, ING

Government spending

The recently released Union budget for 2023/24 also shows that government support for the economy will continue to provide a solid backdrop for the business sector, with strong infrastructure investment likely to help “crowd in” additional business investment.

Capital expenditure accounts for almost a quarter of the Indian government’s expenditure in the coming fiscal year, totalling INR 13,709 bn, an increase of 30% over the previous year. Infrastructure projects will be the main beneficiary of such spending.

Budget figures

(Click on image to enlarge)

Budget finances are kept on an improving path assuming the growth projections run to plan and expenditure doesn’t overrun. But the path to a lower deficit is a gentle one, with the 2023/24 deficit projected to come in at just under 6% after the 6.4% deficit in 2022/23.

If met, that deficit projection should see the debt-to-GDP ratio continue on its downward path, though after hitting almost 90% during the pandemic, there is not a lot of flexibility here for India, and the ratings agencies will want to see continued progress on debt reduction if India is to maintain its BBB- rating (Fitch and S&P) and Baa3 (Moody’s) all with stable outlooks.

Indian deficit and debt evolution

(Click on image to enlarge)

Source: CEIC, ING

Inflation and monetary policy

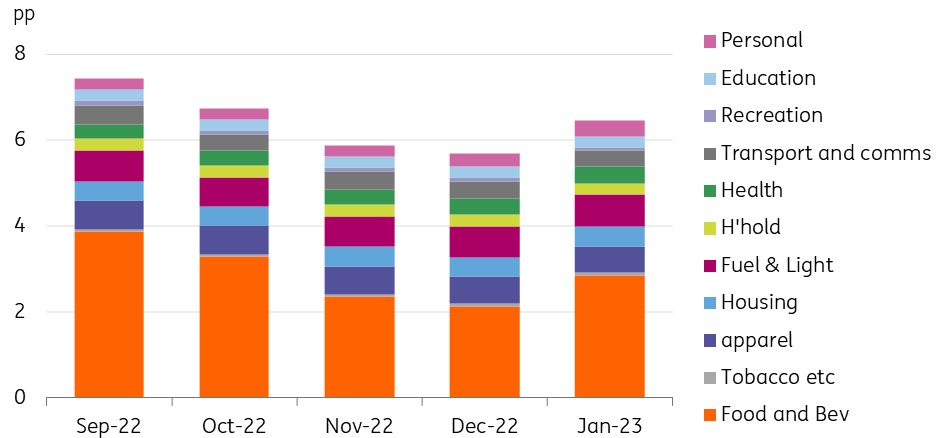

After dropping back to below 6% and within the RBI's 4%+/-2% inflation target in December, inflation shot back up to 6.5% in January. With food making up almost half of the entire CPI basket, it is no surprise that the January lurch higher was due to this component, and in particular, a slight reduction in the decline in vegetable prices from the previous month as well as some higher wheat prices.

Contribution to YoY inflation (pp)

(Click on image to enlarge)

Source: CEIC, ING

However, following the last RBI rate-setting meeting, at which the repo rate was raised a further 25bp to 6.50%, and the tightening bias left in place, much more significant weight was given to core rates of inflation than the headline. So these volatile food price moves can be largely ignored for the time being. The specific core rate we need to focus on is unclear, but neither of the more obvious ones is within the RBI’s target range, and neither shows much sign of falling.

The last rate hike and maintenance of the tightening bias were by no means unanimous, with two of the six board members dissenting. But while core inflation rates remain high and given the shift of the external monetary setting towards a “higher for longer” stance, we consider that it is likely we will see a further 25bp of tightening at the April meeting, taking rates to a more restrictive setting of 6.75%.

That said, we do think both headline and core inflation rates will move down in the coming quarters, so this should not only mark the peak for Indian policy rates, but we could well see rates being pared back before the year-end as this happens.

Headline and core inflation

(Click on image to enlarge)

Source: CEIC, ING

Currency and bond markets

The Indian rupee (INR) was one of the worst-performing currencies in the Asia-Pacific region in 2022, falling by 10.24% against the US dollar (USD), only marginally better than the Japanese yen's 12.05% decline. At the other end of the spectrum, the Thai baht and Vietnamese dong both declined less than 4%.

Weakness in 2022 was at least partly due to USD strength, and the INR was not alone in weakening. But its relative underperformance can be attributed to a few factors:

- The chronic trade deficit, though this is now showing some signs of moderating.

- Within which, the rise in crude oil prices in early 2022 didn’t help – the INR is one of the more energy-sensitive currencies in the region, given its high reliance on imported energy. We do expect oil prices to rise again, especially in the second half of the year, but the greater imports of Russian crude grades should limit the impact of this.

- RBI accommodation – the central bank was pragmatic about the need for higher policy rates during 2022, and only towards the latter part of the year did it shift the balance of policy from both leaning against inflation and supporting growth to a more single-minded pushback against inflation.

- General USD strength was a big factor driving INR weakness. Now, with US pivot hopes being priced out by a run of strong data, the USD is strong again. But we believe this moment will pass, and a more neutral-to-weaker outlook for the USD could help the INR make some moderate gains, though, in the long run, we look for further depreciation against the USD, as Indian inflation is likely to run higher than US inflation over the medium to long run, even if it is currently in line.

- China’s re-opening is likely to result in a stronger Chinese yuan over the year and could drag other Asian currencies along for the ride.

Indian local currency bond yields rose sharply at the beginning of 2022. Yields on 10Y Government securities rose from about 6.45% at the beginning of the year to a peak of 7.60% by mid-June but have been relatively steady since then and currently yield about 7.40%, providing about a per cent of real return over current inflation.

The global bond index inclusion story has gone a bit quiet since its implementation last year was delayed. In theory, this could happen this year, but with the US Treasury market a little unsettled currently, and debt ceiling concerns rumbling in the background, it may be later in the year, once US inflation and rates look more benign before this happens. Estimates of likely capital inflows range from $30-40bn so would likely have a noticeable supportive impact on both government securities as well as the INR.

In the meantime, we anticipate that 10Y bond yields will remain in their current range until mid-year, before slowly declining into the year-end.

Summary forecast table

(Click on image to enlarge)

Source CEIC, ING

More By This Author:

Strong US Jobs, But Market Angst Means The Fed Is In The Balance

FX Daily: US Banking Stress Sends Ripples Across FX Markets

Poland’s Bank Governor Optimistic On Inflation Outlook, No End To Tightening Cycle

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more