High Dividend 50: Sixth Street Specialty Lending

Image Source: Unsplash

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s recent yield is only around ~1.2%. High-yield stocks can be particularly beneficial in supplementing income after retirement. An investment of $120,000 in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Sixth Street Specialty Lending (TSLX) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more. You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link provided.

Next on our list of high-dividend stocks to review is Sixth Street Specialty Lending.

Business Overview

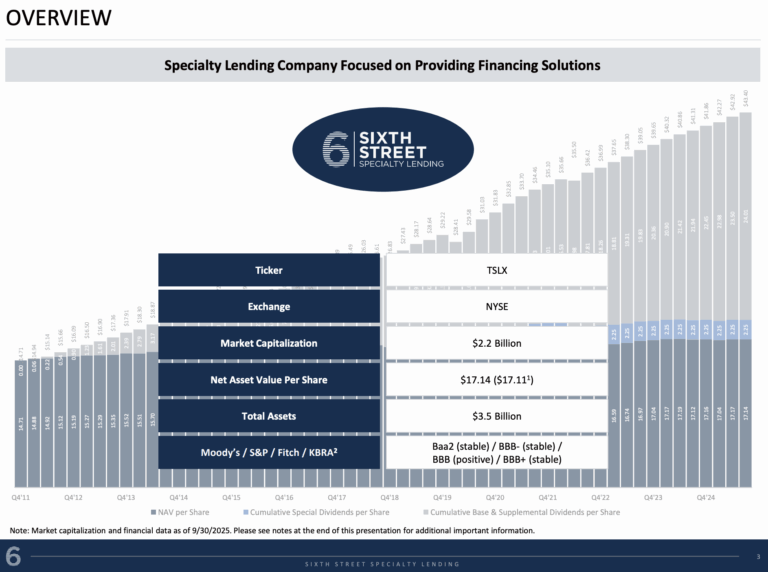

Sixth Street Specialty Lending, Inc. is a business development company (BDC) that provides customized financing solutions to middle-market companies, primarily in the United States. Managed by Sixth Street Partners, a global investment firm with over $70 billion in assets under management, Sixth Street Specialty Lending focuses on originating and investing in senior secured loans, mezzanine debt, and equity investments.

The company’s strategy emphasizes lending to businesses with strong cash flows and defensive characteristics, often in sectors like software, healthcare, and financial services. This approach allows Sixth Street Specialty Lending to generate consistent income while maintaining disciplined risk management.

Sixth Street Specialty Lending benefits from its affiliation with Sixth Street’s extensive credit platform, which provides access to deep industry expertise and sourcing capabilities. The company’s portfolio is diversified across industries and structured with a high percentage of first-lien loans, helping protect against credit losses.

Sixth Street Specialty Lending also prioritizes shareholder returns through a combination of regular and supplemental dividends, supported by strong net investment income and conservative leverage. Overall, the company has built a track record of disciplined underwriting, stable performance, and attractive risk-adjusted returns in the private credit market.

Source: Investor Relations

Sixth Street Specialty Lending reported total assets of $3.51 billion as of Sept. 30, 2025, slightly down from $3.58 billion at the end of 2024. The portfolio consisted primarily of non-controlled, non-affiliated investments valued at $3.31 billion and controlled, affiliated investments of $66 million.

Cash and cash equivalents increased to $83 million from $27 million, while total liabilities declined to $1.89 billion from $1.97 billion, reflecting lower debt levels and other payables. Net assets stood at $1.62 billion, resulting in a net asset value per share of $17.14.

For the third quarter, the company generated $109.4 million in investment income, down from $119.2 million in the same period last year, driven by lower interest and dividend income. Expenses totaled $57.7 million, including interest, management, and incentive fees, resulting in net investment income of $50.7 million, compared to $54.9 million a year earlier. After accounting for realized and unrealized losses of $6.1 million, total net assets increased by $44.6 million for the quarter, translating to basic and diluted earnings of $0.47 per share.

The investment portfolio remained diversified across sectors, with the largest allocations in Internet Services (35.5% of net assets), Healthcare (15%), and Human Resource Support Services (19.4%). The portfolio continues to emphasize first-lien loans with interest rates ranging from 7%-12%, including some paid-in-kind (PIK) structures. Overall, the company maintained a stable NAV, controlled expenses, and delivered consistent net investment income despite minor portfolio losses and lower interest income.

Source: Investor Relations

Growth Prospects

Sixth Street Specialty Lending’s performance is closely tied to its Net Investment Income (NII) and Net Asset Value (NAV), which are key indicators for investors. By law, the company must distribute at least 90% of its net income to shareholders, making its dividend policy directly linked to earnings.

Historically, Sixth Street Specialty Lending has gradually increased distributions in line with NII per share, and management has occasionally issued special dividends during years of higher income, such as FY2019 and FY2020, to comply with regulatory requirements. This demonstrates a strong commitment to shareholder returns while maintaining regulatory compliance.

Looking ahead, growth in NII per share and dividends may be limited due to the current high-interest-rate environment, which could increase financial expenses more than it boosts interest income. Despite these headwinds, Sixth Street Specialty Lending has maintained its base dividend without cuts, even in years when total dividends were lower because of larger special dividends in prior periods.

This stability, combined with a disciplined approach to income distribution, positions the company to deliver steady returns, though meaningful dividend or NII growth is expected to remain modest in the near-term.

Competitive Advantages & Recession Performance

Sixth Street Specialty Lending benefits from its BDC status, which enables it to focus on higher-yielding private credit investments that are typically less accessible to retail investors. The company’s disciplined underwriting process, diverse portfolio, and strong risk management give it an edge over competitors, helping to maintain consistent income and preserve capital. Its ability to issue special dividends during high-income years also highlights operational flexibility and a commitment to maximizing shareholder returns.

In terms of recession performance, Sixth Street Specialty Lending has shown resilience during economic downturns due to its focus on secured lending and portfolio diversification. Even in periods of market stress, the company has maintained its base dividend without cuts, demonstrating the stability of its income streams.

While growth may slow during periods of high interest rates or economic contraction, Sixth Street Specialty Lending’s conservative approach and consistent dividend history make it a relatively defensive investment within the BDC space.

Source: Investor Relations

Dividend Analysis

The company’s annual dividend is $1.84 per share. At its recent share price, the stock has a high yield of almost 9%.

Given the company’s 2025 earnings outlook, NII/share is expected to be $2.30. As a result, the company is expected to pay out roughly 80% of its EPS to shareholders in dividends.

Final Thoughts

Sixth Street Specialty Lending is a well-managed, high-quality BDC. Unlike many of its industry peers that reduced distributions during the pandemic, Sixth Street Specialty Lending maintained and even increased its quarterly dividend while returning investment surpluses to shareholders.

Based on recent forecasts, investors could expect annualized returns of approximately 5.3% through 2030, excluding potential gains from special NII per share and supplemental dividends. While the shares are rated as a hold under this outlook, total returns could be significantly higher given the company’s capacity for additional payouts.

High-Yield Individual Security Research

- 20 Highest Yielding Monthly Dividend Stocks

- 10 Super High Dividend REITs

- 5 Highest Yielding Royalty Trusts

Other Sure Dividend Resources

- Dividend Kings: 50+ years of rising dividends

- Dividend Champions: 25+ years of rising dividends

- Dividend Aristocrats: 25+ years of rising dividends and in the S&P 500

- Dividend Achievers: 10+ years of rising dividends and in the NASDAQ

- High Dividend Stocks: 5%+ dividend yields

- Monthly Dividend Stocks: Individual securities that pay out every month

- MLPs: List of MLPs and more

- REITs: List of REITs and more

- BDCs: List of BDCs and more

More By This Author:

High Dividend 50: Alpine Income Property Trust, Inc.High Dividend 50: Universal Health Realty Income Trust

10 Top Dividend Stocks That Benefit From Lack Of Change

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more