Import Prices Surprise

Image Source: Pexels

The index came in at +0.9% vs. +0.2% m/m.

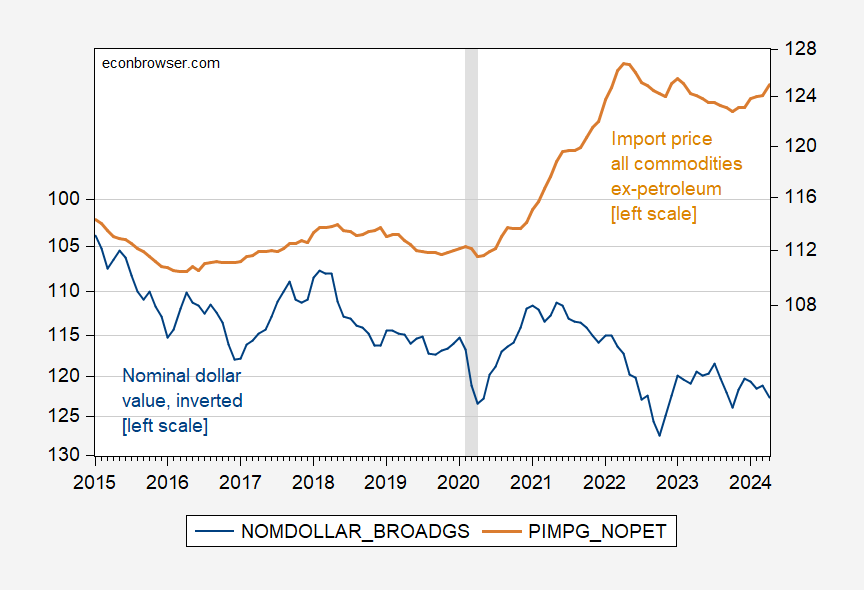

I’ve inverted the dollar index so that the exchange rate and import price should comove if there is exchange rate pass through.

Figure 1: Nominal dollar value inverted (blue, left scale), and price of all imported commodities excluding petroleum, n.s.a. (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve, BLS via FRED, NBER.

Note the uptick in import prices ex-petroleum (which shows up in commodity import prices as well). GS put up their estimate of the PCE deflator inflation by 1 bp (m/m) as a consequence.

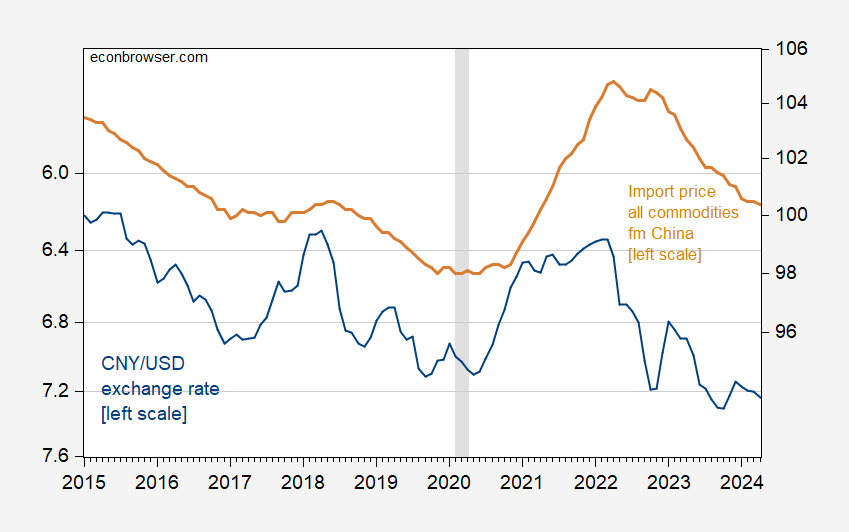

Interestingly, import prices from China have tracked the dollar/yuan.

Figure 2: Nominal CNY/USD inverted (blue, left scale), and price of all imported commodities from China, n.s.a. (tan, right scale). NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve, BLS via FRED, NBER.

Note that the import prices from China do not incorporate the tariff costs (see here).

While the series appear to comove, it’s interesting that in fact exchange rate pass through as much as can be measured is quite low in the most recent period, from 2017M01-2024M04, on the order of 0.05. Using the exchange rate pass through coefficient of 0.3 obtained from a regression 2010M04-2017M01 (lower than previous 0.5 for 2005-2010), the import price is about 5% higher than predicted (although the imprecision of the estimates places the actual within the plus/minus one standard error band). This seems to suggest that US tariffs did not, on net, push down the pre-tariff import price into the US (i.e., essentially full tariff pass through, as noted in U.S. ITC, 2023, page 145).

Caveat: Regression on gross aggregate magnitudes, so these are just back-of-the envelope estimates.

More By This Author:

Business Cycle Indicators Mid-MayThe Trend Break In CPI

Six Measures Of Consumer Prices