High Dividend 50: InPlay Oil Corp.

Image Source: Unsplash

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s recent yield is only around ~1.2%. High-yield stocks can be particularly beneficial in supplementing income after retirement. An investment of $120,000 in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

InPlay Oil Corp. (IPOOF) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more. You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link provided.

Next on our list of high-dividend stocks to review is InPlay Oil Corp.

Business Overview

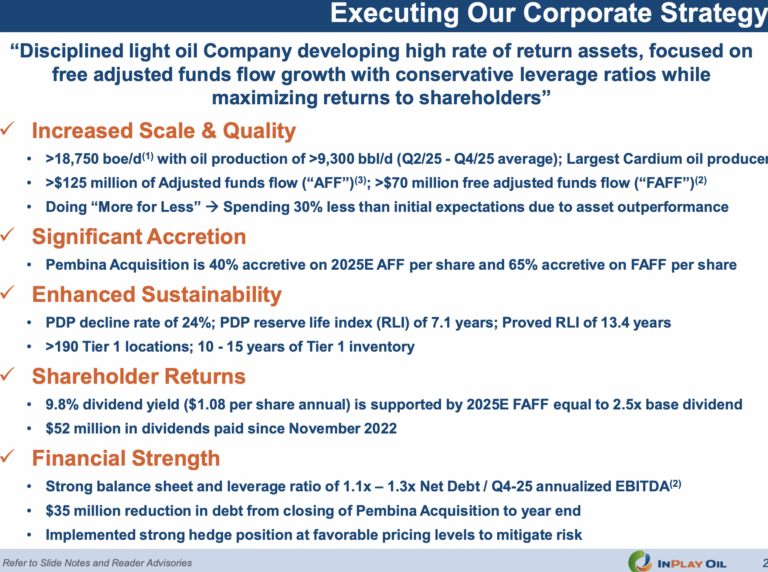

InPlay Oil & Gas is a Calgary-based oil and gas exploration and production company focused on developing light oil and natural gas assets in Alberta, primarily within the Cardium and Belly River formations. Leveraging horizontal drilling, enhanced oil recovery techniques, and infrastructure optimization, the company aims to maximize operational efficiency and returns.

In 2024, InPlay Oil Corp. reported average production of 8,712 barrels of oil equivalent per day, with 58% coming from crude oil and natural gas liquids (NGLs), making it the largest Cardium oil producer and a key player in Western Canada’s light oil market.

Despite its strong production footprint, InPlay Oil Corp. faces significant exposure to the cyclical nature of the oil and gas industry, having experienced losses in five of the past ten years, including a notable downturn in 2015 due to falling commodity prices.

The company began paying dividends in late 2022, signaling growing financial stability. Its leading position in the prolific Cardium region provides economies of scale and a robust platform for future growth, giving InPlay Oil Corp. a competitive edge over other producers struggling to replace declining reserves.

Source: Investor Relations

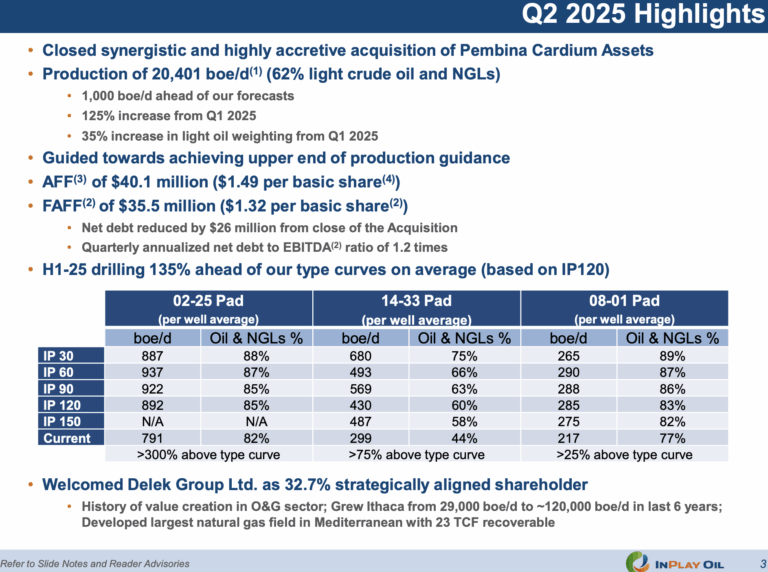

The company reported strong Q2 2025 results following its April acquisition of Cardium-focused light oil assets in Alberta. Production averaged 20,401 boe/d, exceeding expectations, with 62% from light crude oil and NGLs. Seven new wells drilled in March outperformed type curves by ~135%, with three ranking among the top ten Cardium producers. The acquisition expanded drilling inventory, extended reserve life, and improved long-term sustainability.

Financially, InPlay generated $40.1 million in Adjusted Funds Flow and $35.5 million in Free Adjusted Funds Flow, reducing net debt by $26 million. Operating income rose 140% to $50.5 million with a 55% margin, and dividends of $7.9 million were paid to shareholders. Strong capital efficiency and operational synergies supported performance despite lower commodity prices.

Looking ahead, the company plans to drill 5-5.5 net wells in Pembina in H2 2025, with production from a three-well pad expected in October. Hedging covers over 70% of natural gas and ~60% of light oil, and Delek Group’s strategic investment strengthens the growth potential. InPlay is positioned for continued production growth, debt reduction, and shareholder returns.

Source: Investor Relations

Growth Prospects

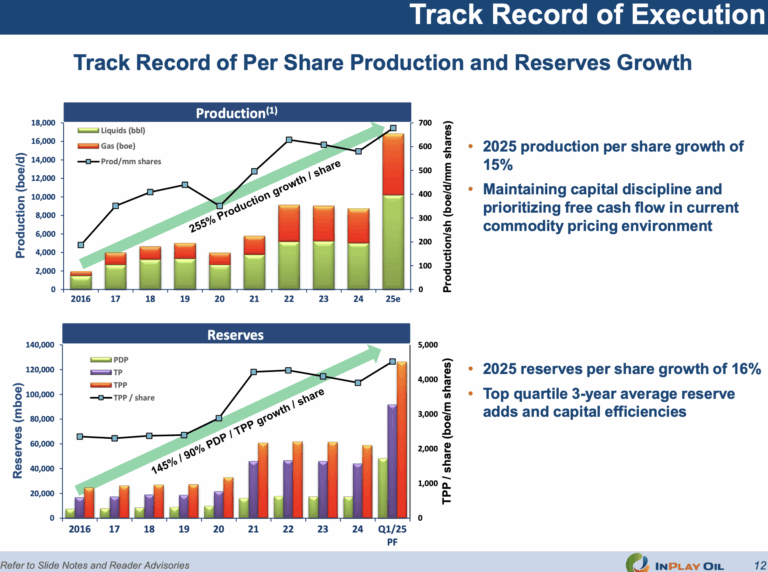

InPlay Oil has strong growth prospects, driven by a decade of profitable acquisitions and operational efficiency. Production per share has increased 255% over the last ten years, and reserves have more than doubled. For 2025, management targets 15% growth in production per share and 16% growth in reserves per share, with expected annual funds flow per share growth of about 5% over the next five years. The company’s ability to acquire high-quality assets and extract synergies positions it well for continued expansion.

However, InPlay remains exposed to oil and gas market volatility. Funds flow per share fell from $3.00 in 2021 to $0.34 in 2024, with 2025 projected at $0.75. The balance sheet is solid, with net debt at $152 million and interest expenses at 37% of operating income, but prolonged downturns could create financial pressure due to leverage from acquisitions.

Overall, InPlay’s strong reserve growth, disciplined capital management, and strategic asset base support sustainable production and shareholder returns despite market risks.

Source: Investor Relations

Competitive Advantages & Recession Performance

InPlay Oil’s competitive advantages stem from its focus on high-quality light oil and natural gas assets in Alberta’s prolific Cardium and Belly River formations. The company leverages advanced horizontal drilling, enhanced recovery techniques, and infrastructure optimization to maximize efficiency and returns.

Its leading position in the Cardium region provides economies of scale, a large inventory of high-potential drilling locations, and a lower corporate decline rate compared to peers. Additionally, InPlay’s proven track record of profitable acquisitions and seamless integration of new assets enhances production growth, cash flow, and long-term sustainability.

InPlay has historically shown resilience during market downturns, though it remains exposed to oil and gas price volatility. While the company posted record earnings per share in 2021 and 2022 due to strong commodity prices, funds flow per share declined sharply during the 2024 pricing environment.

Despite this, InPlay maintains a manageable balance sheet, with net debt of $152 million and interest expense at 37% of operating income, allowing it to service debt under normal conditions. Its focus on operational efficiency, strategic hedging, and disciplined capital allocation helps mitigate risks and sustain shareholder returns even during recessions.

Dividend Analysis

InPlay Oil offers an above-average dividend yield of 9.1%, significantly higher than the S&P 500’s 1.2%, making it appealing to income-focused investors. However, as mentioned, the dividend carries significant risk due to volatility in oil and gas prices.

The company has a high payout ratio of 104%, which is unsustainable over the long-term. Still, given its strong growth prospects and the current commodity price environment, a sharp dividend cut appears unlikely in the near-term.

From a valuation perspective, InPlay Oil has been trading at 11.5 times expected funds flow per share for 2025, slightly above a mid-cycle fair value multiple of 9.0, typical for oil producers. This implies a modest 4.0% annualized drag on returns if the stock reverts to fair value over five years.

Considering projected 5% annual growth in funds flow per share, the 9.1% dividend yield, and the valuation headwind, InPlay Oil could deliver an estimated 10.1% average annual total return over the next five years. This suggests the stock remains a strong long-term investment, even though the oil and gas cycle has passed its recent peak.

Final Thoughts

InPlay Oil has benefited from favorable market conditions since 2021, supported by above-average oil prices. The stock offers a high dividend yield of ~9%, though the payout ratio is elevated at +100%. Coupled with solid growth prospects and a reasonable valuation, the stock may present an attractive opportunity for income-focused investors.

However, the company remains highly sensitive to oil and gas price cycles, making it suitable primarily for patient investors who can tolerate significant volatility. Additionally, InPlay Oil has low trading volume, which can make it challenging to establish or liquidate large positions in the stock.

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more

More By This Author:

High Dividend 50: Sixth Street Specialty Lending

High Dividend 50: Alpine Income Property Trust, Inc.

High Dividend 50: Universal Health Realty Income Trust

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more