How The Explosion In Natural Gas, Cotton And Coffee Have Been Due To Climate Change And La Nina

The big question farmers and commodity traders around the world are asking me, is "will the historical Brazil drought" continue into 2022 and which commodities will it affect? It is pictures like this, which have helped orange juice and coffee prices soar. However, the weather during the next normal wet season in Brazil will have huge implications on whether global food inflation continues into 2022.

Source: Bloomberg

The volatility in natural gas and coffee prices have been nothing short of amazing. When markets are this crazy, using conservative option strategies or ETFs can help you sleep at night. They offer greater rewards for the risk. Here, for example, was my advice for clients over the last few months with regard to trading coffee.

Source: Weather wealth with Jim Roemer

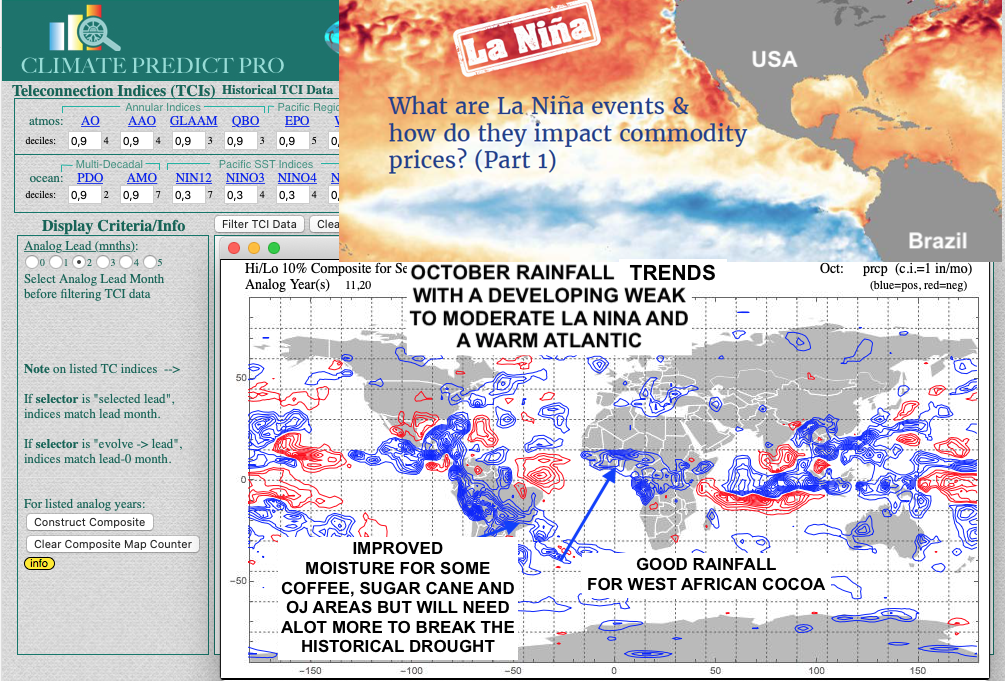

Water levels in Parana and Sao Paulo are the lowest in a century. Brazil is larger than the U.S. as far as putting breakfast on the table for the world. They are a top. producer of soy (SOYB), corn (CORN), coffee, and sugar (CANE). Worried about your morning cup of Joe coffee (JO) or sweetener for your cereal? You better hope the drought breaks soon in Brazil. My in-house Climate Predict program shows improved October rainfall, as we get into Brazil's wet season next month. However, a couple of rain events will not be enough if Brazil's deforestation and Climate Change take precedence.

(Click on image to enlarge)

Source: Jim Roemer's house long-range weather software at ClimatePredict

Natural gas prices (UNG) (BOIL) have seen unprecedented, September historical volatility, not seen since the hurricane Katrina years in 2005. The reasons for the nearly 50% rise in prices in just a matter of weeks are due to the following: 1) LNG exports to China and Europe have soared as they have a supply crunch; 2) The hottest summer in the U.S. in over 100 years lowering U.S. natural gas stocks to well below the 5-year average; 3) The western U.S. drought has been historical. This has resulted in a switch from hydropower to natural gas.; 4) Two Gulf hurricanes that lowered production a few weeks ago.

This was my advice to clients and since then natural gas prices soared above $6.00, only to see a massive 10% sell-off in just 24 hours. This market is not for the faint of heart. What is my feeling about natural gas prices longer-term and winter weather? That is for subscribers to find out.

Source: barchart.com on September 27th before the early week natural gas price explosion

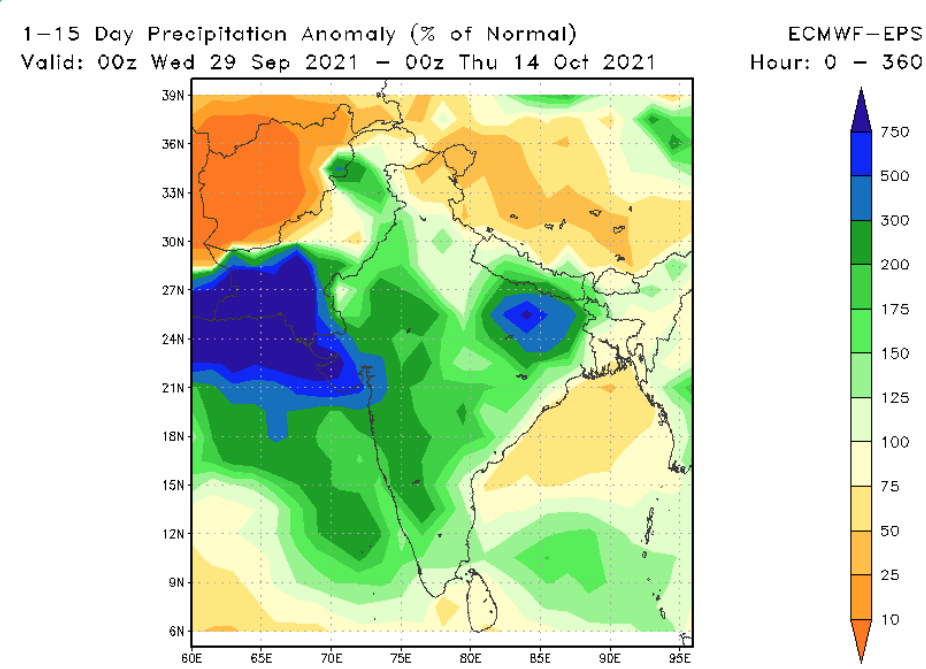

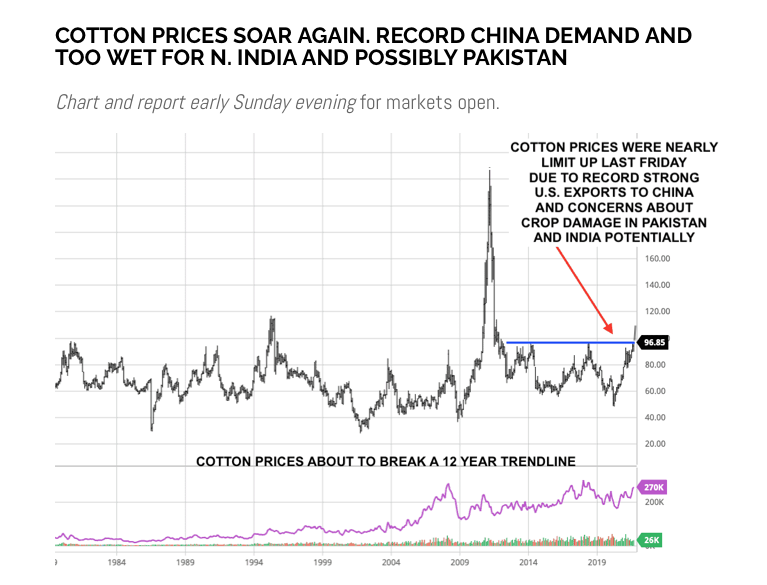

Another market that has been at least party weather is cotton (BAL). China demand has been historical and the drought out west has lowered U.S. cotton crops, while flooding in the deep south has also lowered production. Now we have a potential new weather situation--flooding in NW India and Pakistan. La Nina can sometimes cause problems with the cotton harvest in India and following drought conditions in the #1 Indian producing cotton province (Gujurat) take a look at all of this rain coming.

Source: Stormvista.com. Rainfall % of normal next 2 weeks. It May be too wet for the cotton crop in NW India or Pakistan (Jim Roemer)

We advised traders to buy cotton due to these weather situations a few days ago on this chart. Since then, cotton prices have soared about 4% this week.

Source: Barchart.com and Jim Roemer

Conclusion: Many global commodities are breaking out. Climate Change is part of the reason (whether you believe this or not, it would make sense to throw out the political jargon and look at the reality of what is happening to our planet with droughts, floods, and historical hurricanes). Precious metals, not just some ag commodities and natural gas are important in the global green economy. La Nina and Climate Change together should result in a longer-term bull market in some commodities. It is important to be selective, however, and stay ahead of both short and long-term weather forecasts from Australia to Brazil, Europe, and the U.S.

Receive a FREE issue of Jim Roemer's monthly Climatelligence newsletter and learn how to trade commodities based on weather